Improving your credit scores takes time, but the sooner you address the issues that might be dragging them down, the faster your credit scores will go up. Having bad credit presents serious problems with your personal finances, so it’s important to k…

Bookkeeping 101

Easily Manage Business Expense Records

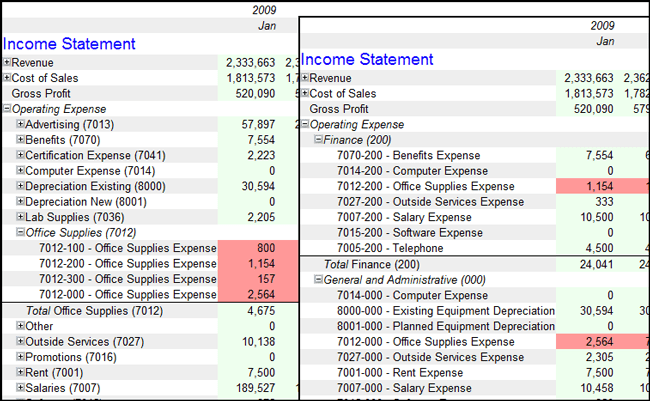

Posted on Posted on: 15.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Easily Manage Business Expense RecordsThe cost you can expense includes the cost to buy and set up the item. Office supplies are tangible objects that aid in the operation of your business. Office expenses can include electronic equipment, such as a computer, printer or fax machine….

OEM definition and meaning

Posted on Posted on: 15.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on OEM definition and meaningTo answer this question, we’ll need to compare OEM vs. aftermarket parts in depth. Economies of scale mean the competitive leverage a larger company usually has over a smaller company. With OEMs, companies can benefit from the economies of scale of h…

Planned obsolescence

Posted on Posted on: 15.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Planned obsolescenceFew design elements highlight so clearly the design tradeoffs to be made between present and future costs. However, this approach conflicts with traditional facilities budgeting and procurement, which focus on first cost alone, preventing the effecti…

Validity and objectivity of tests

Posted on Posted on: 15.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Validity and objectivity of testsFurther, such tax services could be a violation of other SEC rules on auditor independence, where, for example, the firm represents the audit client before tax court or federal court of claims. An accounting firm is prohibited from providing to an au…

Objective vs. Subjective Writing: Understanding the Difference

Posted on Posted on: 15.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Objective vs. Subjective Writing: Understanding the DifferenceSome of this subjectivity is trivial, such as a preference for coffee over tea. Such trivial subjectivity either does not impact the validity of research or can be consciously dismissed if relevant to a study….

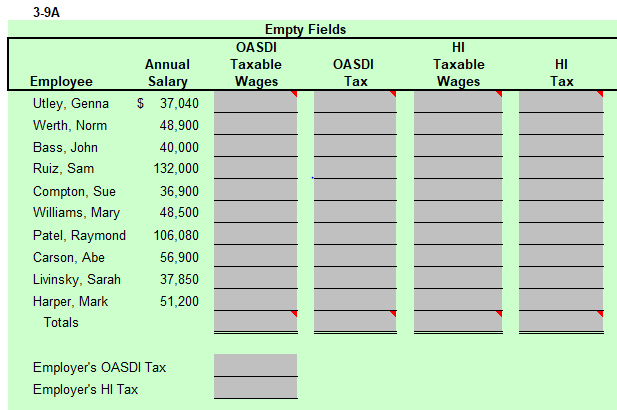

Who Is Exempt from Paying Social Security Tax?

Posted on Posted on: 14.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Who Is Exempt from Paying Social Security Tax?If you work for one employer and it withholds an incorrect amount of Social Security taxes, you need to ask your employer to correct its error and refund the overpayment. You generally cannot claim the overpayment on your income tax return and receiv…

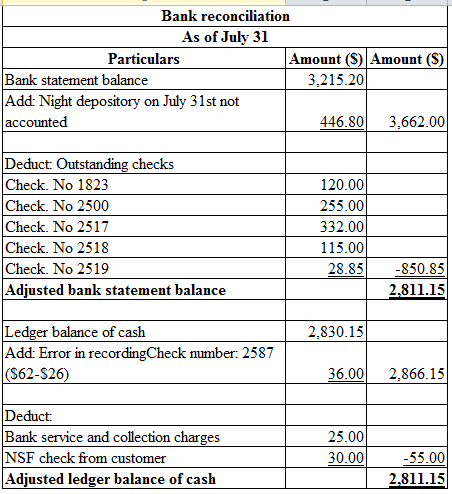

What is a checking account?

Posted on Posted on: 14.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is a checking account?By doing this, they help you avoid incurring any charges—especially if you use the funds right away. You’re responsible for any checks you deposit, so you’ll have to repay any funds you use if the check bounces after you’ve taken the money….

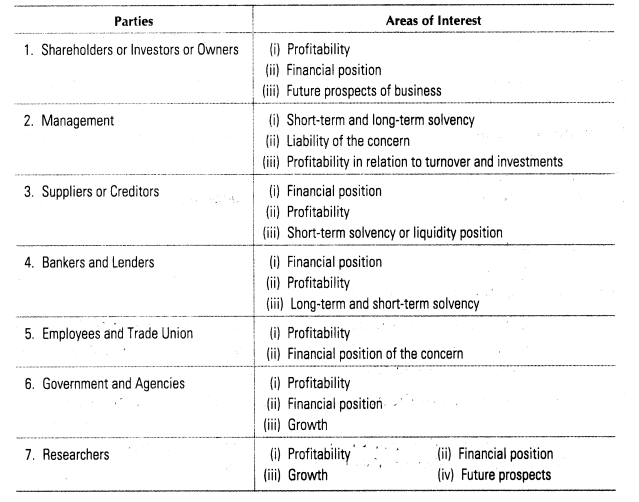

Ten Common Notes to the Financial Statements

Posted on Posted on: 14.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Ten Common Notes to the Financial StatementsThe notes (or footnotes) to the balance sheet and to the other financial statements are considered to be part of the financial statements. The notes inform the readers about such things as significant accounting policies, commitments made by the comp…

What Is a Capital Asset?

Posted on Posted on: 14.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Is a Capital Asset?Accounts receivable usually appear on balance sheets below short-term investments and above inventory. Receivables can be classified as accounts receivables, notes receivable and other receivables ( loans, settlement amounts due for non- current asse…