Do not deduct furniture which is unnecessary for your business or which is, in actuality, a personal expense. When you attempt to deduct these non-deductible expenses, you risk an IRS audit. The IRS will disallow your personal deductions resulting in an underpayment of the tax you owe.

The cost you can expense includes the cost to buy and set up the item. Office supplies are tangible objects that aid in the operation of your business. Office expenses can include electronic equipment, such as a computer, printer or fax machine.

Note that you can deduct your Internet costs whether or not you take the home office deduction. If you’re using the home office deduction, you’ll detail the cost of your Internet usage in that portion of the tax return. You can also deduct items like fax machine usage and a business phone as long as they’re used exclusively for business. For instance, you cannot claim a home phone in its entirety, but you may be able to deduct some of the expenses according to the amount of time you use the phone for business purposes.

Schedule C breaks down your income and expenses and helps to determine whether your business made a profit or had a loss during the tax year. Knowing the difference between office supplies and office expenses is essential to prepare an accurate return. It’s important to be careful about which items you claim as business expenses to stay compliant and avoid penalties. To get a better understanding of why QuickBooks Self-Employed is a business expense, refer to the Canada Revenue Agency (CRA) guidelines.

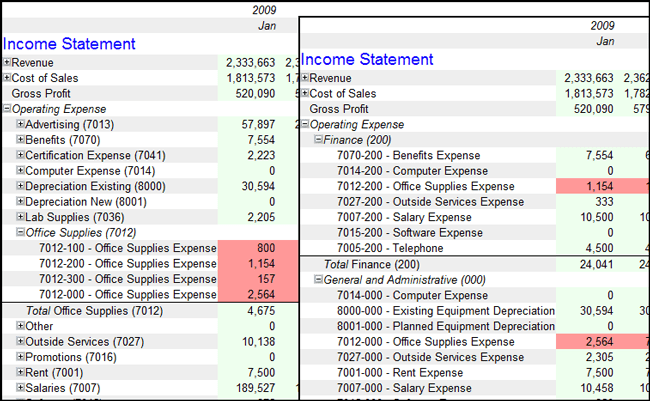

General and administrative (G&A) expenses are listed below cost of goods sold (COGS) on a company’s income statement. The top section of an income statement always displays the company’s revenues for the given accounting period.

AccountingTools

Shipping charges are not tax deductible for such a package, even though you may use supplies bought with business income and postage belonging to the business enterprise. Ordinary and necessary for business purposes must be abided by to rightfully claim any shipping charges as a business expense. However, deductions are complicated, and it’s always a good idea to talk to a tax professional for advice. In the IRS Tax Guide for Small Business, for filers who use Schedule C, instructions for figuring the “cost of goods sold” list shipping as a deductible expense to be added into the total. Instructions for including “Other Costs” state that in a manufacturing or mining business, containers may be included in cost of goods sold with the total amount deducted.

You’ll have to pay interest on this underpaid amount, along with a penalty. You also cannot deduct more than $5,000 of office furniture if you are just starting your business and the cost would be considered a capitalization cost.

Since an Internet connection is technically a necessity if you work at home, you can deduct some or even all of the expense when it comes time for taxes. You’ll enter the deductible expense as part of your home office expenses.

In short, according to the CRA, you can deduct any reasonable cost that you use to earn income. QuickBooks is eligible because it is an expense related exclusively to your business that helps you manage your bookkeeping, invoicing and more. Get more insights on the CRA’s expense guidelines for self-employed professionals with this handy guide from TurboTax. If you’re self-employed, you likely know a critical way to maximize your deductions is to claim your business expenses. However, did you know you could be missing out on major tax deductions?

Without a smart expense management system, you could be leaving money on the table. On average, QuickBooks users saved $19,290 in deductions per year by using QuickBooks’ cash flow management tools[i].

- For example, if you use the office copier and binder to produce a school report for your child, that’s personal use, and those costs should be kept out of your business tax filing.

- Personal expenses are not business expenses, and you can’t deduct them.

- To deduct office supplies on your business tax return, you must be able to show that they are “ordinary and necessary” business expenses, not personal expenses.

Is coffee an office expense or office supply?

Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Examples of office supplies are desk supplies, forms, light bulbs, paper, pens and pencils, and toner cartridges.

Cost Per Employee

The IRS lists examples of expenses that do not qualify for deductions, one of which is personal and family expenses. For example, say your spouse depends on you to remember Aunt Jane’s birthday and send a gift, and you mail her a large package from your office.

Office Expenses

COGS is deducted from the net revenue figure to determine the gross margin. The general and administrative expenses are then deducted from the gross margin to arrive at net income.

QuickBooks Self-Employed helps you organize your expenses and save money. The software is also tax-deductible, which means you can write off the cost of the software, in turn lowering your tax bill.

Your Internet expenses are only deductible if you use them specifically for work purposes. You cannot deduct your Internet expenses if you use your connection to generally surf the web, attend to social networking or emailing unless you use the three for work purposes.

To deduct office supplies on your business tax return, you must be able to show that they are “ordinary and necessary” business expenses, not personal expenses. Personal expenses are not business expenses, and you can’t deduct them. For example, if you use the office copier and binder to produce a school report for your child, that’s personal use, and those costs should be kept out of your business tax filing. As far as the IRS is concerned, office supplies are the tangible items you use and regularly replenish to conduct business in your office, including pens, paper, and printer toner. Office expenses, on the other hand, are items and services you use for your business that don’t fall into more specific deduction categories.

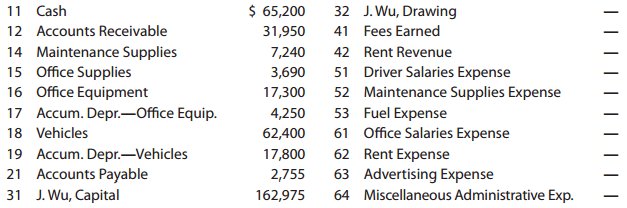

Office supplies also can include printer ink, paper clips, paper and staples. Furniture, such as a desk or chair, are considered office supplies if the item is used solely for the business. The IRS allows small-business owners to deduct 100 percent of office supplies but requires you to retain all receipts for the supplies. Individuals who own and operate a sole proprietorship must keep detailed records to accurately report expenses on their income tax return. When preparing your income tax return, you must use Form 1040 Schedule C to report the financial activity of your business.

The guide goes on to specify that if containers are not “an integral part of the manufacturing product” the costs of containers or packaging are deducted as shipping costs or selling expenses. Furthermore, cost of goods sold includes freight and charges incurred to receive the materials needed to manufacture products for sale. The IRS has a new simpler method for taking smaller cost assets as expenses instead of depreciating them. Effective in 2016 and beyond, you can deduct as an expense business assets (including office assets) that cost $2500 or less. This includes software and software suites, laptops, tablets, smartphones, and other smaller electronics.