The OASDI taxis the amount of money taken from your earned income to pay for Social Security benefits. You give up a portion of your salary, and your employer has to pay a matching portion as well.

If you work for one employer and it withholds an incorrect amount of Social Security taxes, you need to ask your employer to correct its error and refund the overpayment. You generally cannot claim the overpayment on your income tax return and receive a Social Security tax refund from the IRS. People who may fall into this category include some low-income workers. Beneficiaries in these group who do not provide this information to the IRS soon will have to wait until later to receive the payments for dependents.

There is a payroll tax of 6.20% that goes directly toward funding the program; if you’re self-employed, you’ll pay twice that (though you can deduct half). That money is your way of paying into the system so you can collect Social Security benefits come retirement. If you are not a U.S. citizen but worked in the United States, you had Social Security taxes withheld from your paycheck.

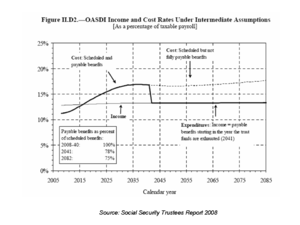

The rate of return on private investments listed in the tables assume a conservative mix of 50 percent large-cap U.S. stocks and 50 percent U.S. Most of us are familiar with theSocial Security tax, since we see it right on our paychecks.

Employees of foreign governments are generally exempt from paying Social Security taxes on income paid to them as a result of their official responsibilities. As long as the foreign government employee is working in an official capacity on official business related to his employment, he does not have to pay Social Security on his pay. The Social Security exemption does not apply to servants of employees of a foreign government or the official’s children or spouse unless they are also employed by the foreign government.

Who Is Exempt from Paying Social Security Tax?

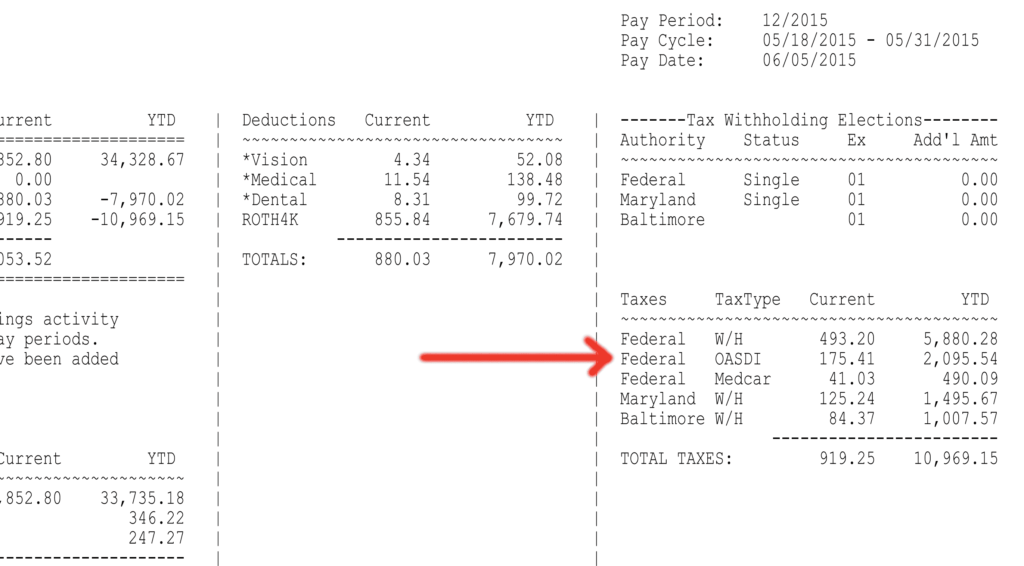

Social Security tax is part of FICA tax, which stands for the Federal Insurance Contributions Act and includes both. You pay this percentage on your income up to an annual limit, which can change from year to year.

On April 24, the IRS announced the SSI and VA beneficiaries have until May 5 to use the non-filers web tool to provide information about their eligible child dependents. Otherwise, they will receive $1,200 automatically and, by law, the additional $500 per eligible child would be paid in association with a return filing for tax year 2020. Stimulus payments will also go out automatically to Social Security Disability Insurance (SSDI) recipients who were not required to file tax returns for 2018 or 2019. Like Social Security beneficiaries, SSDI beneficiaries also receive SSA-1099 benefits statements every January, which the IRS will use to send the payments.

Income limitations

If they receive other sources of income, including tax-exempt interestincome, they must add one-half of their annual Social Security benefits to their other income and then compare the result to a threshold set by the IRS. If the total is more than the IRS threshold, some of their Social Security benefits are taxable. Just like the income tax, most people can’t avoid paying Social Security taxes on their employment and self-employment income. There are, however, exemptions available to specific groups of taxpayers.

Is Oasdi the same as Social Security?

OASDI stands for old age, survivors, and disability insurance tax, and the money that your employer collects goes to the federal government in order to fund the Social Security program.

For example, distributions from your IRA or 401(k) aren’t subject to FICA taxes. Also, if you receive a pension or annuity, those payments aren’t subject to FICA taxes. Other investment income, such as interest, dividends and capital gains are also exempt from FICA taxes.

Self-employed persons pay a total of 15.3 percent—12.4 percent for OASDI and 2.9 percent for Medicare. This rate does not reflect the additional 0.9 percent in Medicare taxes certain high-income taxpayers are required to pay. Social Security taxes are withheld from the paychecks of all employees working in the United States up to the allowable maximums.

Motley Fool Returns

- If you work for one employer and it withholds an incorrect amount of Social Security taxes, you need to ask your employer to correct its error and refund the overpayment.

However, if you are an employee, only 6.2 percent is taken from your wages and your employer pays the other 6.2 percent on your behalf. If you’re self-employed, you must pay the entire 12.4 percent yourself, but you can deduct half of it on your federal income tax return. The amount you pay for the Social Security Tax always reduces the amount of your income, subject to the income tax. The Federal Insurance Contributions Act (FICA) imposes Social Security and Medicare taxes on income earned from working. As of 2018, the Social Security tax equals 6.2 percent for the employee and 6.2 percent for the employer, and the Medicare tax equals 1.45 percent for the employee and 1.45 percent for the employer.

Even if you are not eligible for benefits, you cannot request a refund of these taxes. However, you may be eligible for some Social Security benefits due to international agreements between the United States and other countries. The Social Security tax is based on a percentage of your salary. At the time of publication, you pay 6.2 percent of your income from employment in Social Security taxes.

Social Security tax is based on a flat percentage of salary and does not allow for deductions from your income like the income tax system, so a Social Security tax refund due to overpayment is rare. However, in some cases, a worker may pay too much in Social Security taxes and may be able to claim a credit for this overpayment and potentially receive a refund. Whether you are employed or work for yourself, you must pay 12.4 percent of the first $132,900 (in 2019) of your income to Social Security.

AARP also successfully fought to guarantee that low-income Social Security recipients will receive the full $1,200 check, not $600 as originally proposed. Over a 45-year career, that is up to $212,000 that he could potentially lose if he dies before collecting benefits. Personal savings, on the other hand, do not disappear if their owners die before using them.

No additional paperwork is required, per the latest guidance from the IRS. In retirement, many people rely on their savings, Social Security benefits, and pension benefits for their income, rather than wages or salaries. Many types of retirement income aren’t subject to FICA taxes because they aren’t considered wage income from working.

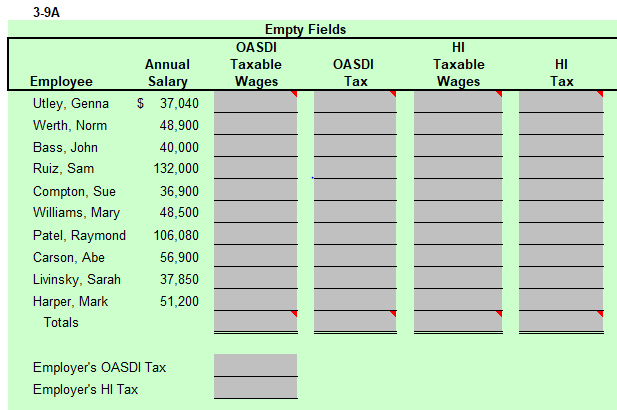

Employees and Employers Pay Into OASDI

Employees and their employers across the country pay to fund the benefit payments that retirees receive. The idea is that you contribute to Social Security benefits throughout your career. Then, once you retire, current workers will keep contributing to the fund while you receive benefits.

If you earn $100,000 dollars per year at your job, $6,200 of it goes to pay Social Security taxes. Only the remaining $93,800 dollars is subject to income tax. So, at least, you’re not being taxed twice on the same money if you are self-employed.

Married couples who live together but file separately have a threshold of $0 and must pay taxes on Social Security benefits regardless of other income earned. Whether Social Security benefits are taxable by the Internal Revenue Service (IRS) depends on how much additional income the person filing taxes receives.

Finally, your Social Security benefits aren’t subject to FICA taxes. But, just because certain types of retirement income aren’t subject to FICA taxes doesn’t mean that you don’t have to include it in your taxable income for income tax purposes. The IRS also has announced that people who receive Compensation and Pensions (C&P) benefits from the Department of Veterans Affairs will receive their stimulus payments automatically even if they have not filed tax returns for 2018 or 2019. The IRS, which made the announcement on April 17, did not say when the stimulus payments would be sent to VA beneficiaries. Seniors whose only source of income is Social Security do not have to pay federal income taxes on their benefits.

How much is the OASDI tax?

As these examples demonstrate, becoming exempt from paying Social Security taxes requires specific action by the taxpayer and special permission from the IRS. There is no legal way to stop paying Social Security taxes without applying and receiving approval or becoming a member of a group that is already exempt. The size of the check will decrease based on income for individuals who earned more than $75,000 based on their federal tax return for 2019 (or their 2018 return if they have not filed yet). The payment for individuals will shrink by $5 for every $100 earned over $75,000.

If you fall under one of these categories, you can potentially save a significant amount of money. However, if you do take advantage of the exemption, you will be ineligible to receive any of the benefits offered by Social Security. AARP worked to ensure that individuals who are collecting Social Security benefits for retirement, disability or Supplemental Security Income (SSI) will be eligible for the stimulus payments.

For couples who filed jointly, the reduction will start once they earn more than $150,000; for heads of household, at $112,500. For 2020, the threshold amount is $25,000 for singles and $32,000 for married couples filing jointly.