Activity-based costing (ABC) is a costing method that assigns overhead and indirect costs to related products and services. This accounting method of costing recognizes the relationship between costs, overhead activities, and manufactured products, a…

Bookkeeping 101

What is the double declining balance method of depreciation?

Posted on Posted on: 17.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is the double declining balance method of depreciation?New hardware runs faster, uses less energy and provides more cores every year, likewise SaaS platforms often employ rapid upgrade cycles with a constant influx of improvements. In that context it doesn’t make sense to sink money into technology that …

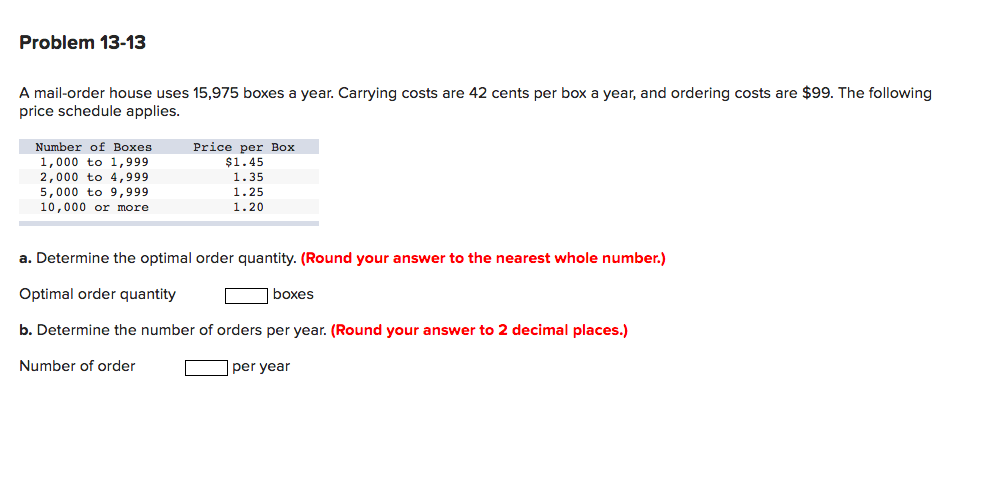

Fixed cost

Posted on Posted on: 17.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Fixed costIf you pay someone a mix of fixed salary plus commission, then they represent both fixed and variable costs. The cost of inventory is the “carrying cost” of holding and storing inventory over a certain period of time. It’s calculated to determine the…

Opportunity

Posted on Posted on: 17.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on OpportunityEven clipping coupons versus going to the supermarket empty-handed is an example of an opportunity cost unless the time used to clip coupons is better spent working in a more profitable venture than the savings promised by the coupons. Opportunity co…

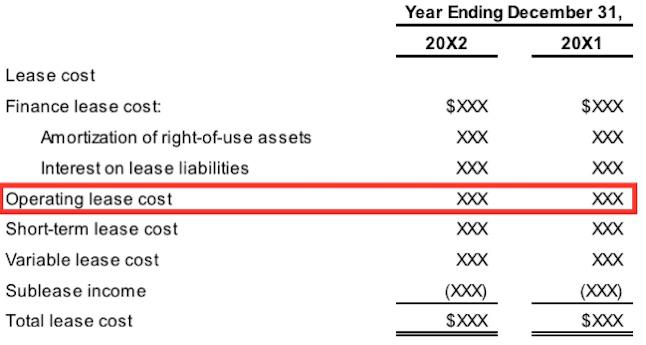

Capitalized Lease Method Definition

Posted on Posted on: 17.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Capitalized Lease Method DefinitionIt guarantees the lessee, also known as the tenant, use of an asset and guarantees the lessor, the property owner or landlord, regular payments for a specified period in exchange. Both the lessee and the lessor face consequences if they fail to uphol…

What is a good operating margin for a business?

Posted on Posted on: 16.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is a good operating margin for a business?However, EBIDA is not often used by analysts, who instead opt for either EBITDA or EBIT. Understanding Earnings Before Interest, Depreciation and Amortization (EBIDA) There are various ways to calculate EBIDA, such as adding interest, depreciation, a…

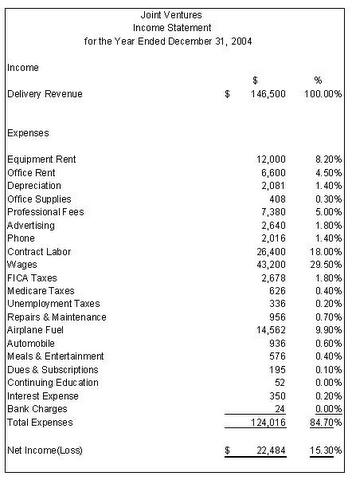

Do Salary Expenses Go on a Balance Sheet?

Posted on Posted on: 16.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Do Salary Expenses Go on a Balance Sheet?Operating and non-operating expenses are listed in different sections of a firm’s income statement. At the top the income statement, the cost of goods sold is subtracted from revenues to find the gross profit….

When Does A Hobby Become A Business?

Posted on Posted on: 16.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on When Does A Hobby Become A Business?The NOL can generally be used to offset the company’s tax payments in other tax periods through an Internal Revenue Service (IRS) tax provision called a loss carryforward. A net operating loss (NOL) is a valuable asset because it can lower a company’…

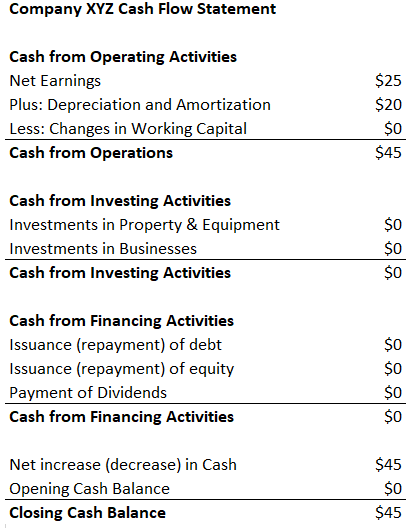

Cash Flow from Investing Activities

Posted on Posted on: 16.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Cash Flow from Investing ActivitiesThere is typically an operating activities section of a company’s statement of cash flows that shows inflows and outflows of cash resulting from a company’s key operating activities. Capital expenses are treated differently for business taxes purpose…

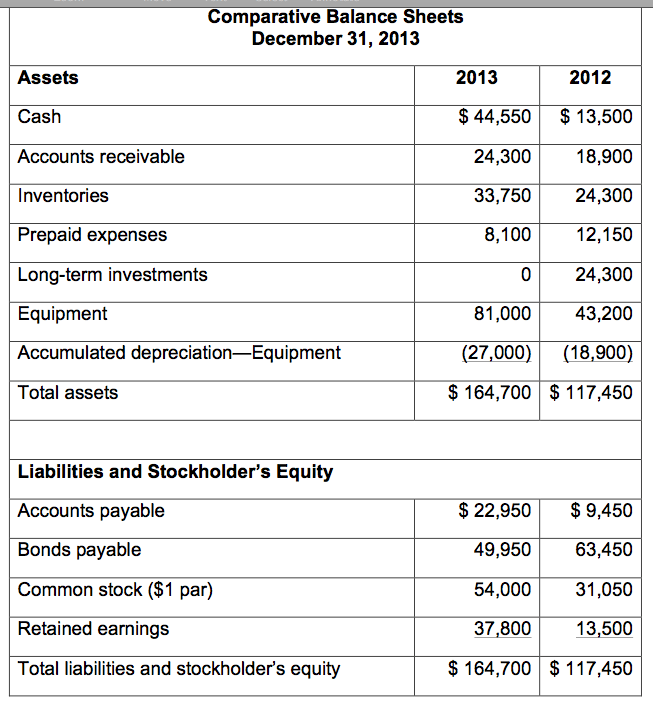

Par bond

Posted on Posted on: 16.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Par bondSay, an investor purchases a bond for $950 and another investor purchases the same bond for $1,020. On the bond’s maturity date, both of the investors will be repaid $1,000 par value of the bond. Some states require that companies cannot sell shares …