Splitting return on equity into three parts makes it easier to understand changes in ROE over time. For example, if the net margin increases, every sale brings in more money, resulting in a higher overall ROE.

What is included in the statement of stockholders equity?

Definition: The statement of stockholders’ equity is a financial report that shows the changes in all of the major equity accounts during a period. In other words, it’s a financial statement that reports the transactions that increase or decrease the stockholders’ equity accounts during an accounting period.

Examples of the Descriptions for the Rows or Lines Appearing on the Statement

The statement of shareholders’ equity is one of the main sections of the balance sheet. Also known as owner’s equity, shareholders’ equity summarizes the ownership structure of a company. It is usually posted after the assets and liabilities sections of the balance sheet. The statement of shareholders’ equity is an important component of planning because it shows the total amount of capital attributable to the owners of a business.

Borrowing creates a new liability and drives down stockholders’ equity. However, borrowing does not force the company to sell off ownership control, as selling stock does.

Equity exists as a balance sheet account and has a normal credit balance. This means that a credit to the shareholders’ equity account increases the amount of equity in the business. On the contrary, a debit to the shareholders’ equity account decreases the amount of equity owners have in the business. The accounting equation, which states assets equal liabilities minus equity, provides the basis for calculating the amount of equity in a business. A company must subtract liabilities from assets to discover the amount of equity in the business.

What Does Statement of Stockholders’ Equity Mean?

Though both methods yield the same figure, the use of total assets and total liabilities is more illustrative of a company’s financial health. The revenue remaining after deducting all expenses, or net income, makes up the retained earnings part of shareholders’ equity on the balance sheet. Revenue accounts have a normal credit balance and increase shareholders’ equity through retained earnings. Expense accounts, however, have a normal debit balance and decrease shareholders’ equity through retained earnings.

For example, common stock and retained earnings have normal credit balances. This means an increase in these accounts increases shareholders’ equity. The dividend account has a normal debit balance; when the company pays dividends, it debits this account, which reduces shareholders’ equity. Shareholder equity can also be expressed as a company’s share capital and retained earnings less the value of treasury shares.

An increase in stockholders’ equity on the balance sheet along with a decrease in the dividend rate points to greater retained earnings. A company’s retained earnings include cash reserves and money spent to acquire new assets as well as money it uses to pay off debt, each of which directly increases stockholders’ equity.

Debit and credit rules date back to 1494, when Italian mathematician and monk, Lucia Pacioli, invented double-entry accounting. This financial statement summarizes on one page all of the changes that occurred in the stockholders’ equity accounts during the accounting year. When a company issues shares of common and preferred stock, the shareholder’s equity section of the balance sheet is increased by the issue price of the shares. The par value may be shown as a separate line item from additional paid-in capital on the shares, or the balance may be totaled on the same line. A company may raise stockholder’s equity by issuing shares of capital to pay off its debts and reduce interest costs.

- The shareholders’ equity section of the balance sheet consists of preferred and common stock, treasury stock, paid-in capital and retained earnings.

- The balance sheet consists of assets, liabilities and shareholders’ equity.

Treasury stock details the amount of shares a company owns of its own stock. Unlike the other equity accounts, treasury stock has a normal debit balance and is subtracted from the amount in shareholders’ equity. Shareholders’ equity, which refers to net assets after deduction of all liabilities, makes up the last piece of the accounting equation. Shareholders’ equity contains several accounts on the balance sheet that vary depending on the type and structure of the company. Some of the accounts have a normal credit balance, while others have a normal debit balance.

Treasury shares or stock (not to be confused with U.S.Treasury bills) represent stock that the company has bought back from existing shareholders. Companies may do a repurchase when management cannot deploy all the available equity capital in ways that might deliver the best returns. Companies can reissue treasury shares back to stockholders when companies need to raise money. Retained earnings are the earnings a business keeps to invest in itself instead of issuing cash dividends to stockholders; these also cause stockholders’ equity to rise.

What does stockholders equity mean?

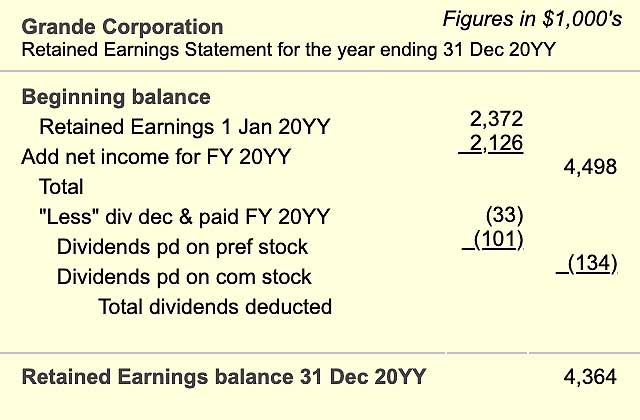

statement of stockholders’ equity definition. A financial statement that shows all of the changes to the various stockholders’ equity accounts during the same period(s) as the income statement and statement of cash flows. It includes the amounts of comprehensive income not reported on the income statement.

How Does a Statement of Shareholders’ Equity Help a Company’s Plan?

The balance sheet consists of assets, liabilities and shareholders’ equity. The shareholders’ equity section of the balance sheet consists of preferred and common stock, treasury stock, paid-in capital and retained earnings. Common and preferred stock represents ownership interest in the business. Paid-in capital indicates the amount contributed by shareholders in exchange for shares of a company. Retained earnings show the amount of net earnings reinvested in the business.

Interest payments to creditors are tax-deductible, but dividend payments to shareholders are not. Thus, a higher proportion of debt in the firm’s capital structure leads to higher ROE. Financial leverage benefits diminish as the risk of defaulting on interest payments increases. If the firm takes on too much debt, the cost of debt rises as creditors demand a higher risk premium, and ROE decreases. Increased debt will make a positive contribution to a firm’s ROE only if the matching return on assets (ROA) of that debt exceeds the interest rate on the debt.

Stockholders’ equity depends on how a business values its assets in its financial statements. An increase in stockholders’ equity may simply indicate a change in the method of valuing assets, or an adjustment to previous accounting. Stockholders’ equity can also rise, or fall then recover value, during and following major financial events that impact accounting.

Stockholders’ equity can be calculated by subtracting the total liabilities of a business from total assets or as the sum of share capital and retained earnings minus treasury shares. In some cases, a rise in stockholders’ equity indicates that a company has sold additional shares of stock. Selling stock results in cash income, which increases the company’s assets. This is the opposite of what happens when a business borrows money to meet expenses.

Stockholders’ equity on the balance sheet

On a company’s balance sheet, the amount of the funds contributed by the owners or shareholders plus the retained earnings (or losses). The DuPont formula, also known as the strategic profit model, is a common way to decompose ROE into three important components. Essentially, ROE will equal the net profit margin multiplied by asset turnover multiplied by financial leverage.

Just as selling stock raises the value of shareholders’ equity, it also creates new shareholders to share in that equity. Accounting involves recording financial events taking place in a company environment. Segregated by accounting periods, a company communicates financial results through the balance sheet and income statement to employees and shareholders. Debits and credits serve as the mechanism to record financial transactions.

Similarly, if the asset turnover increases, the firm generates more sales for every unit of assets owned, again resulting in a higher overall ROE. Finally, increasing financial leverage means that the firm uses more debt financing relative to equity financing.