This makes sense because the retained earnings account holds the company’s profits that were not distributed to owner. In other words, it holds the company’s retained earnings.

A closing entry is a journal entry made at the end of accounting periodsthat involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. Temporary accounts include revenue, expenses, and dividends and must be closed at the end of the accounting year.

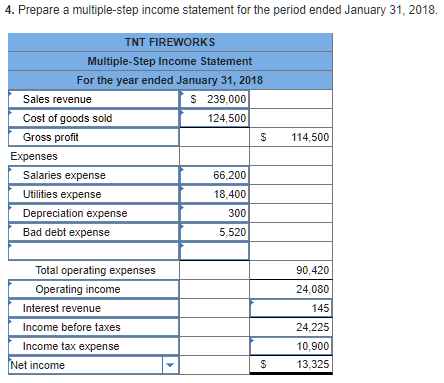

Expenses

In this case, you must debit income summary for $5,000 and credit the capital account for $5,000. This transfers the income summary balance to the company’s capital account.

The balance in your company’s income summary account after revenues and expenses are closed indicates net income. For example, a company with $10,000 in revenue and $5,000 in expenses has a net income of $5,000. The balance in the income summary account is closed to the company’s capital account. The capital account indicates the amount of money that has not been distributed to owners of your company. Let’s say your company has a $5,000 credit balance in the income summary account.

What is the Drawings Account?

This means that the value of each account in the income statement is debited from the temporary accounts and then credited as one value to the income summary account. By closing or zeroing out these temporary accounts, the balances are transferred to the retained earnings account and the next year’s income statement starts fresh. The next year’s balance sheet, however; carries the balances of these accounts in the retained earnings account.

For example, credit income summary for $10,000, the amount of the revenue for that period. This transfers the revenue account balance into your company’s income summary account, another temporary account. Income summary effectively collects net income (NI) for the period and distributes the amount to be retained into retained earnings. Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow. If the income summary account has a credit balance after completing the entries, or the credit entry amounts exceeded the debits, the company has a net income.

The process transfers these temporary account balances to permanent entries on the company’s balance sheet. Temporary accounts that close each cycle include revenue, expense and dividends paid accounts. The income summary account is an account that receives all the temporary accounts of a business upon closing them at the end of every accounting period.

Example of Income Summary Account

If your company has a debit balance in the income summary account, you must credit the income summary account and debit the capital account. This allows your company to have a zero balance in the income summary account for the next accounting period. Temporary – revenues, expenses, dividends (or withdrawals) account. These account balances do not roll over into the next period after closing. The closing process reduces revenue, expense, and dividends account balances (temporary accounts) to zero so they are ready to receive data for the next accounting period.

- A closing entry is a journal entry made at the end of accounting periodsthat involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet.

What are temporary accounts examples?

Temporary accounts refer to accounts that are closed at the end of every accounting period. These accounts include revenue, expense, and withdrawal accounts. They are closed to prevent their balances from being mixed with those of the next period.

This closes expenses for the period, which creates a zero balance in your company’s expense accounts. For instance, if your company has $5,000 total expenses, debit the income summary for $5,000. This transfers the total expenses for the period to your company’s income summary account. Write a corresponding credit to the expense account to balance the entry.

Revenue is a temporary account that indicates the amount of money generated by the company for a certain period of time. Close a revenue account by writing a debit entry for the total amount generated in the period. For example, if your company generates $10,000 for the period, you must write a debit in the revenue account for $10,000. Write a corresponding credit in the income summary account to balance the entry.

If a company’s revenues were greater than its expenses, the closing entry entails debiting income summary and crediting retained earnings. In the event of a loss for the period, the income summary account needs to be credited and retained earnings are reduced through a debit.

Therefore, if your company debits income summary for $5,000, you must credit expenses for $5,000. The term “temporary account” refers to items found on your income statement, such as revenues and expenses. “Permanent accounts” consist of items located on the balance sheet, such as assets, owners’ equity and liability accounts. Unlike permanent accounts, temporary ones must be closed at the end of your company’s accounting period to begin the new accounting cycle with zero balances. This means that at the end of each accounting period, you must close your revenue, expense and withdrawal accounts.

The income summary account serves as a temporary account used only during the closing process. It contains all the company’s revenues and expenses for the current accounting time period.

Income Summary

In other words, it contains net incomeor the earnings figure that remains after subtracting all business expenses, depreciation, debt service expense, and taxes. The income summary account doesn’t factor in when preparing financial statements because its only purpose is to be used during the closing process. Expenses are temporary accounts that illustrate a company’s cost of conducting business. Expenses include items such as supplies, advertising and other costs your company must pay to generate revenue. Debit the income summary account for the total expenses for the period.

A term often used for closing entries is “reconciling” the company’s accounts. Accountants perform closing entries to return the revenue, expense, and drawing temporary account balances to zero in preparation for the new accounting period. is a temporary account of the company where the revenues and expenses were transferred to. After the other two accounts are closed, the net income is reflected. Taking the example above, total revenues of $20,000 minus total expenses of $5,000 gives a net income of $15,000 as reflected in the income summary.