The internal rate of return is a discounting calculation and makes no assumptions about what to do with periodic cash flows received along the way. It can’t because it’s a DISCOUNTING function, which moves money back in time, not forward. Recall that IRR is the discount rate or the interest needed for the project to break even given the initial investment. If market conditions change over the years, this project can have multiple IRRs.

What is a Good IRR?

Further information about potential problems with the IRR method (compared to NPV) may be obtained from most finance textbooks. One major problem with IRR is the possibility of obtaining multiple rates of return (multiple “roots”) when solving for the IRR of an investment. This can occur in the unusual case where cash flows change erratically from positive to negative (in large quantities or for sustained time periods) more than once during the life of the investment. The graph in the following example illustrates how multiple IRR roots can occur for investments with these types of cash flows. The second graph is for comparison purposes and typifies the IRR calculation and graph for most investments.

What does the IRR tell you?

Internal rate of return (IRR) is the interest rate at which the net present value of all the cash flows (both positive and negative) from a project or investment equal zero. Internal rate of return is used to evaluate the attractiveness of a project or investment.

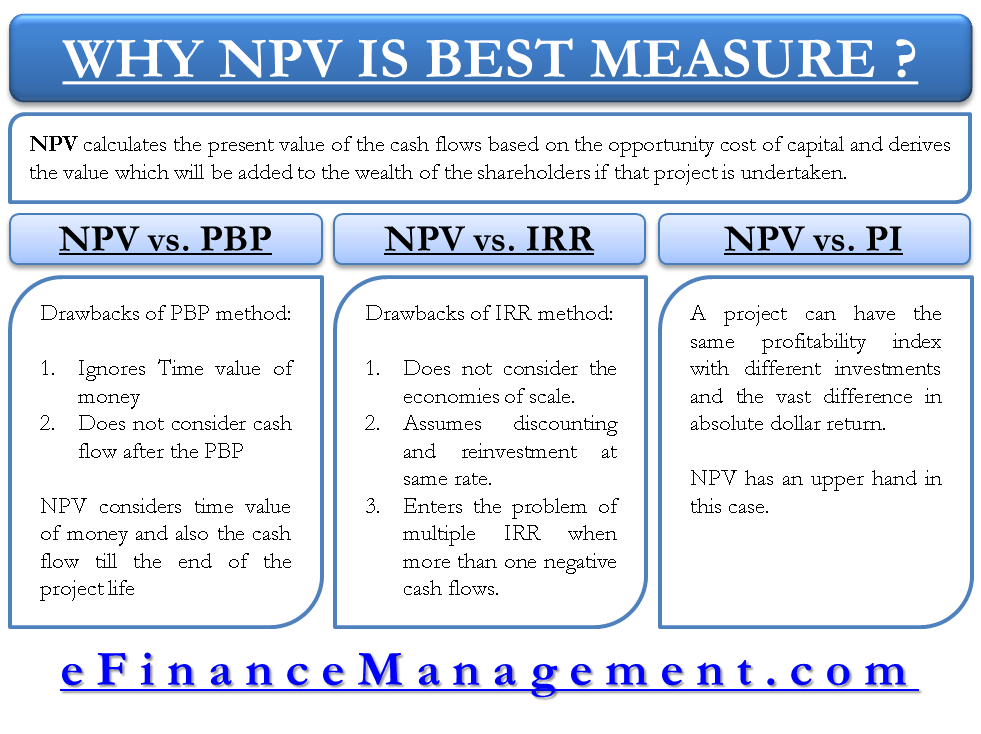

Whenever an NPV and IRR conflict arises, always accept the project with higher NPV. It is because IRR inherently assumes that any cash flows can be reinvested at the internal rate of return.

This assumption is problematic because there is no guarantee that equally profitable opportunities will be available as soon as cash flows occur. The risk of receiving cash flows and not having good enough opportunities for reinvestment is called reinvestment risk.

The catch is that discount rates usually change substantially over time. For example, think about using the rate of return on a T-bill in the last 20 years as a discount rate.

What is a good IRR?

The internal rate of return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. The internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

When evaluating potential capital investments by your small business in various projects, the Internal Rate of Return, or IRR, can be a valuable tool in assessing the projects most worth pursuing. IRR measures the rate of return of projected cash flows generated by your capital investment. The IRR for each project under consideration by your business can be compared and used in decision-making. The presumed rate of return for the reinvestment of intermediate cash flows is the firm’s cost of capital when NPV is used, while it is the internal rate of return under the IRR method. Theinternal rate of return(IRR) is a core component of capital budgeting and corporate finance.

But with IRR you calculate the actual return provided by the project’s cash flows, then compare that rate of return with your company’s hurdle rate (how much it mandates that investments return). IRR has a number of distinct advantages (as does NPV) over both the payback and ROR methods as a decision-making tool for evaluating potential investments. The first advantage is that the IRR calculation takes into account TVM. Therefore, IRR is an objective criterion, rather than a subjective criterion, for making decisions about investment projects. Thirdly, IRR uses actual cash flows rather than accounting incomes like the ROR method.

- The IRR method has several disadvantages compared to the NPV method, though only one disadvantage is mentioned here for purposes of brevity.

- The internal rate of return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments.

- The internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

It applies a discount rate for borrowing cash, and the IRR is calculated for the investment cash flows. This applies in real life for example when a customer makes a deposit before a specific machine is built. However, using IRR to sort projects in order of preference does not result in the same order as using NPV. The appropriate minimum rate to maximize the value added to the firm is the cost of capital, i.e. the internal rate of return of a new capital project needs to be higher than the company’s cost of capital. This is because only an investment with an internal rate of return which exceeds the cost of capital has a positive net present value.

What is Internal Rate of Return (IRR)?

The internal rate of return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. The internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. The IRR method has several disadvantages compared to the NPV method, though only one disadvantage is mentioned here for purposes of brevity.

Miscalculating using IRR in this way may lead to the belief that a project is more profitable than it actually is. This, along with the fact that long projects with fluctuating cash flows may have multiple distinct IRR values, has prompted the use of another metric called modified internal rate of return (MIRR). However, for capital budgeting, when the objective is to maximize value, finance theory holds that NPV using the firm’s cost of capital is the optimal metric. Internal rate of return (IRR) is the interest rate at which the NPV of all the cash flows (both positive and negative) from a project or an investment equals zero. As shown in the step-by-step approach above, the IRR makes no such assumption.

What’s the difference between NPV and IRR?

Businesses use it to determine whichdiscount ratemakes the present value of future after-tax cash flows equal to the initial cost of thecapital investment. Rather, when positive cash flows are reinvested, it will be at a rate that more resembles the cost of capital.

You also have to be careful about how IRR takes into account the time value of money. IRR assumes future cash flows from a project are reinvested at the IRR, not at the company’s cost of capital, and therefore doesn’t tie as accurately to cost of capital and time value of money as NPV does. According to Knight, it’s commonly used by financial analysts in conjunction with net present value, or NPV. That’s because the two methods are similar but use different variables. With NPV you assume a particular discount rate for your company, then calculate the present value of the investment (more here on NPV).

NPV, on the other hand, does not suffer from such a problematic assumption because it assumes that reinvestment occurs at the cost of capital, which is conservative and realistic. Modified Internal Rate of Return (MIRR) considers cost of capital, and is intended to provide a better indication of a project’s probable return.

One-year T-bills returned between around 0.1% and 6.4% in the last 20 years, so clearly the discount rate is changing. It then discounts them into present value amounts using a discount rate representing the project’s capital costs as well as its risk. The investment’s future positive cash flows are then reduced into a single present value figure. This number is deducted from the initial amount of cash needed for the investment.

In other words, long projects with fluctuating cash flows and additional investments of capital may have multiple distinct IRR values. Although using one discount rate simplifies matters, there are a number of situations that cause problems for IRR. If an analyst is evaluating two projects, both of which share a common discount rate, predictable cash flows, equal risk, and a shorter time horizon, IRR will probably work.