An alternative format is to add as many years as will fit on the page, without showing a variance, so that you can see general changes by account over multiple years. A less-used format is to include a vertical analysis of each year in the report, so that each year shows each line item as a percentage of the total assets in that year. Horizontal analysis of the income statement is usually in a two-year format, such as the one shown below, with a variance also shown that states the difference between the two years for each line item.

Comparability is the ability to review side-by-side two or more different companies’ financials. Horizontal analysis not only improves the review of a company’s consistency over time directly, but it also improves comparability of growth in a company to that of its competitors as well. Horizontal analysis of financial statements involves comparison of a financial ratio, a benchmark, or a line item over a number of accounting periods. Horizontal analysis allows the assessment of relative changes in different items over time. It also indicates the behavior of revenues, expenses, and other line items of financial statements over the course of time.

If analysis reveals any unexpected differences in income statement accounts, management and accounting staff at the company should isolate the reasons and take action to fix the problem(s). Indeed, sometimes companies change the way they break down their business segments to make the horizontal analysis of growth and profitability trends more difficult to detect.

An alternative format is to simply add as many years as will fit on the page, without showing a variance, so that you can see general changes by account over multiple years. A third format is to include a vertical analysis of each year in the report, so that each year shows expenses as a percentage of the total revenue in that year. Horizontal analysis is the comparison of historical financial information over a series of reporting periods, or of the ratios derived from this information.

All the items in the balance sheet are stated as a percentage of the total assets. Whereas the opposite of the vertical analysis of financial statement is the Horizontal analysis always looks at the amount from the financial statement over the horizon of many years. Horizontal and vertical analysis are two main types of analysis methods used for this purpose. To illustrate horizontal analysis, let’s assume that a base year is five years earlier.

Criticism of Horizontal Analysis

Vertical analysis restates each amount in the income statement as a percentage of sales. This analysis gives the company a heads up if cost of goods sold or any other expense appears to be too high when compared to sales.

Seeing the horizontal analysis of every item allows you to more easily see the trends. It will be easy to detect that over the years the cost of goods sold has been increasing at a faster pace than the company’s net sales. From the balance sheet’s horizontal analysis you may see that inventory and accounts payable have been growing as a percentage of total assets. Another form of financial statement analysis used in ratio analysis is horizontal analysis or trend analysis. Vertical analysis is a method of financial statement analysis in which each line item is listed as a percentage of a base figure within the statement.

Horizontal analysis is used in financial statement analysis to compare historical data, such as ratios or line items, over a number of accounting periods. The key difference between horizontal and vertical analysis depends on the way financial information in statements are extracted for decision making. Horizontal analysis compares financial information over time by adopting a line by line method. Vertical analysis is focused on conducting comparisons of ratios calculated using financial information. Both these methods are conducted using the same financial statements and both are equally important to make decisions that affect the company on an informed basis.

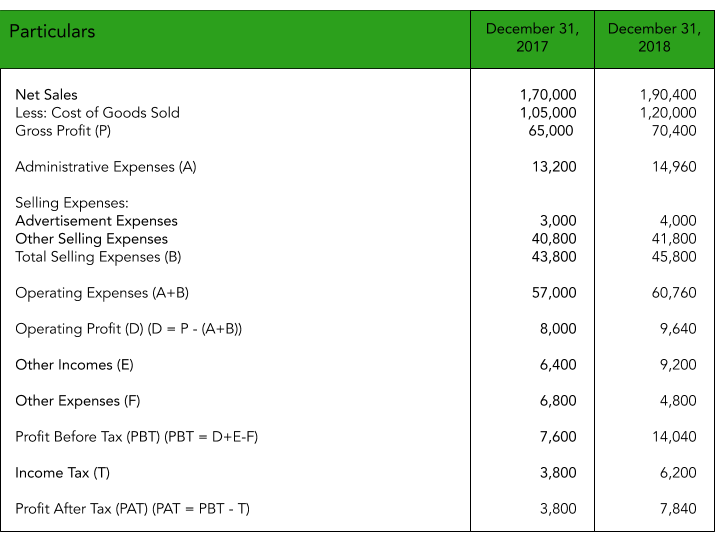

Comparative income statement with horizontal analysis:

What is horizontal analysis?

Definition: Horizontal analysis, sometimes called trend analysis, is the process of comparing line items in comparative financial statements or financial ratios across a number of years in an effort to track the history and progress of a company’s performance.

But if sales revenue increases by only 5%, then it needs to be investigated. Or if you find an unexpected increase in cost of goods sold or any operating expense, you can investigate and find the reason. Comparison of financial statements or specific items in a financial statement that covers two or more periods. Comparative study of a balance sheet or income statement for two or more accounting periods, to compute both total and relative variances for each line item.

Comparative balance sheet with horizontal analysis:

On the other hand, horizontal analysis refers to the analysis of specific line items and comparing them to a similar line item in the previous or subsequent financial period. Although common size analysis is not as detailed as trend analysis using ratios, it does provide a simple way for financial managers to analyze financial statements. Financial statements that include vertical analysis clearly show line item percentages in a separate column. These types of financial statements, including detailed vertical analysis, are also known as common-size financial statements and are used by many companies to provide greater detail on a company’s financial position. Common-size financial statements often incorporate comparative financial statements that include columns comparing each line item to a previously reported period.

Horizontal analysis is used in financial statement analysis to compare historical data, such as ratios, or line items, over a number of accounting periods. Vertical analysis is the proportional analysis of a financial statement, where each line item on a financial statement is listed as a percentage of another item. This means that every line item on an income statement is stated as a percentage of gross sales, while every line item on a balance sheet is stated as a percentage of total assets. Horizontal analysis of financial statements can be performed on any of the item in the income statement, balance sheet and statement of cash flows.

For example, this analysis can be performed on revenues, cost of sales, expenses, assets, cash, equity and liabilities. It can also be performed on ratios such as earnings per share (EPS), price earning ratio, dividend payout, and other similar ratio.

- Vertical analysis is a kind of financial statement analysis wherein each item in the financial statement is shown in percentage of the base figure.

- Here all the items in the income statement are stated as a percentage of gross sales.

All of the amounts on the balance sheets and the income statements will be expressed as a percentage of the base year amounts. The amounts from five years earlier are presented as 100% or simply 100. The amounts from the most recent years will be divided by the base year amounts. For instance, if a most recent year amount was three times as large as the base year, the most recent year will be presented as 300. If the previous year’s amount was twice the amount of the base year, it will be presented as 200.

What is a horizontal and vertical analysis?

Horizontal analysis (also known as trend analysis) is a financial statement analysis technique that shows changes in the amounts of corresponding financial statement items over a period of time. It is a useful tool to evaluate the trend situations. The statements for two or more periods are used in horizontal analysis.

Horizontal Analysis

It is used to see if any numbers are unusually high or low in comparison to the information for bracketing periods, which may then trigger a detailed investigation of the reason for the difference. It can also be used to project the amounts of various line items into the future.

Accurate analysis can be affected by one-off events and accounting charges. Horizontal analysis of the balance sheet is also usually in a two-year format, such as the one shown below, with a variance showing the difference between the two years for each line item.

Vertical analysis makes it much easier to compare the financial statements of one company with another, and across industries. This is because one can see the relative proportions of account balances. In a horizontal analysis the the changes in income statement and balance sheet items are computed (in dollars and percentage) and compared with the expected changes. For example, you start an advertising campaign and expect a 25% increase in sales.

For example, by showing the various expense line items in the income statement as a percentage of sales, one can see how these are contributing to profit margins and whether profitability is improving over time. It thus becomes easier to compare the profitability of a company with its peers. The most common use of vertical analysis is within a financial statement for a single reporting period, so that one can see the relative proportions of account balances. Vertical analysis is also useful for trend analysis, to see relative changes in accounts over time, such as on a comparative basis over a five-year period. For example, if the cost of goods sold has a history of being 40% of sales in each of the past four years, then a new percentage of 48% would be a cause for alarm.

To increase the effectiveness of vertical analysis multiple year’s statement or reports can be compared and comparative analysis of statements can be done. This analysis makes easier to compare the financial statements of one company with another and across the companies as one can see the relative proportion of accounts. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

Generally accepted accounting principles (GAAP) are based on consistency and comparability of financial statements. Consistency is the ability to accurately review one company’s financial statements over a period of time because accounting methods and applications remain constant.

The balance sheet uses this presentation on individual items like cash or a group of items like current assets. Cash is listed as an individual entry in the assets section with the total balance being listed on the left and its percentage of total assets being listed on the right. The income statement also uses this presentation with revenue entries referencing total revenues and expense entries referencing total expenses. A common size financial statement allows for easy analysis between companies or between periods for a company. It displays all items as percentages of a common base figure rather than as absolute numerical figures.

Vertical analysis is a kind of financial statement analysis wherein each item in the financial statement is shown in percentage of the base figure. This is one of the popular methods of financial statements used as it is simple and also called a common size analysis. Here all the items in the income statement are stated as a percentage of gross sales.

Reviewing these comparisons allows management and accounting staff at the company to isolate the reasons and take action to fix the problem(s). Horizontal analysis allows investors and analysts to see what has been driving a company’s financial performance over a number of years, as well as to spot trends and growth patterns such as seasonality. It enables analysts to assess relative changes in different line items over time, and project them into the future.

This percentage can be used to compare bothbalance sheetandincome statementperformance within the company. Much like ratio analysis, vertical analysis allows financial information of a small company to be compared with that of a large company. The common size percentage can also be used to compare different companies within the same industry or companies that use different currencies.

Financial statements should be prepared in a standard vertical format in accordance with accounting standards. The main use of vertical analysis is to calculate the financial ratios which in turn are key metrics in evaluating company performance. Once the ratios are calculated, they can be easily compared with ratios in similar companies for benchmarking purpose. If a company’s inventory is $100,000 and its total assets are $400,000 the inventory will be expressed as 25% ($100,000 divided by $400,000). If cash is $8,000 then it will be presented as 2%($8,000 divided by $400,000).

Related Terms

If the accounts payable are $88,000 they will be restated as 22% ($88,000 divided by $400,000). If owner’s equity is $240,000 it will be shown as 60% ($240,000 divided by $400,000). The vertical analysis of the balance sheet will result in a common-size balance sheet. The percentages on a common-size balance sheet allow you to compare a small company’s balance sheets to that of a very large company’s balance sheet. A common-size balance sheet can also be compared to the average percentages for the industry.