Year-to-date refers to the cumulative balance appearing in an income statement account for the current year, through the end of the most recent reporting period. Thus, for financial statements using the calendar year, the concept refers to the period between January 1 and the current date. Periodic reporting at half yearly, quarterly and sometimes even monthly intervals, provides users with more current information for use in assessing the performance of a business enterprise.

Unlike annual statements, interim statements do not have to be audited. Interim statements increase communication between companies and the public and provide investors with up-to-date information between annual reporting periods. A financial statement can be prepared for a company for any length of time and at any point in time.

What is interim information?

Interim financial statements are financial statements that cover a period of less than one year. Technically, the “interim” concept does not apply to the balance sheet, since this financial statement only refers to assets, liabilities, and equity as of a specific point in time, rather than over a period of time.

Example: Quarterly Reports

Examples include changes in estimate in the final interim period relating to inventory write-downs, restructurings, or impairment losses that were reported in an earlier interim period of the financial year. The disclosure required by the preceding paragraph is consistent with AS 5 requirements and is intended to be restricted in scope so as to relate only to the change in estimates.

Interim financial statements

But there are a few key differences between what’s included in interim financial statements and what’s included in annual financial statements. Especially if you follow publicly traded companies, you might have heard of “interim financial statements,” which are published with publicly traded companies’ quarterly reports. The term also appears on occasion in non-public companies, especially if a board of directors is involved or if the company is seeking investors. The revenues generated by a business may be significantly impacted by seasonality. If so, interim statements may reveal periods of major losses and profits, which are not apparent in the annual financial statements.

Interim Financial Statements vs. Annual Financial Statements

Interim financial statements are financial statements that cover a period of less than one year. They are used to convey information about the performance of the issuing entity prior to the end of the normal reporting year, and so are closely followed by investors. The concept is most commonly applied to publicly-held companies, which must issue these statements at quarterly intervals. These entities issue three sets of interim statements per year, which are for the first, second, and third quarters.

Interims help parents stay on top of their child’s progress in a given subject, and because they’re usually issued half-way through a grading period, they also give families a chance to correct academic problems, if they exist. A change in accounting policy, other than one for which the transition is specified by an Accounting Standard, should be reflected by restating the financial statements of prior interim periods of the current financial year. The twelve-month measurements will reflect any changes in estimates of amounts reported for the first six-month period.

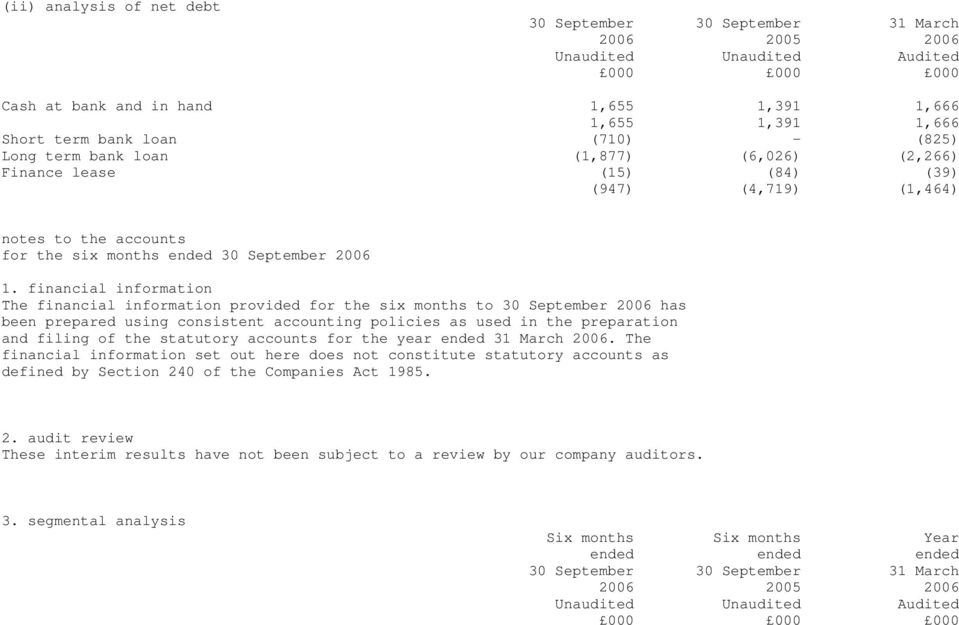

Such periodic reporting between the dates of annual financial statements is known as interim reporting. profit and loss statement, a balance sheet, and a statement of cash flows.

The most common interim statement may be the quarterly report. Aquarterly reportis a summary or collection of un-audited financial statements, such as balance sheets, income statements, and cash flow statements, issued by companies every quarter (three months). Publicly-traded companies must file their reports with the Securities Exchange Commission. This form, known as a 10-Q, does not include all the detailed information, such as background and operations detail that the annual report (known as a 10-K) would. Even if your company is turning a profit, it may be falling short because you don’t have adequate cash flow, so it is just as important to prepare a statement of cash flows as it is to prepare the income statement and balance sheet.

Because of various time lag relationships between costs and sales difficulties are created in matching costs and revenues. Interim accruals for various expenses that normally require companies to rely heavily on estimates, the problem is also multiplied due to the tendency of investors to project a full year’s results on the basis of data given in interim reports. Seasonal business also raises a problem about matching of revenues and expenses during the accounting period. In every business organisation inventories are main elements in the generation of income. Interim reporting concentrates on providing periodic interim reports on fix interval during an accounting period say half yearly, quarterly or monthly.

Information from your accounting journal and your general ledger is used in the preparation of your business’s financial statement. The income statement, the statement of retained earnings, the balance sheet, and the statement of cash flows all make up your financial statements. Also, information from the previous statement is used to develop the next one.

But the principles for recognising assets, liabilities, income, and expenses for interim periods are the same as in annual financial statements. The objective of this Standard is to prescribe the minimum content of an interim financial report and to prescribe the principles for recognition and measurement in a complete or condensed financial statements for an interim period. Timely and reliable interim financial reporting improves the ability of investors, creditors, and others to understand an enterprise’s capacity to generate earnings and cash flows, its financial condition and liquidity. The International Accounting Standards Board (IASB) suggests certain standards be included while preparing interim statements. These include a series of condensed statements covering the company’s financial position, income, cash flows, and changes in equity along with notes of explanation.

- Information from your accounting journal and your general ledger is used in the preparation of your business’s financial statement.

- Also, information from the previous statement is used to develop the next one.

The definitions of assets, liabilities, income, and expenses are fundamental to recognition, both at annual and interim financial reporting dates. Paragraph 16(d) of this Standard requires similar disclosure in an interim financial report.

The final reporting period of the year is encompassed by the year-end financial statements, and so is not considered to be associated with interim financial statements. The preparation of financial statements involves the process of aggregating accounting information into a standardized set of financials. The completed financial statements are then distributed to lenders, creditors, and investors, who use them to evaluate the performance, liquidity, and cash flows of a business. If you have a child in middle school or high school, you’ve probably encountered interims, or progress reports, as they are sometimes called.

This statement compares two time periods of financial data and shows how cash has changed in the revenue, expense, asset, liability, and equity accounts during these time periods. However, by providing that the frequency of an enterprise’s reporting should not affect the measurement of its annual results, paragraph 27 acknowledges that an interim period is a part of a financial year. Year-to-date measurements may involve changes in estimates of amounts reported in prior interim periods of the current financial year.

What is an interim balance sheet?

August 26, 2018. An interim period is a financial reporting period that is shorter than a full fiscal year. Interim financial reports are generally quarterly financial reports that are required for any entities whose debt securities or equity securities are publicly traded.

Unlike an IRS or other tax audit, the purpose of an external audit is to verify the accuracy of the financial statements and to examine the business’s accounting practices. But external audits can become expensive and complicated, so interim financial statements aren’t audited. This could lead you to make costly—or even devastating—mistakes in your business decisions.

Interim report may be a problem if the inventory level at the end of reporting period is below than in the beginning of the year. Consistently apply the same accounting policies used for the construction of full-year financial statements to the construction of interim statements. If you plan to apply a new accounting policy to the full-year statements of the current fiscal year, then use them in the interim period, too. Most accounting software will also let you reconcile loan accounts, as we mentioned in step three. Completing the reconciliation process will help you identify any duplicate or missing transactions, which would misstate your interim financial statements.

In measuring assets, liabilities, income, expenses, and cash flows reported in its financial statements, an enterprise that reports only annually is able to take into account information that becomes available throughout the financial year. For your interim financial statements to make sense, your profit and loss statement and statement of cash flows need to be produced using the same date range, and your balance sheet needs to be produced as of the last date of the same period. An interim statement is a financial report covering a period of less than one year. Interim statements are used to convey the performance of a company before the end of normal full-year financial reporting cycles.

The amounts reported in the interim financial report for the first six-month period are not retrospectively adjusted. Paragraphs 16(d) and 25 require, however, that the nature and amount of any significant changes in estimates be disclosed.

This Standard does not prohibit or discourage an enterprise from presenting a complete set of financial statements in its interim financial report, rather than a set of condensed financial statements. This Standard also does not prohibit or discourage an enterprise from including, in condensed interim financial statements, more than the minimum line items or selected explanatory notes as set out in this Standard. Problems related with accounting can be minimized by having a close date which coincides with a time of low activity in company’s natural operating cycles. Businesses facing more than one business cycle during a year can improve the significance of period statements by reporting for seasonal cycles rather than for calendar years. Business activities are not similar and uniform throughout the accounting period.

The statement of retained earnings is the second financial statement you must prepare in the accounting cycle. Net profit or loss must be calculated before the statement of retained earnings can be prepared. After you arrive at your profit or loss figure from the income statement, you can prepare this statement to see what your total retained earnings are to date and how much you’ll pay out to your investors in dividends, if any. This statement shows the distribution of profits that are retained by the company and which are distributed as dividends.

Interim Statement

However, the frequency of an enterprise’s reporting (annual, half-yearly, or quarterly) should not affect the measurement of its annual results. To achieve that objective, measurements for interim reporting purposes should be made on a year-to-date basis.

Set the basis for your financial statements.

An enterprise is not required to include additional interim period financial information in its annual financial statements. Other Accounting Standards specify disclosures that should be made in financial statements. In that context, financial statements mean complete set of financial statements normally included in an annual financial report and sometimes included in other reports. The disclosures required by those other Accounting Standards are not required if an enterprise’s interim financial report includes only condensed financial statements and selected explanatory notes rather than a complete set of financial statements.

So, review your loan statements for each month in the interim financial statement period, and make sure your interest payments have been properly recorded as expenses. The best way to check this is to reconcile your loan statement each month, making sure the principal balance on the loan statement matches the loan balance on your balance sheet. Publicly traded companies and most nonprofits undergo an annual external audit.

Some companies prepare financial statements monthly to keep a tight handle on the financial position of the firm. Financial statements must be prepared at the end of the company’s tax year. The statement of cash flows must be prepared last because it takes information from all three previously prepared financial statements. The statement divides the cash flows into operating cash flows, investment cash flows, and financing cash flows. The final result is the net change in cash flows for a particular time period and gives the owner a very comprehensive picture of the cash position of the firm.

The basic problem which every reporting entity faces is determination of quantity of inventory, valuation of inventory and adjustments of valuation in every report. Inventory problem becomes more complex for companies following LIFO method.