That’s because it offers insights on a longer time period than other time-based metrics such as MTD. This example comes from a financial modeling exercise where an analyst is comparing the number of units sold in Q to the number of units sold in Q3 2017. YOY also differs from the term sequential, which measures one quarter or month to the previous one and allows investors to see linear growth.

- It’s important to compare the fourth-quarter performance in one year to the fourth-quarter performance in other years.

- The company also revealed plans to reorganize its North America and Asia-Pacific segments, removing several divisions from the former and reorganizing the latter into Kellogg Asia, Middle East, and Africa.

- This covers the time since the time between the beginning of the previous month and the current date.

Some of the primary economic data reported this way are the consumer price index, gross domestic product, unemployment rates, and interest rates. Businesses will also use year-over-year data to calculate key financial performance metrics. If we multiply the prior period balance by (1 + growth rate assumption), we can calculate the projected current period balance. By comparing a company’s current annual financial performance to that of 12 months back, the rate at which the company has grown as well as any cyclical patterns can be identified.

To properly quantify a company’s performance, it makes sense to compare revenue and profits YOY. Because of this, it makes much more sense to compare quarterly financials on a YoY basis. It gives a more accurate view of whether the numbers are growing or declining. An excellent example of this is Meta’s (formerly Facebook) 2021 financial highlights from its investor page. The statement shows the year-over-year changes for a three-month period from the end of 2021 and the period December 2020 to December 2021.

How to Use YoY in Reporting

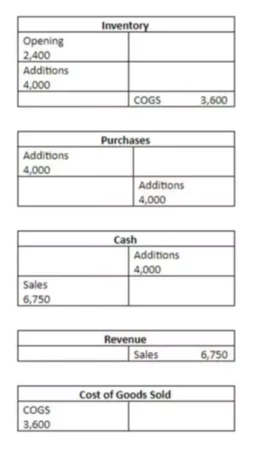

Here, by dividing the current period amount by the prior period amount, and then subtracting 1, we arrive at the implied growth rate. Once we perform the same process for revenue in all forecasted periods, as well as for EBIT, the next part of our modeling exercise is to calculate the YoY growth rate. Despite that, MoM reporting is still very useful when reporting financial, marketing, and sales data because it helps businesses detect new trends and make adjustments. To find this percentage, you need to subtract the previous month’s value from this month’s value, divide the result by the previous month’s value, and multiply by 100. You can also divide the current month’s value by the previous value, subtract 1 from the result, and multiply by 100. For example, retailers have a peak demand season during the holiday shopping season, which falls in the fourth quarter of the year.

Sales, profits, and other financial metrics change during different periods of the year because most lines of business have a peak season and a low demand season. For example, in the first quarter of 2021, the Coca-Cola corporation reported a 5% increase in net revenues over the first quarter of the previous year. By comparing the same months in different years, it is possible to draw accurate comparisons despite the seasonal nature of consumer behavior. Investors like to examine YOY performance to see how performance changes across time. Year-over-year (YOY)—sometimes referred to as year-on-year—is a frequently used financial comparison for looking at two or more measurable events on an annualized basis.

Year-over-year, often referred to as YOY or YoY is a metric used to compare data from the current year vs. the previous year. Using YoY analysis, finance professionals can compare the performance of key financial metrics such as revenues, expenses, and profit. This helps analysts spot growth trends and patterns needed to make strategic business decisions. YOY comparisons are popular when analyzing a company’s performance because they help mitigate seasonality, a factor that can influence most businesses.

Common YoY economic indicators

And, like YTD, MTD only covers the period ending at the last finalized business day. The formula to calculate Year-over-Year (YoY) is the current year’s value divided by the previous year’s value minus one. Year-to-date (YTD) looks at a change relative to the beginning of the year (usually Jan. 1). The company also revealed plans to reorganize its North America and Asia-Pacific segments, removing several divisions from the former and reorganizing the latter into Kellogg Asia, Middle East, and Africa.

- However, it can be difficult or time-consuming to have to work out these figures every time on Excel.

- That’s because it offers insights on a longer time period than other time-based metrics such as MTD.

- If by April you have figures of $55,450 for January, $87,690 for February, $50,460 for March, and $40,600 so far in April, your YTD results will be the sum of these revenues.

- They are most useful in businesses where keeping a handle on small daily and monthly changes is important.

- By comparing months in a year-over-year fashion, the comparison becomes more relevant than two consecutive months that are affected by varying seasonality or other factors.

- But this quarter includes the holidays, which tend to lead to a lot of sales each year.

After inputting our assumptions into the formula, we arrive at an YoY growth rate of 20% in the company’s revenue. The objective of performing a year over year growth analysis (YoY) is to compare recent financial performance to historical periods. As you can see, YoY reporting gives a more global, stable view of company performance despite factors such as seasonality.

Supercharge your skills with Premium Templates

When you convert to a percentage, you find that the dealership’s MoM growth was 66.67% as of February. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

For instance, the number of cell phones a tech company sold in the fourth quarter compared with the third quarter or the number of seats an airline filled in January compared with December. It’s important to compare the fourth-quarter performance in one year to the fourth-quarter performance in other years. Common YOY comparisons include annual and quarterly as well as monthly performance.

What’s the Difference Between YOY and YTD?

It allows executives to be even more strategic and to make good decisions even in changing business environments. Year-over-year analysis is most commonly used when discussing financial or economic data, especially regarding growth. YoY data shows how a given variable increases or decreases from one year to the next. YTD returns can also be used to compare performance with a different year for the same time period. Analyzing current performance against historical data reveals what trends are taking place. For example, seasonality (how certain seasons affect revenues) is not accounted for in a YoY analysis.

If by April you have figures of $55,450 for January, $87,690 for February, $50,460 for March, and $40,600 so far in April, your YTD results will be the sum of these revenues. If your organization uses a non-standard fiscal year, YTD might also reference the period between the beginning of the current fiscal year and the current date. It should give you clear insights not only into what’s going on with your business but also help you predict the future and make better decisions. The value of business reports lies in how they present information clearly and concisely. If a report is unintelligible or too complex, it becomes difficult to draw useful insights to help you navigate your business. You can compute month-over-month or quarter-over-quarter (Q/Q) in much the same way as YOY.

Suppose we’re analyzing the growth profile of a company that generated $100 million in revenue and $25 million in operating income (EBIT) in the trailing twelve months. Just like YTD, MTD (month-to-date) is a period that starts at the beginning of the current month to the current date. It is a much shorter period compared to YTD, but it is very useful in reporting interim monthly performance. In another example, a company such as Spirit Halloween that sells costumes would expect most of its annual revenue between late August and early November.