Long-term assets can include fixed assets such as a company’s property, plant, and equipment, but can also include other assets such as long-term investments or patents. It is not uncommon for capital-intensive industries to have a large portion of their asset base composed of noncurrent assets. Conversely, service businesses may require minimal to no use of fixed assets.

What is Owner’s Capital?

Noncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year. Examples of noncurrent assets include investments in other companies, intellectual property (e.g. patents), and property, plant and equipment. Knowing where a company is allocating its capital and how it finances those investments is critical information before making an investment decision.

Recording Capital Assets

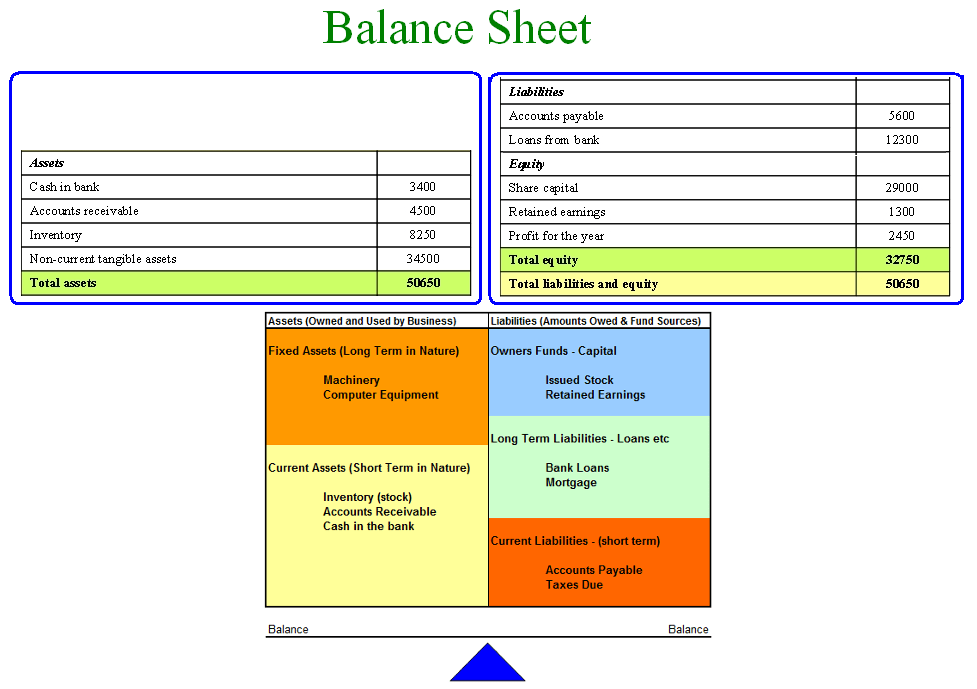

The balance sheet reports the assets – property and rights to property – belonging to the company, such as equipment and accounts receivable. The balance sheet also shows the liabilities – debts or obligations – owed to others, such as accounts payable and notes payable. Fixed assetsare noncurrent assets that a company uses in its production or goods and services that have a life of more than one year. Fixed assets are recorded on the balance sheet and listed asproperty, plant, and equipment(PP&E).

Is capital an asset or owner’s equity?

Basically, the owner’s capital account represents the net assets of the company. It’s the amount of money left over after the company sells all of its assets and pays off all of its creditors. This remaining amount of money is what the owner actually owns.

Since Cash is an asset account, its normal or expected balance will be a debit balance. In the first transaction, the company increased its Cash balance when the owner invested $5,000 of her personal money in the business. (See #1 in the T-account above.) In our second transaction, the business spent $3,000 of its cash to purchase equipment. Hence, item #2 in the T-account was a credit of $3,000 in order to reduce the account balance from $5,000 down to $2,000. When J. Lee invests $5,000 of her personal cash in her new business, the business assets increase by $5,000 and the owner’s equity increases by $5,000.

Comments for Is Equity and Capital the Same?

This capital employed appears on the assets side of the balance sheet, and its amount is exactly equal to its sources of funds included on the liability side. A balance sheet is one of the fundamental financial statements used by most businesses.

In keeping with double-entry bookkeeping, every journal entry requires both a debit and a credit. Because a cash withdrawal requires a credit to the cash account, an entry that debits the drawing account will have an offsetting credit to the cash account for the same amount.

Capital investment might include purchases of equipment and machinery or a new manufacturing plant to expand a business. In short, capital investment for fixed assets means the company plans to use the assets for several years. “Owner Capital” is reported in the equity section of a sole proprietorship balance sheet. Any money the owner invests to start the business or keep it running is classified as owner capital. Because equity accounts normally have a credit balance, all owner contributions are recorded as credits.

Fixed assets arelong-term assetsand are referred to as tangible assets, meaning they can be physically touched. Capital investment decisions are long-term funding decisions that involve capital assets such as fixed assets. Capital investments can come from many sources, including angel investors, banks, equity investors, and venture capital.

- Noncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year.

- Examples of noncurrent assets include investments in other companies, intellectual property (e.g. patents), and property, plant and equipment.

- Knowing where a company is allocating its capital and how it finances those investments is critical information before making an investment decision.

Irrespective of the number of promoters, the possibility that the business runs in loss or is sold to another company needs to be taken into account when the balance sheet is prepared. This is so because a balance sheet has to account for all events in business. Balance sheet is prepared based on transactions and transactions can take place only between two entities. For this purpose, promoter/s are considered as entity/ies separate from business.

In fundamental accounting, debits are balanced by credits, which operate in the exact opposite direction. The drawing account’s debit balance is contrary to the expected credit balance of an owner’s equity account because owner withdrawals represent a reduction of the owner’s equity in a business.

A company might be allocating capital to current assets, meaning they need short-term cash. Or the company could be expanding its market share by investing in long-term fixed assets. It’s also important to know how the company plans to raise the capital for their projects, whether the money comes from a new issuance of equity, or financing from banks or private equity firms. Current assets are short-term assets, whereas fixed assets are typically long-term assets. All capital, that is the funds put in by the owners of a business or a firm appear on the liability side of a balance sheet.

It is assumed that every business that is established is growth oriented and growth is foeither profit based or on a no profit no loss basis. To acheive these ends, capital needs to be infused into the business by the promoter/s.

These funds may appear under different account heads such as owners funds, share capital, and retained earnings. An a wider meaning of capital, which is generally used in some phrase like ‘capital employed’ refers to what ever is the value of the assets owned by the including its fixed assets and working capital.

Having shown business as a separate entity in the balance sheet, should a promoter choose to retire/withdraw from business, investment made by the promoter becomes a liability for business. Since the balance sheet is prepared for the business and not the promoter, capital is shown under liabilities although it is an investment made by the promoter. Other noncurrent assets include the cash surrender value of life insurance.

As a result, the accounting equation for the business will be in balance. When a partner in apartnershiptakes money out of the company for personal reasons, the cash account is credited and the partner’s withdrawal account is debited. When the accounting period is closed, the withdrawal accounts are closed to the capital accounts by aclosing entry. This shows that the withdrawal decreases the partner’s equity stake in the company, but does not affect his ownership share. Noncurrent assets (like fixed assets) cannot be liquidated readily to cash to meet short-term operational expenses or investments.

Therefore, while a high proportion of noncurrent assets to current assets may indicate poor liquidity, this may also simply be a function of the respective company’s industry. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days.

A bond sinking fund established for the future repayment of debt is classified as a noncurrent asset. Some deferred income taxes, goodwill, trademarks, and unamortized bond issue costs are noncurrent assets as well. Accounts payable are the opposite of accounts receivable, which are current assets that include money owed to the company. We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping.

Capital Asset

Depending on the type of asset, it may be depreciated, amortized, or depleted. Long-term assets are investments in a company that will benefit the company for many years.

Additionally, equipment or supplies donated to the business by the owner should be included in the owner capital account. At the end of the fiscal period, the net income or net loss also is transferred to the owner capital account.

Noncurrent assets are a company’s long-term investments, which are not easily converted to cash or are not expected to become cash within a year. Using depreciation, a business expenses a portion of the asset’s value over each year of its useful life, instead of allocating the entire expense to the year in which the asset is purchased. This means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded. The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current market value of the assets. A debit is an accounting entry that results in either an increase in assets or a decrease in liabilities on a company’s balance sheet.