How Can Companies Increase Market Share?

While both groups emphasize a large number of competitive weapons, small-share businesses lack the sales volume to support such broad-scale aggressive strategies. For proprietary reasons, the names of the companies or the industry segments they serve are not given in the data base.

How do you define market share?

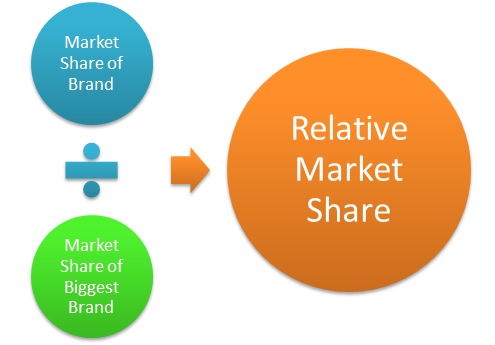

Market share represents the percentage of an industry, or a market’s total sales, that is earned by a particular company over a specified time period. Market share is calculated by taking the company’s sales over the period and dividing it by the total sales of the industry over the same period.

The most distinctive feature of these strategies is selective focus. They do not copy the strategies of market leaders (unlike ineffective low-share businesses). These high-performing, low-share businesses choose particular bases of competition, such as product quality and price. In general, the resource allocation patterns of ineffective low-share performers are similar to those of effective large-share businesses. The latter offer a broad line of products complemented by aggressive marketing, selling, R&D, and new product introduction.

Thus Crown Cork & Seal has segmented its market by products, customers, customer service, and plant location. It is significant that the company sells to growth segments in which it has special expertise. First, to be successful, most businesses must compete in a limited number of segments within their industry, and they must choose these segments carefully.

For example, the market share of General Motors in 2011 was 19.4%, more than 6 times the share of BMW at 2.82%. GM reported profits of $9.2 billion while BMW reported profits of about $4.9 billion Euros ($5.3 billion U.S.) during the same period. Whether measured by per unit sales or total revenue, BMW showed a higher degree of profitability than GM. Profit per unit, not just market share, is the goal of most companies.

These environments are not characterized by an absence of large-market-share businesses, as might be expected if “niche” strategies were followed. Low market growth, infrequent product and process changes, high value added, and high purchase frequency all contribute to more predictable and less turbulent environments. These markets are unlikely to attract new competitors, but they may be viewed as unexciting by existing competitors. As such, competitors’ divisions may receive less top management attention and staff support, and they may be staffed by less able and creative managers. Building market share is a risky, costly activity that can ignite retaliatory actions by competitors.

Their aim is to capture the specific customers that will enable the company to maximize profit. Large market share, whether measured in units sold or total revenues, does not always correlate with high profitability.

Market Share

For low-share businesses in particular, share building may not even be possible because of limitations of resources or market influence. To reposition in an effort to dominate a market segment, a company must have product- and market-development capabilities. Harvesting or divestiture may be especially difficult in the multibusiness corporation because facilities, distribution channels, or customers are shared with other units in the company. Legal or social pressures may make it difficult to leave a business, and finally, those companies that lack attractive investment alternatives may realize little benefit from harvesting funds.

What is a market share example?

Definition: Market share is a firm’s percentage of an industry’s total sales. It is calculated as the product of the firm’s sales over the industry’s sales during a specified period. For example, Apple has a huge MS is smartphone industry, but it has a small MS in the personal computing industry.

For such products, customers tend to rely more on experience and less on the brand name of market leaders for indications of reliability and performance. Thus, the share advantage of market leaders is less pronounced in these markets.

This indicates that their marketing and pricing strategies were more effective than competitors like Lexus, Mercedes, and Acura. All companies make their products and services unique and offer them at different price levels.

- Second, a stable market environment contributes to low-share success.

These market characteristics may stem from the nature of industrial components and supplies, which (as we discuss next) are the main products of successful low-share businesses. These products often require little subsequent servicing or technical support. The two market segments Crown Cork & Seal serves have both grown more rapidly than the total industry, but they also require expert skills in container design and manufacturing. The company has a particular advantage over competitors in the soft drink and brewing industries because it is the largest supplier of filling equipment to these companies.

Despite weaker positions in cost, quality, and product value, a targeted marketing focus enables these businesses to derive rather strong margins from a low-share position in a declining market environment. Market share appears to be less important for products that need to be bought often. More than half the low-share businesses studied produced such items (groups two and four).

While market share does not give a company a defined number regarding its profitability, it does provide key insights about a company’s revenues, growth and net profits. The larger the enterprise, the better it can serve larger numbers of people in a more cost-efficient manner. In layman’s terms, the bigger the company, the more economically that company can provide products or service to each customer. Goods or supplies are bought for deeper discounts, because of large wholesale orders.

Although there are numerous ways to define successful performance and low market share, we have chosen two straightforward definitions. Low market share is less than half the industry leader’s share, and successful companies are those whose five-year average return on equity surpasses the industry median. Applying these criteria to the over 900 businesses in 30 major industries listed in Forbes Annual Report on American Industry revealed numerous successful low share businesses. These three companies have surpassed not only their industries’ average return on equity but have actually led their industries in several important performance categories. Investors look at market share increases and decreases as a possible sign of relative competitiveness of a company’s products or services.

The heavy emphasis given to marketing, particularly in the use of their sales forces, compensates for the other shortcomings of these businesses. Their reputations for quality were lower than competitors’, and their product lines were not as broad. They sustain higher direct costs and have less forward and backward integration than do competitors.

Second, a stable market environment contributes to low-share success. The performance of effective low-share businesses depends on both the characteristics of their industry settings and their business strategies. The successful businesses tend to concentrate in competitive environments somewhat different from those of effective large-share businesses but similar to those of ineffective low-share performers.

What Strategies Do Companies Employ to Increase Market Share?

Thus, even at the same price point as its competitors, a larger company that has a greater market share can have a higher net profit, making it a stronger company overall. It also enables the company to offer more promotions or sales, thus driving market share even higher, as the company captures new customers from its competitors. of our sample, effective low-share businesses adopt an aggressive marketing strategy and place less emphasis on quality, competitive prices, or research and development.

Thinking in broader terms than only the range of products offered and the types of customers served, most successful companies define market segments in unique and creative ways. Investors and analysts monitor increases and decreases in market share carefully as this can be a sign of the relative competitiveness of the company’s products or services. As the total market for a product or service grows, a company that is maintaining its market share is growing revenues at the same rate as the total market.

Purchase decisions for industrial products are based largely on performance, service, and cost. In industrial markets, it may be possible for small-share businesses to develop strong relationships with selected customers through emphasis on performance variables important to them. Advertising, normally thought to have high economies of scale, is usually less important for industrial products; therefore, small-share businesses are at only a minor competitive disadvantage. Competing in such markets permits focused strategies, in which companies need not incur the costs of providing custom products or special services.

As the market of a product or service within an industry expands, a company that is maintaining its market share is growing revenues at the same rate as the total market. A company that is growing its market share will be growing its revenues faster than its competitors. Alternatively, you can compare all the companies within a competitive space. Changes in market share might mean the company’s strategy is effective (if market share is rising), faulty (if market share falls), or was not implemented effectively. For example, BMW’s number of autos sold and their market share increased from 2010.