Their joint tax bill is thus $2,821 higher than the sum of their hypothetical individual tax bills, imposing on them a marriage penalty equal to 1.4 percent of their adjusted gross income. Marriage penalties and bonuses occur because income taxes apply to a couple, not to individual spouses.

Do Canadians Really Pay More Taxes Than Americans?

The rate on the first $9,700 of taxable income would be 10%, then 12% on the next $29,775, then 22% on the final $10,525 falling in the third tax bracket. This is because marginal tax rates only apply to income that falls within that specific bracket.

Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products and services such as Refund Transfer. Valid for 2017 personal income tax return only.

In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1). The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $510,300 and higher for single filers and $612,350 and higher for married couples filing jointly.

Couples filing jointly receive a $24,000 deduction in 2018, while heads of household receive $18,000. The combination of these two factors yields a marriage bonus of $7,719, or 3.9 percent of their adjusted gross income.

State Income Tax vs. Federal Income Tax: What’s the Difference?

Under a progressive income tax, a couple’s income can be taxed more or less than that of single individuals. A couple is not obliged to file a joint tax return, but their alternative—filing separate returns as a married couple—almost always results in higher tax liability.

Essentially, tax brackets are the cutoff values for taxable income—income past a certain point is taxed at a higher rate. The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates. In some states, the average federal income tax refund is over $3,000.

To calculate the final tax, you will have to use the applicable tax rates before subtracting taxes already paid through advance tax or TCS/TDS from the tax amount due. The first set of numbers below shows the brackets and rates that apply to the 2019 tax year and relate to the tax return you’ll file in 2020. The second set shows the tax brackets and federal income tax rates that apply to the 2020 tax year and relate to the tax return you’ll file in 2021. In the United States, the dollar amounts of the Federal income tax standard deduction and personal exemptions for the taxpayer and dependents are adjusted annually to account for inflation. This results in yearly changes to the personal income tax brackets even when the Federal income tax rates remain unchanged.

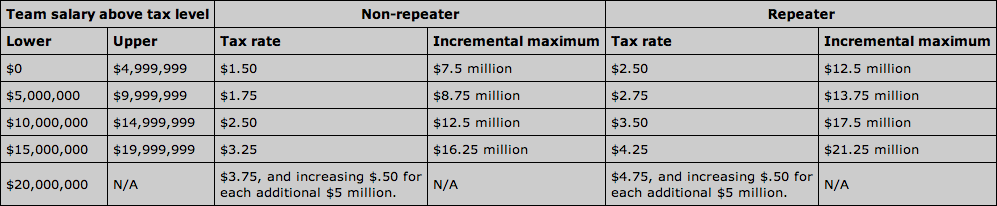

What Is an Incremental Tax?

What are the US tax brackets for 2019?

incremental income tax rate definition. The combined federal and state income tax rate that applies to an additional amount of taxable income.

In addition, due to a provision in the tax code referred to as indexing, the dollar range of each marginal tax bracket typically increases annually to account for inflation. Under a marginal tax rate, taxpayers are most often divided into tax tax brackets or ranges, which determine the rate applied to the taxable income of the tax filer. As income increases, what is earned will be taxed at a higher rate than the first dollar earned. Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

Understanding the Marginal Tax Rate

- Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations.

And tax provisions that phase in or out with income also produce marriage penalties or bonuses. In 2017, Joe earned $9,000 of taxable income. For 2017, the lowest individual income tax rate was 10% for single filers with taxable income of $9,325 or less. Joe fell into the 10% tax bracket, meaning all his taxable income was taxed at 10%. Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer).

Consider parents of two children, each parent earning $100,000 (table 1). Filing jointly and taking a $24,000 standard deduction, their taxable income is $176,000, for which their 2018 income tax liability is $26,819. If they could file separately, one as single and the other as the head of a household, the single filer would owe a tax of $15,410 and the head-of-household filer would owe $8,588, yielding a total tax of $23,998.

It’s tempting just to spend that money, but it can also help you meet some of your financial goals. For example, maybe you want to pay down your credit card debt or your mortgage this year. Putting your refund toward those debts can certainly help you in the long run.

Consider a couple with two children and $200,000 in total earnings, all earned by spouse two (table 2). Under 2018 tax law, filing a joint return rather than having spouse two file as head of household, will yield the couple a marriage bonus of more than $7,000 as a result of two factors. Second, the couple would benefit from an increased standard deduction.

It is essential to gather all the details required to file your Income Tax Returns before computing your taxable income on salary. You will then have to calculate your total taxable income, followed by the calculation of final tax refundable or payable.

Income Tax vs. Capital Gains Tax: Which Is More?

Based on these rates, this hypothetical $50,000 earner owes $6,858.50, an effective tax rate of 13.7%. Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates. The seven marginal tax rates of the brackets remain constant regardless of a person’s filing status. However, the dollar ranges at which income is taxed at each rate change depending on whether the filer is a single person, a married joint filer, or a head of household filer.

Second—and more significant—filing separate returns, the head of household could claim an EITC of $5,434 and a $2,825 child tax credit; the other spouse would get neither tax credit. On net, the head of household would receive a payment of $8,059 and the other spouse would pay $800, yielding a joint tax refund of $7,259. Filing jointly, the couple would get a smaller EITC of $2,420, somewhat offset by a larger child tax credit of $4,000. A couple with children can still face a marriage penalty because single parents can use the head of household filing status.

For starters, federal tax rates apply only to taxable income. This is different than your total income (also called gross income). Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income. In 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $518,400 and higher for single filers and $622,050 and higher for married couples filing jointly.

Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. Of course, calculating how much you owe in taxes is not quite that simple.

Marginal tax brackets refer to the tax imposed on thenext dollar earned, which is a useful concept for tax planning because it enables people to analyze the tax impact of additional income or deductions. The marginal tax bracket is the highest tax rate imposed on your income. Ordinary income tax rates apply to most kinds of income, and they are distinguished from thecapital gains tax rateimposed on long-term gains and qualified dividends. Based on the rates in the table above, a single filer with an income of $50,000 would have a top marginal tax rate of 22%. However, that taxpayer would not pay that rate on all $50,000.