The source of the company’s assets are creditors/suppliers for $40,000 and the owners for $60,000. The creditors/suppliers have a claim against the company’s assets and the owner can claim what remains after the Accounts Payable have been paid. Revenue is only increased when receivables are converted into cash inflows through the collection. Revenue represents the total income of a company before deducting expenses. Companies looking to increase profits want to increase their receivables by selling their goods or services.

Along with owner’s equity, liabilities can be thought of as a source of the company’s assets. They can also be thought of as a claim against a company’s assets. For example, a company’s balance sheet reports assets of $100,000 and Accounts Payable of $40,000 and owner’s equity of $60,000.

The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, and Payroll Accounting. Accountants must look past the form and focus on the substance of the transaction. Accounts receivablesare money owed to the company from its customers.

This is distinct from the banking concept that requires a monetary addition to a client’s account. A prepaid expense is carried on the balance sheet of an organization as a current asset until it is consumed. The reason for the current asset designation is that most prepaid assets are consumed within a few months of their initial recordation. If a prepaid expense were likely to not be consumed within the next year, it would instead be classified on the balance sheet as a long-term asset (a rarity). We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping.

Prepaid rent expense exists as an asset account that indicates the amount of rent a company has paid in advance. After a prepaid rent expense gets recorded in the general journal, a company must make an adjustment to indicate the amount of rent used during a specific period of time.

In finance and accounting, accounts payable can serve as either a credit or a debit. Because accounts payable is a liability account, it should have a credit balance.

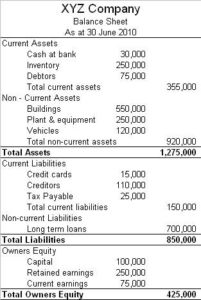

The balance sheet reports the assets – property and rights to property – belonging to the company, such as equipment and accounts receivable. The balance sheet also shows the liabilities – debts or obligations – owed to others, such as accounts payable and notes payable. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days.

Accounts Payable vs. Accounts Receivable

At the end of the fiscal period, the net income or net loss also is transferred to the owner capital account. Expenses normally have debit balances that are increased with a debit entry. Since expenses are usually increasing, think “debit” when expenses are incurred. Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets.

As a result, accounts receivable are assets since eventually, they will be converted to cash when the customer pays the company in exchange for the goods or services provided. Accounts payable are the opposite of accounts receivable, which are current assets that include money owed to the company. Accounts payable is a liability account and has a default Credit side.

This means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded. The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current market value of the assets. Accounts payable is considered a current liability, not an asset, on the balance sheet. Individual transactions should be kept in theaccounts payable subsidiary ledger. “Owner Capital” is reported in the equity section of a sole proprietorship balance sheet.

Rent is the amount paid for the use of property not owned by the company, as explained by the Internal Revenue Service website. The calculation of prepaid rent expenses depends on the amount of a company’s monthly rent. For instance, a company that prepays $12,000 for a one-year lease must credit cash for $12,000 and debit prepaid rent for the same amount. A balance sheet is one of the fundamental financial statements used by most businesses. It details the company’s financial standing at a particular moment.

Prepaid Expenses

- Prepaid rent expense exists as an asset account that indicates the amount of rent a company has paid in advance.

- Rent is the amount paid for the use of property not owned by the company, as explained by the Internal Revenue Service website.

- After a prepaid rent expense gets recorded in the general journal, a company must make an adjustment to indicate the amount of rent used during a specific period of time.

Company A will debit Cash and will credit its current asset Accounts Receivable. Using depreciation, a business expenses a portion of the asset’s value over each year of its useful life, instead of allocating the entire expense to the year in which the asset is purchased.

Accounts payable is a promise made by company to pay for goods/services later. The credit balance in Accounts payable indicates the sum of money the company owes to suppliers or vendors. A current asset account that reports the amount of future rent expense that was paid in advance of the rental period. The amount reported on the balance sheet is the amount that has not yet been used or expired as of the balance sheet date. Cash is classified as a current asset on the balance sheet and is therefore increased on the debit side and decreased on the credit side.

AccountingTools

Since your company did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable. If a company buys additional goods or services on credit rather than paying with cash, the company needs to credit accounts payable so that the credit balance increases accordingly.

The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or decrease a company’s balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. Liabilities are obligations of the company; they are amounts owed to creditors for a past transaction and they usually have the word “payable” in their account title.

Common Reasons for Prepaid Expenses

“Temporary accounts” (or “nominal accounts”) include all of the revenue accounts, expense accounts, the owner’s drawing account, and the income summary account. Generally speaking, the balances in temporary accounts increase throughout the accounting year. At the end of the accounting year the balances will be transferred to the owner’s capital account or to a corporation’s retained earnings account. As noted earlier, expenses are almost always debited, so we debit Wages Expense, increasing its account balance.

These accounts normally have credit balances that are increased with a credit entry. When a landlord sends a corporate tenant a bill for rent charges, a bookkeeper debits the rent expense account and credits the rent payable account. This entry, in itself, showcases the interrelation between rent payable and rent expense. When the tenant remits funds, the bookkeeper credits the cash account and debits the rent payable account to bring it back to zero. In accounting terminology, crediting the cash account means reducing money in company coffers.

They can be current liabilities such as accounts payable and accruals or long-term liabilities like bonds payable or mortgages payable. Since cash was paid out, the asset account Cash is credited and another account needs to be debited. Because the rent payment will be used up in the current period (the month of June) it is considered to be an expense, and Rent Expense is debited.

Why prepaid rent is an asset?

prepaid rent definition. A current asset account that reports the amount of future rent expense that was paid in advance of the rental period. The amount reported on the balance sheet is the amount that has not yet been used or expired as of the balance sheet date.

If the payment was made on June 1 for a future month (for example, July) the debit would go to the asset account Prepaid Rent. When the amount of the credit sale is remitted, Company B will debit its liability Accounts Payable and will credit Cash.

Any money the owner invests to start the business or keep it running is classified as owner capital. Because equity accounts normally have a credit balance, all owner contributions are recorded as credits. Additionally, equipment or supplies donated to the business by the owner should be included in the owner capital account.

The adjusting journal entry for a prepaid expense, however, does affect both a company’s income statement and balance sheet. The adjusting entry on January 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent). The expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the assets on the balance sheet by $10,000. Liabilities are any items on the balance sheet that the company owes to financial institutions or vendors.