An individual taxpayer operates a farming business and incurs an NOL of $150,000 for 2019. The $125,000 farming loss is eligible for the 2-year carryback (subject to the limitations). The $25,000 nonfarming loss is not eligible for carryback but is carried forward to 2020. The deduction of the 2019 NOL in 2017 is limited to 80% of the 2017 taxable income of $100,000 (determined without regard to any NOL deduction).

The NOL can generally be used to offset the company’s tax payments in other tax periods through an Internal Revenue Service (IRS) tax provision called a loss carryforward. A net operating loss (NOL) is a valuable asset because it can lower a company’s future taxable income. For this reason, the IRS restricts using an acquired company simply for its NOL’s tax benefits. Section 382 of the Internal Revenue Code states that if a company with a NOL has at least a 50% ownership change, the acquiring company may use only part of the NOL in each concurrent year.

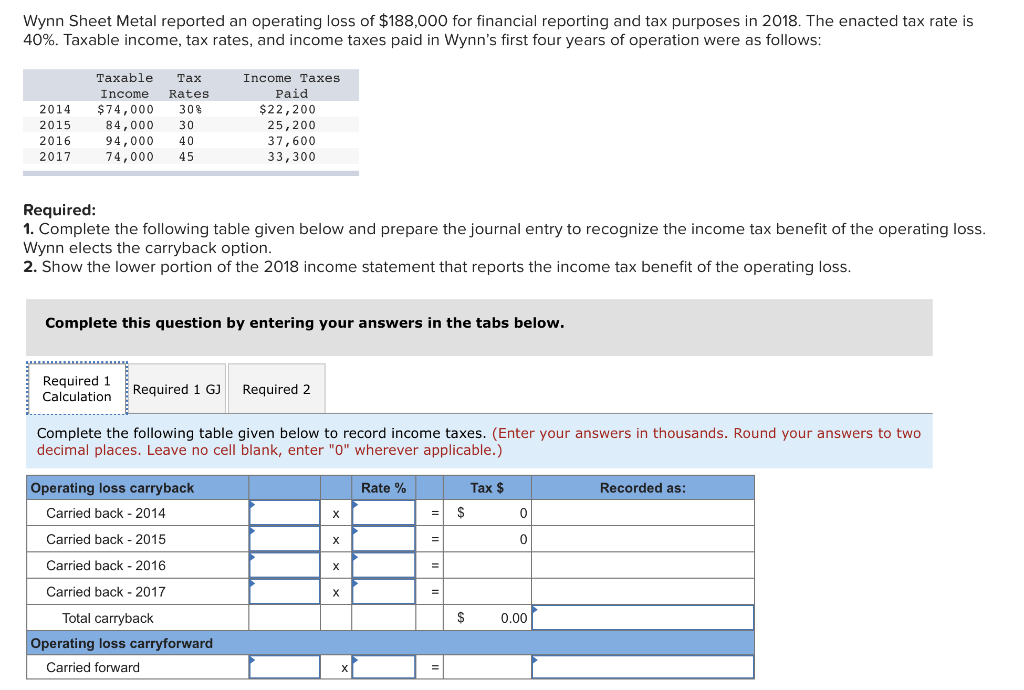

The state in which a company’s operating expenses exceed its income for a given period of time, usually a quarter or a year. A company can carry back or carry forward operating losses for a certain number of years, reducing the company’s tax liability.

Excess business losses that are disallowed are treated as an NOL carryover to the following tax year. 225 and the Instructions for Schedule F (Form 1040 or 1040-SR). When this happens, the IRS offers tax relief in the form of net operating loss (NOL). This means that business owners don’t owe any taxes for the particular year. What’s more, they might also get a refund for the taxes paid in the previous years or use the losses to reduce future tax payments.

If you’re a sole proprietor who files IRS Schedule C, the expenses listed on the form will exceed your reported business income. If your business is a partnership, LLC, or S corporation shareholder, your share of the business’s losses will pass through the entity to your personal tax return. Your business loss is added to all your other deductions and then subtracted from all your income for the year. A net operating loss (NOL) exists if a company’s deductions exceed taxable income. An operating loss occurs when a company’s operating expenses exceed gross profits (or revenues in the case of a service-oriented company, generally speaking, instead of a manufacturer).

The at-risk limits and the passive activity limits are applied before figuring the amount of any excess business loss. A “trade or business” includes, but is not limited to, Schedule C and Schedule F activities, the activity of being an employee, and certain activities reported on Schedule E.

In most other situations, an operating loss, if sustained, is a sign of deteriorating fundamentals of a company’s products or services. In such a scenario, a company may be hit with a few or several quarters of operating losses until the bump-up of these expenditures declines and the benefits of added spending begin to manifest in the top line.

What does operating at a loss mean?

Operating Loss. The state in which a company’s operating expenses exceed its income for a given period of time, usually a quarter or a year. This is positive, but an operating loss still means that the company is losing money, which cannot be sustained over the long term.

However, purchasing a business with a substantial NOL may mean a larger sum of money going to the acquired company’s shareholders than if the acquired company possessed a smaller NOL. Noncorporate taxpayers may be subject to excess business loss limitations.

When it comes time to compute your total income, you subtract the amount of your loss. If you had, say, a loss of $2,000 in your sole proprietorship and income of $5,000 from all other sources, then your total income would be $3,000. If you file a joint return, business losses can offset other income received by both you and your spouse. See instructions__________8.Enter any adjustments to your itemized deductions from line 27 below. You can use Form 1045, Schedule B, to figure your modified taxable income for carryback years and your carryover from each of those years.

Operating Income vs. Net Income: What’s the Difference?

What to do if your business is operating at a loss?

How many years can I take a loss on my business? The IRS will only allow you to claim losses on your business for three out of five tax years. If you don’t show that your business was profitable longer than that, then the IRS can prohibit you from claiming your business losses on your taxes.

For tax years ending after 2017, only losses from farming businesses can be carried back. If your 2019 return includes an NOL deduction from an NOL year before 2018 that reduced your taxable income to zero (to less than zero, if an estate or trust), see NOL Carryover From 2019 to 2020 below. In general, a net operating loss (NOL) is the amount by which a taxpayer’s business deductions exceed his or her business gross income (Sec. 172(c)). An NOL from a given tax year can be carried back and carried forward to other tax years and deducted against the taxpayer’s gross income in those years. A net operating loss is a tax credit that occurs when the business tax deductions are more than its taxable income in a year.

If the loss from your sole proprietorship is large enough that it exceeds your income from all other sources, then you’ll have a “net operating loss” for the year. Not only will you not have to pay any income taxes that year, but you’ll also be able to carry that loss over to other years, which will reduce your tax burden in those years. Operating income is a company’s profit after deducting operating expenses which are the costs of running the day-to-day operations.

This loss is carried forward in future to set off future profits, thus reducing the tax liability of the business. When your allowable deductions exceed the gross income in a tax year, you have net operating losses. To calculate the net operating loss for your business, you need to subtract your tax deductions from the taxable income for the year. The TCJA also limits deductions of “excess business losses” by individual business owners.

- A net operating loss (NOL) may be carried forward to offset taxable income in future years in order to reduce a company’s futuretax liability.

- Because the time value of money shows that tax savings in the present are more valuable than in the future, the carryback method was the more beneficial choice.

- After 20 years, any remaining losses expired and could no longer be used to reduce taxable income.

What Is an Operating Loss (OL)?

Figuring the amount of an NOL is not as simple as deducting your losses from your annual income. First, you must determine your annual losses from your business (or businesses).

Married taxpayers filing jointly may deduct no more than $500,000 per year in total business losses. If a business is owned through a multi-member LLC taxed as a partnership, partnership, or S corporation, the $250,000/$500,000 limit applies to each owners’ or members’ share of the entity’s losses.

In addition, the taxpayer has an NOL carryover from 2016 to 2017 of $40,000. The 2016 NOL is not subject to the 80%-of-taxable-income limit. The taxpayer’s total NOL deduction for 2017 is $120,000 ($80,000 plus $40,000). However, only $100,000 of this NOL deduction is used to reduce 2017 taxable income to zero. (The $40,000 NOL from 2016 reduces taxable income to $60,000, and $60,000 of the farming loss from 2019 is used to reduce taxable income to zero).

Most taxpayers can only carry NOLs arising from tax years ending after 2017 to a later year. If you want to skip the carryback period and instead carry forward the amount of your net operating losses, you’ll need to include a statement with your tax return for the NOL year saying that you’re doing so. According to the IRS, to have a net operating loss, it must be caused by certain deductions. These include expenses related trade or business, casualty and theft losses, your work as an employee, moving expenses and/or rental property expenses.

Unused losses may be deducted in any number of future years as part of the taxpayer’s net operating loss carryforward. This limitation takes effect in 2018 and is scheduled to last through 2025. An operating loss could indicate that a company’s core operations are not profitable and that changes need to be made either to increase revenues, decrease costs or both.

Because the time value of money shows that tax savings in the present are more valuable than in the future, the carryback method was the more beneficial choice. After 20 years, any remaining losses expired and could no longer be used to reduce taxable income.

The immediate solution is typically to cut back on expenses, as this is within the control of company management. That may entail layoffs, office or plant closings, or reductions in marketing spending. An operating loss can be expected for start-up companies that mostly incur high expenses (with little or no revenues) as they attempt to grow quickly.

A net operating loss (NOL) may be carried forward to offset taxable income in future years in order to reduce a company’s futuretax liability. The purpose behind this tax provision is to allow some form of tax relief when a company loses money in a tax period. The IRS recognizes that some companies’ business profits are cyclical in nature and not in line with a standard tax year. For income tax purposes, a net operating loss (NOL) is the result when a company’s allowable deductions exceed its taxable income within a tax period.

The taxpayer’s taxable income for 2018 (determined without regard to any NOL deduction) is zero. The total NOL carryover to 2020 is $90,000 ($25,000 nonfarming loss and $65,000 of unused 2019 farming loss). Estates and trusts that do not file Form 1045 must file an amended Form 1041 (instead of Form 1040-X) for each carryback year to which NOLs are applied. Use a copy of the appropriate year’s Form 1041, check the “Net operating loss carryback” box, and follow the Form 1041 instructions for amended returns. Include the NOL deduction with other deductions not subject to the 2% limit (line 15a).

Understanding the Income Statement

Also, see the special procedures for filing an amended return due to an NOL carryback, explained under Form 1040-X, later. For tax years beginning after 2017, excess business loss is limited. For 2019, the total loss from all of the taxpayer’s trades or businesses is limited to the amount of income earned from those businesses plus $255,000 ($510,000 for joint returns). For most taxpayers, this means that the NOL carryback won’t exceed $255,000 ($510,000 for joint returns). The Tax Cuts and Jobs Act (TCJA), section 13302, eliminated the option for most taxpayers to carry back a net operating loss (NOL).

An operating loss does not consider the effects of interest income, interest expense, extraordinary gains or losses, income or losses from equity investments or taxes. These items are ‘below the line,’ meaning they are added or subtracted after the operating loss (or income, if positive) to arrive at net income. The IRS is aware that some people will try to claim losses from “businesses” that are essentially hobbies, such as painting or making jewelry. A Schedule C business that fails to show a profit in at least three out of five consecutive years is at risk of an audit, which could result in a ruling that the business is merely a hobby.

Operating income, which is synonymous with operating profit, allows analysts and investors to drill down to see a company’s operating performance by stripping out interest and taxes. Analyzing operating income is helpful to investors since it doesn’t include taxes and other one-off items that might skew profit or net income.

When that happens, the taxpayer cannot deduct any expenses in excess of the income they received from their hobby, and they are liable for taxes on the excess losses going back three years. When your revenue on Schedule C exceeds your business expenses, you have a profit, which you report as income on Line 12 of your tax return, Form 1040. If your business expenses exceed your business revenue, though, you have a loss, which you also report on Line 12.