Non-cash investing and financing activities are disclosed in footnotes to the financial statements. General Accepted Accounting Principles (GAAP), non-cash activities may be disclosed in a footnote or within the cash flow statement itself.

What is the purpose of a statement of cash flows?

The purpose of the cash flow statement is to show where an entities cash is being generated (cash inflows), and where its cash is being spent (cash outflows), over a specific period of time (usually quarterly and annually). It is important for analyzing the liquidity and long term solvency of a company.

Figure 12.1 “Examples of Cash Flows from Operating, Investing, and Financing Activities” shows examples of cash flow activities that generate cash or require cash outflows within a period. Figure 12.2 “Examples of Cash Flow Activity by Category” presents a more comprehensive list of examples of items typically included in operating, investing, and financing sections of the statement of cash flows.

The third category covers non-operating gains or losses, which means income or losses generated by activities other than the core functions of the company. The statement of cash flows reports the cash receipts, cash payments, and net change in cash resulting from the operating, investing, and financing activities of a company during a period.

Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. The statement captures both the current operating results and the accompanying changes in the balance sheet and income statement.

This typically includes net income from the income statement, adjustments to net income, and changes in working capital. The operating cash flows component of the cash flow statement refers to all cash flows that have to do with the actual operations of the business. It refers to the amount of cash a company generates from the revenues it brings in, excluding costs associated with long-term investment on capital items or investment in securities (these are investing or financing activities). Essentially, it is the difference between the cash generated from customers and the cash paid to suppliers. For public companies, there’s a much easier way to find the end result instead of doing all the math yourself.

A current income statement provides information about the amount of cash provided from operating activities. Certain transactions provide additional detailed information needed to determine whether cash was provided or used during the period. Opposite of the noncash items, certain current assets affect your company’s actual cash flow but don’t affect your income statement profit. When a current asset increases, it reduces your operating cash flow in relation to net income.

The main purpose of the statement of cash flows is to provide information about a company’s cash receipts and cash payments in a period. The statement of cash flows provides information about a company’s operating, financing, and investing activities. It reports cash receipts, cash payments, and net change in cash from operating, investing, and financing activities.

How Do the Balance Sheet and Cash Flow Statement Differ?

The exact formula used to calculate the inflows and outflows of the various accounts differs based on the type of account. In the most commonly used formulas, accounts receivable are used only for credit sales and all sales are done on credit. If cash sales have also occurred, receipts from cash sales must also be included to develop an accurate figure of cash flow from operating activities. Since the direct method does not include net income, it must also provide a reconciliation of net income to the net cash provided by operations. The purpose of drawing up a cash flow statement is to see a company’s sources of cash and uses of cash over a specified time period.

For example, if you have an item in inventory, that means you’ve laid out cash for it. But because of accrual accounting rules, if you haven’t sold it yet, you can’t report its cost as an expense, and therefore, its cost hasn’t yet reduced net income. In financial accounting, a cash flow statement (also known as statement of cash flows or funds flow statement) is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents. The cash flow statement, as the name suggests, provides a picture of how much cash is flowing in and out of the business during the fiscal year. The first, noncash items, includes items that don’t reduce cash, but they still get recorded as an income statement expense that reduces net income.

All other changes in balance sheet accounts are analyzed to determine their effect on cash. Cash flows from operating activities can be calculated and disclosed on the cash flow statement using the direct or indirect method. The direct method shows the cash inflows and outflows affecting all current asset and liability accounts, which largely make up most of the current operations of the entity. Those preparers that use the direct method must also provide operating cash flows under the indirect method. The indirect method must be disclosed in the cash flow statement to comply with U.S. accounting standards, or GAAP.

Evaluating Your Personal Financial Statement

- Essentially, the cash flow statement is concerned with the flow of cash in and out of the business.

As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. International Accounting Standard 7 (IAS 7) is the International Accounting Standard that deals with cash flow statements. One of the main financial statements (along with the income statement and balance sheet).

In contrast, under the indirect method, cash flow from operating activities is calculated by first taking the net income from a company’s income statement. Because a company’s income statement is prepared on an accrual basis, revenue is only recognized when it is earned and not when it is received. The indirect method also makes adjustments to add back non-operating activities that do not affect a company’s operating cash flow.

The second category, timing differences, involves changes in assets and liabilities on the balance sheet. These adjusting entries compensate for the way companies recognize revenue and expenses under accrual accounting rules.

Save yourself the time and effort and just review the company’s statement of cash flows, included with its financial statements. The statement of cash flows includes the cash impact of changes to accounts payable and accounts receivable, as well as every other material impact on cash from both the income statement and balance sheet. Comparative balance sheets, a current income statement, and certain transaction data all provide information necessary for preparation of the statement of cash flows. Comparative balance sheets indicate how assets, liabilities, and equities have changed during the period.

Non-cash financing activities may include leasing to purchase an asset, converting debt to equity, exchanging non-cash assets or liabilities for other non-cash assets or liabilities, and issuing shares in exchange for assets. This is the first section of the cash flow statement and includes transactions from all operational business activities.

What is in a statement of cash flows?

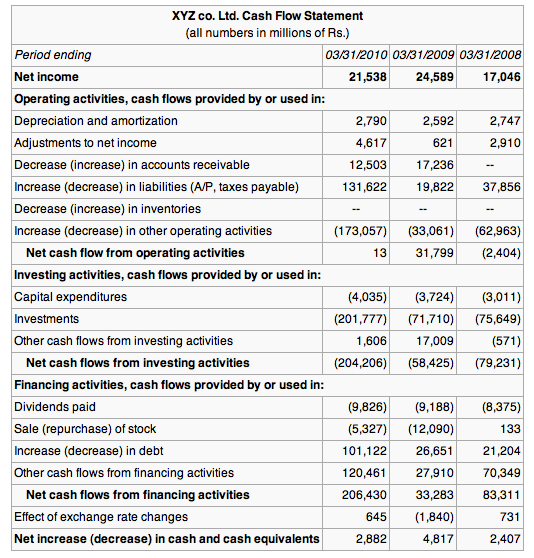

Statement of cash flows: Statement of cash flows includes cash flows from operating, financing and investing activities. Financing activities include the inflow of cash from investors, such as banks and shareholders and the outflow of cash to shareholders as dividends as the company generates income.

What Is a Cash Flow Statement?

With theindirect method, cash flow from operating activities is calculated by first taking the net income off of a company’s income statement. Because a company’s income statement is prepared on anaccrual basis, revenue is only recognized when it is earned and not when it is received. Cash flows from operating activities is a section of a company’s cash flow statement that explains the sources and uses of cash from ongoing regular business activities in a given period.

In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included. However, purchases or sales oflong-term assetsare not included in operating activities. Many line items in the cash flow statement do not belong in the operating activities section.

The cash flows from operations section begins with net income, then reconciles all noncash items to cash items involving operational activities. Still, whether you use the direct or indirect method for calculating cash from operations, the same result will be produced.

Cash Flows From Operations

The statement of cash flows reports the sources and uses of cash by operating activities, investing activities, financing activities, and certain supplemental information for the period specified in the heading of the statement. This is simply the difference between the beginning and ending cash balances. This involves analyzing the current year’s income statement, comparative balance sheets and selected transaction data.