An entire generation of investors has only known the stock market of 2003 to 2013. Our most recent past is not a precursor to what our long-term investing future will be.

What is ROI?

For instance, with the purchase of capital equipment, it is expected that equipment will provide a benefit to the company for several years. As such, the net income will need to be estimated for future time periods to determine the overall ROI. Additionally, maintenance costs over the life of the equipment will reduce the overall ROI.

ROI Frequently Asked Questions (FAQ):

A high ROI means the investment’s gains compare favorably to its cost. As a performance measure, ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several different investments. In economic terms, it is one way of relating profits to capital invested. Since mutual funds are typically used for long-term investments, investors will often look at how they expect a mutual fund to perform over the length of time they plan on holding their investment.

In order to evaluate returns on this type of investment, you have to understand the difference in the level of risk you take when investing in a stock versus investing in a stock index fund. Peer-To-Peer Lending through companies like Prosper and Lending Club are my favorite way to earn a rate of return on investment over 10% annually. Lending Club’s most conservatively A rated loan earns over 6% for the investor. And, Lending Club’s most risky investments earn a rate of return on investment of over 20% annually.

Unless there are compelling soft benefits for you, it would be better to keep looking for a different business with higher returns while you stay in your current job. On the other hand, real estate investors who choose to invest in strong, growing markets, often overlooked for the glitz and glam of big market cities, minimize their risk exponentially. Although buying a rental property requires more cash upfront, you won’t lose your entire investment because it’s a physical asset with (hopefully) appreciating value. This helps make real estate a relatively low risk, high return investment.

It’s easy to up automatic investments either with your bank, a discount broker, or even a smartphone app like Robinhood. Avoiding investing mistakes will make you more money in the long run than trying to pick the hottest sector/stock/fund/investment over the years. For a full list of the best investing apps for 2019, check out LearnBonds app investing guide for more investment ideas like this for 2019.

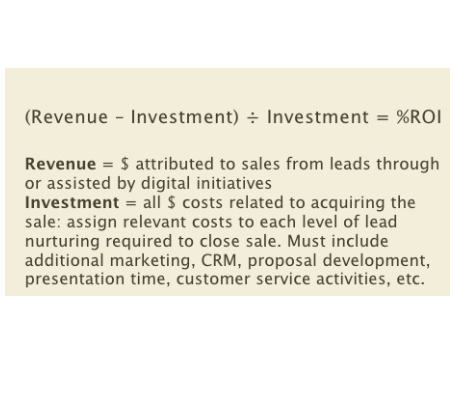

What is ROI and how is it calculated?

Definition: A profitability measure that evaluates the performance of a business by dividing net profit by net worth. Return on investment, or ROI, is the most common profitability ratio. There are several ways to determine ROI, but the most frequently used method is to divide net profit by total assets.

It was one of the best ways to earn a 10% rate of return on investment. Whether it is opening a neighborhood restaurant or as simple as starting a blog, a business venture is a great way to boost your investments’ returns.

Therefore, they tend to put more of their money in securities like debt and fixed-income. Similar to Discounted Cash Flow, a Discounted ROI should be used instead. Yes, depending on what variables you’d like to be considered there are more precise ways to calculate return on investment.

Anyone who has at least $1,000 available to invest and a desire to diversify their portfolio beyond stocks and bonds should consider investing in commercial real estate with Streitwise. It is also used as an indicator to compare different investments within a portfolio. The investment with the largest ROI is usually prioritized, even though the spread of ROI over the time period of an investment should also be taken into account. Finding safe investments with high returns is one of the best ways to protect and grow your money to build lasting wealth.

- In a small business, the uses of ROI could be to measure the performance of pricing policies, an investment in capital equipment, or an inventory investment.

- When purchasing assets in a business, such as inventory or equipment, you expect to get a financial benefit from the purchase.

- Return on investment is a tool to help decide between purchase alternatives that will either generate revenue or result in cost savings that benefit the net income of the business.

An accountant can assist with the formulas to determine more complex ROI calculations. Some financial planners believe those with long time horizons have time to weather market volatility. They could thus concentrate more on growth-focused, albeit volatile, investments like equities. On the other hand, those closer to their golden years may want to protect the savings they already have.

Granted, short-term stock trading is not for everyone and should not be done with a large portion of your entire investment portfolio. Trying to time the stock market is a rough way to earn a 10% rate of return on investments, but it could be well worth your time and efforts with a small portion of your investment portfolio.

Return on investment is a useful and simple measure of how effective a company generates profits from an investment. Many firms use ROI as a convenient tool to compare the benefit of an investment with the cost of the investment.

Not the answer you’re looking for? Browse other questions tagged rate-of-return or ask your own question.

Keeping a property in your portfolio long-term can continually generate more and more passive income each year. One issue with the simple return on investment formula is that it is often used for short-term investments, so it does not account for the time value of money. Thus, it is less accurate for calculating ROI for long-term investments over one year. To measure the long term return on investment for future years, use the discounted ROI formula.

A 10% annual rate of return on investments over the long term is very much achievable. Real estate is a great way to earn over 10% rate of return on investments. This allows companies to value their investments not just for their financial return but also the long term environmental and social return of their investments. The social cost of carbon is one value that can be incorporated into Return on Integration calculations to encompass the damage to society from greenhouse gas emissions that result from an investment.

In a survey of nearly 200 senior marketing managers, 77 percent responded that they found the “return on investment” metric very useful. Return on investment (ROI) is a ratio between net profit (over a period) and cost of investment (resulting from an investment of some resources at a point in time).

You may want to keep most of your money into super safe investments, like high-yield savings accounts, CDs and US Treasury securities. But if you are looking to get better overall returns, start by investing small amounts of money in bonds, dividend-paying stocks, REITs, real estate or P2P lending. That way, you’ll enjoy higher returns offered by lower-risk investments.

In a small business, the uses of ROI could be to measure the performance of pricing policies, an investment in capital equipment, or an inventory investment. When purchasing assets in a business, such as inventory or equipment, you expect to get a financial benefit from the purchase. Return on investment is a tool to help decide between purchase alternatives that will either generate revenue or result in cost savings that benefit the net income of the business. Investors will also look at return on investment when choosing whether to fund a business venture.

For example, if a company effectively utilizes an investment and produces gains, ROI will both be high. Whereas if a company ineffectively utilizes an investment and produces losses, ROI will be low. For investors, choosing a company with a good return on investment is important because a high ROI means that the firm is successful at using the investment to generate high returns. Investors will typically avoid an investment with a negative ROI, or if there are other investment opportunities with a positive ROI. Return on investment models are used often because the ROI ratio and inputs can be modified to fit different companies and financial situations.

What is a Good ROI?

Mutual funds will normally show you their historic returns for one year, three years, five years, 10 years, and 20 years. This data helps determine which mutual funds will provide a good return on investment. If, on the other hand, the typical third year gross income is only $90,000 instead of $150,000, you would clear the same return on the capital you invested but the ROI on your time investment would be zero.

This approach provides decision makers with the insight to identify opportunities for value creation that promote growth and change within an organization. Marketers should understand the position of their company and the returns expected.

What is ROI mean?

Return on investment (ROI) measures the gain or loss generated on an investment relative to the amount of money invested. ROI is usually expressed as a percentage and is typically used for personal financial decisions, to compare a company’s profitability or to compare the efficiency of different investments.