Using estimated rates of return, you can compare the value of the annuity payments to the lump sum. The present value interest factor may only be calculated if the annuity payments are for a predetermined amount spanning a predetermined range of time.

One of the big selling points for a fixed annuity is that it is actually an insurance contract, and as such, it is based upon guarantees made by the insurance company. A big part of an annuity is a guarantee that you will continue to receive an income, no matter how the stock market performs or how long you will live. However, the insurance company will charge a large fee to make this guarantee and sometimes even keep any remaining funds if you die before the amount deposited has been fully paid out. So, if you are confident that you have sufficient funds to last during retirement and don’t need an insurance company sending you a guaranteed monthly income, there is no reason to buy an annuity. Annuities are a financial product sold by financial institutions (usually insurance companies) that are used as a way to grow funds to pay out a stream of income over a certain period of time.

These include when payments begin, how long they last and whether money will go to a beneficiary when the annuitant dies. Two of the most common annuity payouts are period certain, which guarantees income for a specific time period, and guaranteed lifetime payments. If annuity payments are due at the beginning of the period, the payments are referred to as an annuity due. To calculate the present value interest factor of an annuity due, take the calculation of the present value interest factor and multiply it by (1+r), with the variable being the discount rate.

Annuity Derivation Vs. Perpetuity Derivation: What’s the Difference?

In simple terms, you buy an annuity plan with one large payment or series of contributions. From there, the financial institution distributes money back to you for a certain time frame, depending on what kind of annuity you purchase. The money you put in grows through various investments made by the financial institution. There are immediate annuities, meaning you would get your monthly payments immediately, as well as deferred annuities where the principal is held for a certain period of time before being distributed back to you.

How an Annuity Table Can Help You

One version of a variable annuity, called an equity-indexed annuity, tracks a specific stock index such as the S&P 500. Obviously, opting for a variable rate holds out the possibility of greater returns; but it also carries greater risk. Individual retirement accounts (IRAs) and annuities both provide tax-advantaged ways to save for retirement, but there are distinct differences between the two. For one thing, an IRA is not actually an asset itself, but a vehicle for holding financial assets—stocks, bonds, mutual funds. In contrast, annuities are assets—specifically insurance products, designed to generate income.

How do you calculate an annuity table?

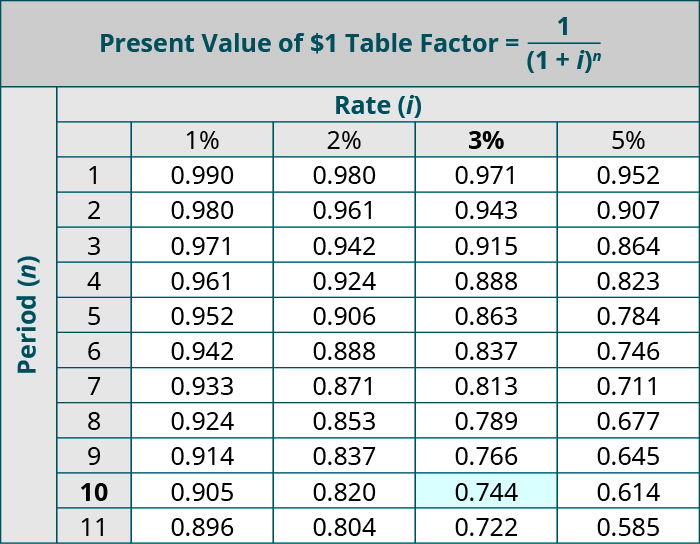

An annuity table is a tool used to determine the present value of an annuity. It is a variation of a present value table used by accountants. An annuity table calculates the present value of an annuity using a formula that applies a discount rate to future payments.

Annuities can help you plan for your retirement by providing a guaranteed source of income for you and your family when you reach your golden years. They aren’t the simplest of investments, though, and sometimes it can be difficult to know exactly how much your annuity is worth.

First is the situation where the investor is ultraconservative and wants stable income for a very long time. It seems that with annuity plans you are paying a lot with the hopes of reduced risk and guaranteed income. The opportunity cost of putting most of a retirement nest egg into an annuity is just too great. Annuity purchasers have options regarding how the annuity payouts are structured.

- From there, the financial institution distributes money back to you for a certain time frame, depending on what kind of annuity you purchase.

- In simple terms, you buy an annuity plan with one large payment or series of contributions.

What Is the Present Value Interest Factor of an Annuity?

The discount rate used in the present value interest factor calculation approximates the expected rate of return for future periods. It is adjusted for risk based on the duration of the annuity payments and the investment vehicle utilized. This is because the value of $1 today is diminished if high returns are anticipated in the future. The present value interest factor of an annuity is useful when determining whether to take a lump-sum payment now or accept an annuity payment in future periods.

As with IRAs, you will be penalized if you try to withdraw funds from the deferred annuity early before the payout period begins. Annuities are insurance products that provide a source of monthly, quarterly, annual, or lump-sum income during retirement. An annuity makes periodic payments for a certain amount of time, or until a specified event occurs (for example, the death of the person who receives the payments).

A variable annuity allows you to invest money in stocks, bonds, funds, etc. Variable annuities allow you to choose from a menu of investment options. These options could include mutual funds, bond funds or money-market accounts.

Annuity Table and the Present Value of an Annuity

Annuities are typically used by individuals seeking a means to receive steady cash flow into retirement. With animmediate annuity, also known as a SPIA, you begin receiving payments within a year of purchasing the annuity. If you’re about to retire, it can be a good way to use a part of your retirement savings to create an income stream.

Fixed rate annuities guarantee a certain payment that does not fluctuate, while variable rate annuities’ income payout depends on the underlying investment performance. With an immediate payment annuity (also called an income annuity), fixed payments begin as soon as the investment is made. If you invest in a deferred annuity, the principal you invest grows for a specific period of time until you begin taking withdrawals—usually during retirement.

What Is an Annuity Table?

How do you create an annuity table in Excel?

An annuity table typically has the number of payments on the y-axis and the discount rate on the x-axis. Find both of them for your annuity on the table, and then find the cell where they intersect. Multiply the number in that cell by the amount of money you get each period.

Once annuitization takes place, a fixed amount is paid to you—either as a lump sum or in payments over several years or your lifetime. This is the case withannuities, which provide guaranteed income in retirement but limit access to the money that funds those income payments for a period of time.

An annuity table can help with that by allowing you to easily calculate the present value of your annuity. This information allows you to make informed decisions about what steps to take to plan for your retirement.

Money invested in an annuity grows tax-deferred until it is withdrawn. A lottery winner could use an annuity table to determine whether it made more financial sense to take his lottery winnings as a lump-sum payment today or as a series of payments over many years. More commonly, annuities are a type of investment used to provide individuals with a steady income in retirement.

If you need assistance with annuities or retirement planning more generally, find a financial advisor to work with using SmartAsset’s free financial advisor matching service. They often come with some level of guarantee, but typically at a much higher fee. A fixed annuity will pay out a predetermined amount based on the contract.