Below, we’ll look at those protected classes and try to explain why they’re exempt from Social Security taxes. If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

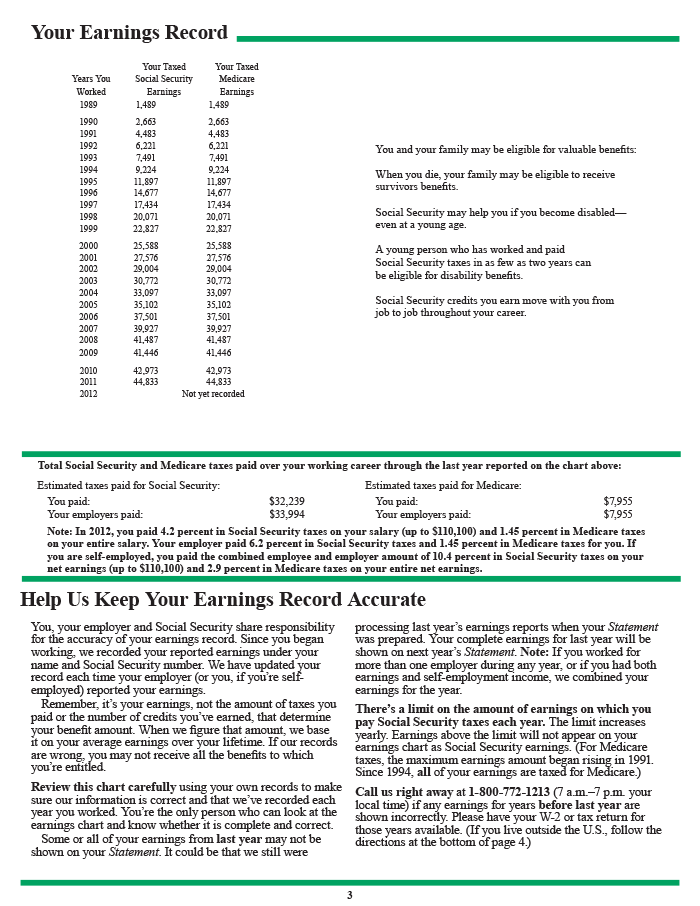

Currently, the Social Security tax is 12.4% — half of which is paid by the employer, with the other 6.2% paid by the worker through payroll withholding. For Medicare, that tax is a combined 2.9%, split between the employee and employer. (Self-employed workers have to cover the entire FICA tax themselves).

The self-employment tax is made up of the Social Security tax and Medicare tax. As of 2020, the self-employment tax is 15.3% (12.4% Social Security tax + 2.9% Medicare Tax). Nevertheless, there are still some state and local employees who don’t get Social Security coverage and therefore don’t pay Social Security taxes.

In contrast, a married couple can earn no more than $34,000 in combined income without paying extra taxes. However, a married couple can get the same treatment as singles if they live apart part of the year and file their taxes separately. If you work for one employer and it withholds an incorrect amount of Social Security taxes, you need to ask your employer to correct its error and refund the overpayment. You generally cannot claim the overpayment on your income tax return and receive a Social Security tax refund from the IRS. Together, the Social Security and Medicare programs make up theFederal Insurance Contributions Act (FICA) tax rate of 15.3%.

Who Is Exempt From Paying Into Social Security?

Employers usually withhold this tax from employees’ paychecks and forward it to the government. The funds collected from employees for Social Security are not put into a trust for the individual employee currently paying into the fund, but rather are used to pay existing retirees in a “pay-as-you-go” system. Social Security disability is a disability benefit program administered by the Social Security Administration (SSA). It falls under Title II of the Social Security Act and is available to individuals who have earned enough “work credits.” Credits are earned by working and paying FICA taxes.

If you file as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits in 2020, according to the Social Security Administration. The tax laws encourage retired people to “live in sin”—that is, without benefit of marriage. A couple increases the amount of income they can earn without being taxed on their Social Security benefits if they aren’t married and file their taxes separately. Each will be entitled to earn $25,000 in combined income without paying tax on their benefits, for a total of $50,000 of income without extra taxes.

In other words, if you’ve worked enough at a job where you pay Social Security taxes, you’ll have enough credits to be eligible for Social Security disability benefits. SSDI is paid for out of the Social Security trust fund. Most workers have payroll taxes withheld from their paychecks that go toward supporting the Social Security and Medicare programs. However, there are some employees who don’t have to pay Social Security payroll taxes.

In addition, federal workers, including members of Congress, who have been serving consistently since before 1984 are covered under another retirement plan, so they’re also exempt from Social Security taxes. For tax year 2019, you will need to file a return if you are unmarried and at least 65 years of age, and your gross income is $13,850 or more. However, if you live on Social Security benefits, you don’t include this in gross income. If this is the only income you receive, then your gross income equals zero, and you don’t have to file a federal income tax return.

- Today Social Security is one of the largest government programs in the world, paying out hundreds of billions of dollars each year.

- The system and its rules have evolved in the decades since.

But if you do earn other income that is not tax-exempt, then each year you must determine whether the total exceeds $13,850. The vast majority of American workers pay in to the country’s Social Security system through payroll taxes. These taxes provide retirement and disability income, as well as death and survivorship benefits.

While best known for retirement benefits, it also provides survivor benefits and disability income. Social Security tax is also taken from the earnings of the self-employed.

The system and its rules have evolved in the decades since. Today Social Security is one of the largest government programs in the world, paying out hundreds of billions of dollars each year. In 2020 the Social Security Administration says about 178 million people pay Social Security taxes, while about 64 million receive monthly Social Security benefits. These days, most public employees have Social Security coverage — and thus pay into the system out of their paychecks — but there are still a few exceptions. These include public workers who participate in a government pension plan comparable to Social Security.

Social Security Tax for the Self-Employed

Most of these employees have money deducted from their paychecks as contributions to a public pension plan, and the exemption from Social Security effectively prevents their payroll income from being taxed twice. Exemptions under the religious group provision aren’t automatic. To claim them, a member must file IRS Form 4029 with the Social Security Administration. Doing so keeps you from having to pay tax, but it also forces you to waive any benefits you’d otherwise be eligible to receive under Social Security.

How the Social Security Tax Works

Seniors whose only source of income is Social Security do not have to pay federal income taxes on their benefits. If the total is more than the IRS threshold, some of their Social Security benefits are taxable. Social Security is the term used for the Old-Age, Survivors, and Disability Insurance (OASDI) program in the United States, run by the Social Security Administration (SSA), which is a federal agency.

Since the Internal Revenue Service (IRS) considers a self-employed individual to be both an employer and an employee, they have to pay the full 12.4% Social Security tax. The Social Security tax is applied to all net earnings up to the wage limit.

Still, not every worker is required to pay them. Read on to see if you’re exempt from Social Security taxes, and what not paying them can mean for your future retirement. The Social Security tax is applied to income earned by employees and self-employed taxpayers.

What is Social Security tax 2020?

Social Security tax is the tax levied on both employers and employees to fund the Social Security program. Social Security tax is collected in the form of a payroll tax mandated by the Federal Insurance Contributions Act (FICA) or a self-employment tax mandated by the Self-Employed Contributions Act (SECA).