Overview

You can categorize bookkeeping accounts in a number of different ways. For example, you can categorize accounts by which financial statement they are reported on and by whether or not they are current or long-term.

Now, you will categorize your bookkeeping accounts in a new way – whether they are permanent and closed at the end of the period or temporary and not affected by the closing entries. Closed means balances are zeroed out. You would leave all Balance sheet accounts as they are; they do not change. All your revenue and expense accounts are going to be closed into your Retained earnings.

Let’s assume that you have analyzed the financial transactions, recorded them in the journals, and posted the final balances to the General ledger. After you prepare your financial statements, you are going to do your closing entries. The closing entries are necessary to close out all of your income and expense accounts.

In order to get all your revenues and expenses into our Retained earnings, you need to use an account in called Income summary. Revenues and expenses are closed to Income summary. The Income summary account, essentially, is going to be the same in total value as your Net income. This is an important aspect to remember. The Income summary is a transitional account.

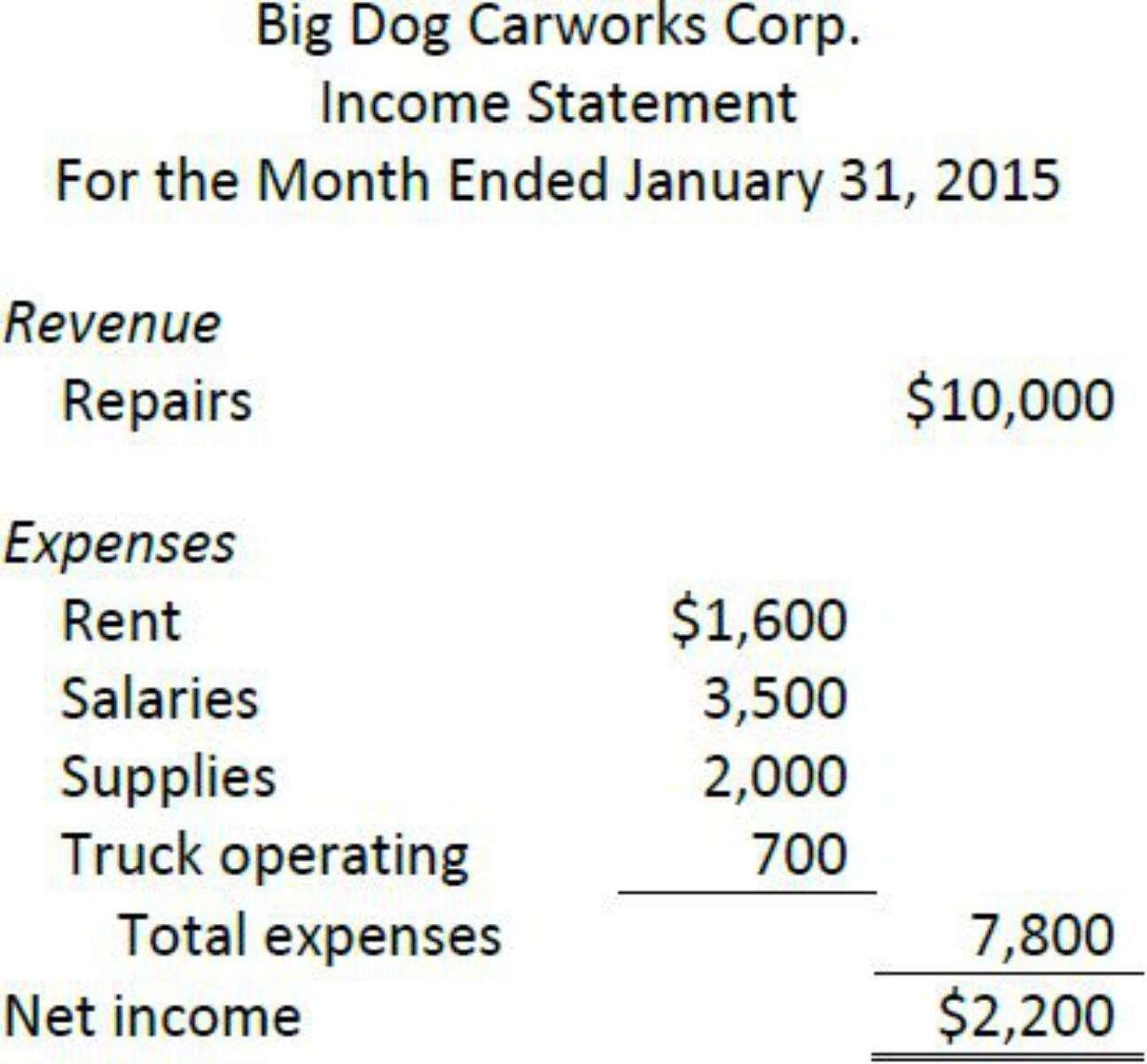

Example

Let’s walk through the closing process step by step and close the Income statement (shown above) accounts. So, our first step would be to close all revenue accounts. A journal entry for this is very simple.

Date

Account Name

DR

CR

May 31

Repairs Income

$10,000

Income Summary

$10,000

To close all revenue accounts.

Next, we need to move all the expenses this company has to the Income summary account as well. We will do it with just one journal entry. The expense accounts would be zeroed out by crediting each account with the respective amount and debiting the total to the Income summary to ensure a balance is maintained.

Date

Account Name

DR

CR

Income Summary

$7,800

May 31

Rent

$1,600

Salaries

$3,500

Supplies

$2,000

Truck Operating

$700

To close all expense accounts.

As we mentioned in the beginning, the Income summary account is also a temporary account. Thus, we need to close it as well. To do so, you would make a credit entry in the Income summary account and record a balancing entry in the Retained earnings account.

Date

Account Name

DR

CR

May 31

Retained Earnings

$2,200

Income Summary

$2,200

To close out income summary and update retained earnings.