They generally are due within 30 to 60 days of invoicing, and businesses are usually not charged interest on the balance if payment is made in a timely fashion. Examples of accounts payable include accounting services, legal services, supplies, and utilities.

Trade Payables Financing

Current liabilities are short-term liabilities of a company, typically less than 90 days. All outstanding payments due to vendors are recorded in accounts payable. As a result, if anyone looks at the balance in accounts payable, they will see the total amount the business owes all of its vendors and short-term lenders.

Increasingly, large firms are using specialized Accounts Payable automation solutions (commonly called ePayables) to automate the paper and manual elements of processing an organization’s invoices. An accounts payable is recorded in the Account Payable sub-ledger at the time an invoice is vouched for payment. Vouchered, or vouched, means that an invoice is approved for payment and has been recorded in the General Ledger or AP subledger as an outstanding, or open, liability because it has not been paid. Common examples of Expense Payables are advertising, travel, entertainment, office supplies and utilities. AP is a form of credit that suppliers offer to their customers by allowing them to pay for a product or service after it has already been received.

These billed amounts, if paid on credit, are entered in the accounts payable module of a company’s accounting software, after which they appear in the accounts payable aging report until they are paid. Any amounts owed to suppliers that are immediately paid in cash are not considered to be trade payables, since they are no longer a liability. The accounts payable turnover ratio shows investors how many times per period a company pays its accounts payable. In other words, the ratio measures the speed at which a company pays its suppliers.

If the turnover ratio declines from one period to the next, this indicates that the company is paying its suppliers more slowly, and may be an indicator of worsening financial condition. A change in the turnover ratio can also indicate altered payment terms with suppliers, though this rarely has more than a slight impact on the ratio. If a company is paying its suppliers very quickly, it may mean that the suppliers are demanding fast payment terms, or that the company is taking advantage of early payment discounts.

After this is accomplished, the invoices must go through the company’s respective business process in order to be paid. The suppliers in our scenario have their own cash flow considerations in setting how long they’re willing to wait to receive payment. For the supplier, letting a customer wait for a little while before paying is called an account receivable.

What is Accounts Payable non trade?

Trade Payables Financing. Financing program that enables a company (Buyer) to extend the payment terms of its purchases from key Suppliers, by engaging ADF as payment agent. ADF then pays the Suppliers on behalf of the company in the due date and collects from the company at a later date agreed between them.

Accounts payable is listed on the balance sheet undercurrent liabilities. Accounts payable automation or AP automation is the ongoing effort of many companies to streamline the business process of their accounts payable departments. The accounts payable department’s main responsibility is to process and review transactions between the company and its suppliers. In other words, it is the accounts payable department’s job to make sure all outstanding invoices from their suppliers are approved, processed, and paid. Processing an invoice includes recording important data from the invoice and inputting it into the company’s financial, or bookkeeping, system.

Conversely, a lower accounts payable turnover ratio usually signifies that a company is slow in paying its suppliers. Companies sometimes measure the accounts payable turnover ratio by only using the cost of goods sold in the numerator.

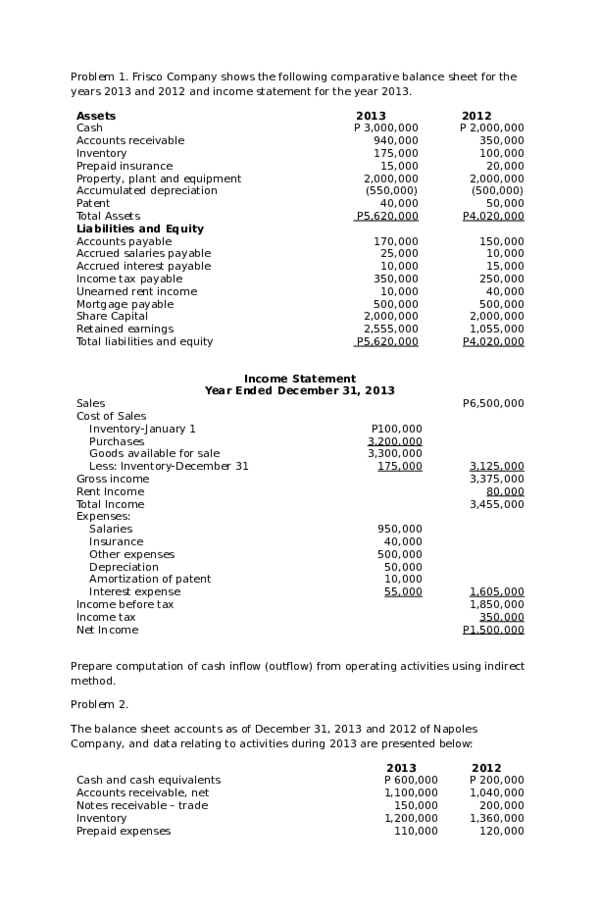

How Do the Balance Sheet and Cash Flow Statement Differ?

Accounts payable are usually reported in a business’ balance sheet under short-term liabilities. For example, imagine a business gets a $500 invoice for office supplies. When the AP department receives the invoice, it records a $500 credit in accounts payable and a $500 debit to office supply expense.

- Accounts payable are debts that must be paid off within a given period to avoid default.

- A company’s total accounts payable (AP) balance at a specific point in time will appear on its balance sheetunder the current liabilities section.

Accounts payable turnover ratio is an accounting liquidity metric that evaluates how fast a company pays off its creditors (suppliers). The ratio shows how many times in a given period (typically 1 year) a company pays its average accounts payable. An accounts payable turnover ratio measures the number of times a company pays its suppliers during a specific accounting period. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet.

Accounts payable are usually due in 30 to 60 days, and companies are usually not charged interest on the balance if paid on time. When the turnover ratio is increasing, the company is paying off suppliers at a faster rate than in previous periods. An increasing ratio means the company has plenty of cash available to pay off its short-term debt in a timely manner. As a result, an increasing accounts payable turnover ratio could be an indication that the company managing its debts and cash flow effectively.

Accounts payable (AP) is money owed by a business to its suppliers shown as a liability on a company’s balance sheet. It is distinct from notes payable liabilities, which are debts created by formal legal instrument documents. Accounts payable are monies that are owed to outside individuals and other businesses for goods and services provided. Accounts payable are usually a short-term liability, and are listed on a company’s balance sheet.

Accounts Payable vs. Accounts Receivable

The other party would record the transaction as an increase to its accounts receivable in the same amount. In households, accounts payable are ordinarily bills from the electric company, telephone company, cable television or satellite dish service, newspaper subscription, and other such regular services. Householders usually track and pay on a monthly basis by hand using cheques, credit cards or internet banking.

What are trade payables on a balance sheet?

A trade payable is an amount billed to a company by its suppliers for goods delivered to or services consumed by the company in the ordinary course of business. Other types of payables, such as accrued expenses, dividends payable, or wages payable, are recorded in other accounts in order to more easily identify them.

These short-term credits are recorded as current assets on the balance sheet, and they have an inverse impact on cash flow as accounts payable. Payment requirements will usually vary from supplier to supplier, depending on its size and financial capabilities. A high ratio means there is a relatively short time between purchase of goods and services and payment for them.

This is incorrect, since there may be a large amount of administrative expenses that should also be included in the numerator. If a company only uses the cost of goods sold in the numerator, this creates an excessively high turnover ratio. An incorrectly high turnover ratio can also be caused if cash-on-delivery payments made to suppliers are included in the ratio, since these payments are outstanding for zero days. Accounts payable turnover is a ratio that measures the speed with which a company pays its suppliers.

What is Accounts Payable (AP)?

The accounts receivable turnover ratio is an accounting measure used to quantify a company’s effectiveness in collecting its receivables or money owed by clients. The ratio shows how well a company uses and manages the credit it extends to customers and how quickly that short-term debt is collected or is paid. Accounts payable are short-term debt that a company owes to its suppliers and creditors.

The accounts payable turnover ratio shows how efficient a company is at paying its suppliers and short-term debts. The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. Accounts payable turnover shows how many times a company pays off its accounts payable during a period. Accounts receivable are similar to accounts payable in that they both offer terms which might be 30, 60, or 90 days. However, with receivables, the company will be paid by their customers, whereas accounts payables represent money owed by the company to its creditors or suppliers.

A company’s total accounts payable (AP) balance at a specific point in time will appear on its balance sheetunder the current liabilities section. Accounts payable are debts that must be paid off within a given period to avoid default. At the corporate level, AP refers to short-term debt payments due to suppliers. The payable is essentially a short-term IOU from one business to another business or entity.

Payment terms may include the offer of a cash discount for paying an invoice within a defined number of days. For example, 2%, Net 30 terms mean that the payer will deduct 2% from the invoice if payment is made within 30 days. A trade payable is an amount billed to a company by its suppliers for goods delivered to or services consumed by the company in the ordinary course of business.

For example, the terms could stipulate that payment is due to the supplier in 30 days or 90 days. The payable is in default if the company does not pay the payable within the terms outlined by the supplier or creditor. Accounts payable are short-term liabilities relating to the purchases of goods and services incurred by a business.