Additional paid-in capital reflects the amount of equity capital that is generated by the sale of shares of stock on the primary market that exceeds its par value. The par value of a stock is the minimum value of each share as determined by the company at issuance. If a share is issued with a par value of $1 but sells for $30, the additional paid-in capital for that share is $29. When a company has exactly the same amount of current assets and current liabilities, there is zero working capital in place. This is possible if a company’s current assets are fully funded by current liabilities.

A company’s working capital is a core part of funding its daily operations. However, it’s important to analyze both the working capital and cash flow of a company to determine whether the financial activity is a short-term or long-term event.

When this is the case, the account is described as “Deficit” or “Accumulated Deficit” on the corporation’s balance sheet. Gross working capital is the sum of a company’s current assets, which are convertible to cash and used to fund daily business activity. Additional paid-in capital is included inshareholder equityand can arise from issuing either preferred stock orcommon stock.

If an S corporation has no earnings and profit, then the business should capitalize via capital contributions rather than debt. That way, any distributions will reduce the shareholder’s stock basis, helping to avoid taxable income.

– For example, if 1,000 shares of $10 par value common stock are issued by at a price of $12 per share, the additional paid-in capital is $2,000 (1,000 shares x $2). Additional paid-in capital is shown in the Shareholders’s Equity section of the balance sheet. A working capital ratio of 1.0 indicates the company’s readily available financial assets exactly match its current short-term liabilities. Excess working capital provides some cash cushion against unexpected expenses and can be reinvested in the company’s growth.

A ratio below 1.0 is unfavorable, as it indicates the company’s current assets are not sufficient to cover their near-term obligations. For common stock, paid-in capital, also referred to as contributed capital, consists of a stock’s par value plus any amount paid in excess of par value. In contrast, additional paid-in capital refers only to the amount of capital in excess of par value or the premium paid by investors in return for the shares issued to them. Preferred shares sometimes have par values that are more than marginal, but most common shares today have par values of just a few pennies. Because of this, “additional paid-in capital” tends to be essentially representative of the total paid-in capital figure and is sometimes shown by itself on the balance sheet.

The key is thus to maintain an optimal level of working capital that balances the needed financial strength with satisfactory investment effectiveness. To accomplish this goal, working capital is often kept at 20% to 100% of the total current liabilities. Working capital can be negative if a company’s current assets are less than its current liabilities. Working capital is calculated as the difference between a company’s current assets and current liabilities. A company can be endowed with assets and profitability but may fall short of liquidity if its assets cannot be readily converted into cash.

More definitions of Excess Capital

The result is that nearly all of the price paid for a share of stock is recorded as additional paid-in capital (or capital surplus, to use the older term). If a company issues shares that have no stated par value at all, then there is no capital surplus; instead, the funds are recorded in the common stock account. The working capital ratio is calculated by dividing a company’s current assets by its current liabilities.

Paid-in capital represents the funds raised by the business through selling its equity and not from ongoing business operations. As a result, additional paid-in capital is the amount of equity available to fund growth. And since expansion typically leads to higher profits and higher net income in the long-term, additional paid-in capital can have a positive impact on retained earnings, albeit an indirect impact. Negative working capital is closely tied to the current ratio, which is calculated as a company’s current assets divided by its current liabilities.

Paid-in capital also refers to a line item on the company’s balance sheet listed under stockholders’ equity, often shown alongside the line item for additional paid-in capital. Paid-in capital is the amount of capital “paid in” by investors during common or preferred stock issuances, including the par value of the shares themselves plus amounts in excess of par value.

If a company purchased a fixed asset such as a building, the company’s cash flow would decrease. The company’s working capital would also decrease since the cash portion of current assets would be reduced, but current liabilities would remain unchanged because it would be long-term debt. If a transaction increases current assets and current liabilities by the same amount, there would be no change in working capital.

How do you calculate excess capital?

Paid in capital in excess of par is essentially the difference between the fair market value paid for the stock and the stock’s par value. In other words, it’s the premium paid for an appreciated stock. Paid in capital in excess of par is created when investors pay more for their shares of stock than the par value.

For this calculation, current assets are assets a company reasonably expects to be converted into cash within one year or one business cycle. This includes items such as inventory, accounts receivables, and cash or cash equivalents. Current liabilities include accounts payables, leases, income taxes and payable dividends. Additional paid-in capitaldoes not directly boost retained earnings but can lead to higher RE in the long-term.

A managerial accounting strategy focusing on maintaining efficient levels of both components of working capital, current assets, and current liabilities, in respect to each other. Working capital management ensures a company has sufficient cash flow in order to meet its short-term debt obligations and operating expenses. Par value was originally the price at which a company’s shares were initially offered for sale, so that prospective investors could be assured that the company would not issue shares at a price below the par value. However, par value is no longer required by some states; in other states, companies are allowed to set the par value at a minimal amount, such as $0.01 per share.

- The paid in capital is essentially the company’s funds as a result of equity rather than business operations.

- Paid in Capital is the contributed capital and additional paid in capital during common or preferred stock issuances and the par value of the shares.

- Capital that is contributed by investors, both potential investors and stock, is referred to as “Paid in Capital”.

Capital in excess of par

If the first payment is considered additional paid-in capital, then any additional payments to the principal (owner) are considered dividend distribution (or wage) and will be taxable. A loan may be considered additional paid-in capital if an agreement doesn’t exist between the S corp and the principal.

The amount of additional paid-in capital is determined solely by the number of shares a company sells. Any aspect of business that increases or decreases net income will impact retained earnings, including revenue, sales, cost of goods sold, operating expenses, depreciation, and additional paid-in capital. In earlier days, the $800 entry to the Additional Paid-In Capital account would instead have been made to the Capital Surplus account.

If there are multiple shareholders, ratable capital contributions should be made. S corporations can record additional capital contributions on its books as additional paid-in capital.

Positive working capital is required to ensure that a firm is able to continue its operations and that it has sufficient funds to satisfy both maturing short-term debt and upcoming operational expenses. The management of working capital involves managing inventories, accounts receivable and payable, and cash. Companies with high amounts of working capital possess sufficient liquid funds needed to meet their short-term obligations. Working capital, also called “net working capital,” is a liquidity metric used in corporate finance to assess a business’ operational efficiency. It is calculated by subtracting a company’s current liabilities from its current assets.

What is paid in capital in excess of par value?

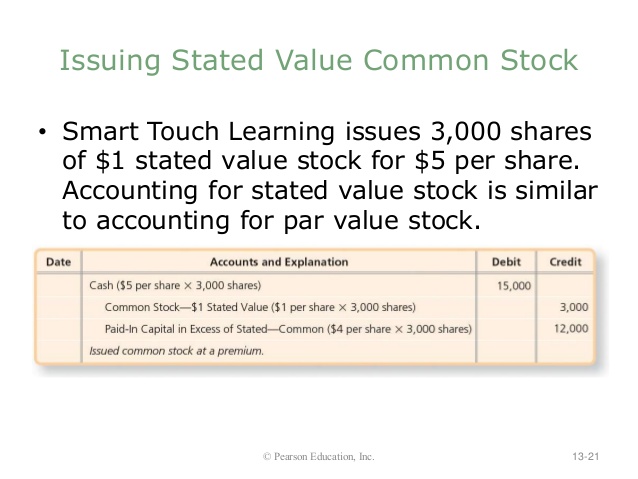

paid-in capital in excess of stated value – common stock definition. The stockholders’ equity account that reports the amount paid to a corporation that is in excess of the common stock’s stated value. The stated value of each share issued is recorded in the Common Stock account.

Capital that is contributed by investors, both potential investors and stock, is referred to as “Paid in Capital”. Paid in Capital is the contributed capital and additional paid in capital during common or preferred stock issuances and the par value of the shares.

A boost in cash flow and working capital might not be good if the company is taking on long-term debt that doesn’t generate enough cash flow to pay off. Conversely, a large decrease in cash flow and working capital might not be so bad if the company is using the proceeds to invest in long-term fixed assets that will generate earnings in the years to come.

Having zero working capital, or not taking any long-term capital for short-term uses, potentially increases investment effectiveness, but it also poses significant risks to a company’s financial strength. The additional funds parked in inventories or receivables are not financed by short-term liabilities but rather long-term capital, which should be used for longer-term investments to increase investment effectiveness.

For example, if a company received cash from short-term debt to be paid in 60 days, there would be an increase in the cash flow statement. However, there would be no increase in working capital, because the proceeds from the loan would be a current asset or cash, and the note payable would be a current liability since it’s a short-term loan. It is common forS corporationshareholders to make cash advances to the corp during those years when the company’s profits are low.

What Does Paid-In Capital in Excess of Par Mean?

The paid in capital is essentially the company’s funds as a result of equity rather than business operations. You can find paid in capital listed under the stock holder’s equity or additional paid-in capital. After reading this article you will have the knowledge to reduce paid in capital.

Paid-In Capital

If a current ratio is less than 1, the current liabilities exceed the current assets and the working capital is negative. Imagine if Exxon borrowed an additional $20 billion in long-term debt,boosting the current amount of $24.4 billion (listed below the red shaded area) to $44.4 billion. Working capital would also increase by $20 billion and would be added to current assets without any debt added to current liabilities; since current liabilities are short-term or one year or less.

This, however, doesn’t mean that the company is required to issue additional shares of stock. The term retained earnings refers to a corporation’s cumulative net income (from the date of incorporation to the current balance sheet date) minus the cumulative amount of dividends declared. An established corporation that has been profitable for many years will often have a very large credit balance in its Retained Earnings account, frequently exceeding the paid-in capital from investors.