Paid in capital

Paid-up capitalis the amount of money a company has been paid from shareholders in exchange for shares of its stock. Paid-up capital is created when a company sells its shares on theprimary market, directly to investors. A company that is fully paid-up has sold all available shares and thus cannot increase its capital unless it borrows money by taking on debt. In other words, the authorized share capital represents the upward bound on possible paid-up capital.

All paid-up capital is listed under the shareholders’ equity section of the issuing company’s balance sheet. Legal capital is that amount of a company’s equity that cannot legally be allowed to leave the business; it cannot be distributed through a dividend or any other means. It is the par value of common stock and the stated value of the preferred stock that a business has sold or otherwise issued to investors. The legal capital concept does not apply to any stock that is authorized for issuance but which has not yet been issued.

Share capital consists of all funds raised by a company in exchange for shares of either common orpreferred sharesof stock. The amount of share capital orequity financinga company has can change over time. A company that wishes to raise more equity can obtain authorization to issue and sell additional shares, thereby increasing its share capital.

Paid in Capital is the contributed capital and additional paid in capital during common or preferred stock issuances and the par value of the shares. The paid in capital is essentially the company’s funds as a result of equity rather than business operations. You can find paid in capital listed under the stock holder’s equity or additional paid-in capital. After reading this article you will have the knowledge to reduce paid in capital. At the time of incorporation of company promoters and investors purchase the shares of the company.

Firstly, the authorized share capital is fixed by the company beyond which the company cannot issue the shares in the market. So initially in the balance sheet, the issued and paid in capital is recorded at the par value. After the amount has been paid by the investor, a new journal entry will be passed by recording the increase in the paid-in capital of the company. Stock prices in the secondary market don’t affect the amount of paid-in calculation in the balance sheet.

Contributed capital can be compared with additional paid-in capital, and the difference between the two values will equal the premium paid by investors over and above thepar valueof the company’s shares. The par value is merely an accounting value of each of the shares to be offered and is not equivalent to the market value that investors are willing to pay. Contributed capital, also known as paid-in capital, is the cash and other assets that shareholders have given a company in exchange for stock. Investors make capital contributions when a company issues equity shares based on a price that shareholders are willing to pay for them.

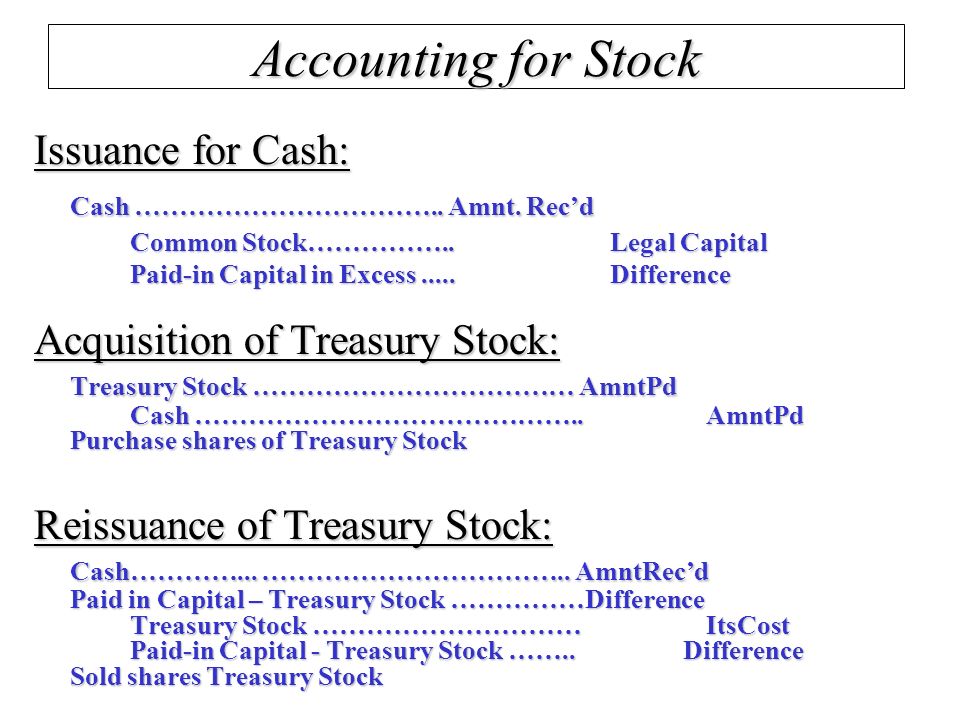

Legal Capital

The total amount of contributed capital or paid-in-capital represents their stake or ownership in the company. Paid-up capital doesn’t need to be repaid,which is a major benefit of funding business operations in this manner. Also called paid-in capital, equity capital, or contributed capital, paid-up capital is simply the total amount of money shareholders have paid for shares at the initial issuance. It does not include any amount that investors later pay to purchase shares on the open market. The investors pay $10,000 for these shares because of the company prospects and change to increase their investments.

In other words, a company may elect to only issue a portion of the total share capital with the plan of issuing more shares at a later date. Not all these shares may sell right away, and the par value of the issued capital cannot exceed the value of the authorized capital. The total par value of the shares that the company sells is called its paid share capital. Issued share capital is simply the monetary value of the portion of shares of stock a company offers for sale to investors.

What is included in legal capital?

legal capital. Capital that by law or resolution must remain within a firm and that is restricted for purposes of dividends or other distributions. Legal capital is generally equal to the par or stated value of all outstanding stock. Also called stated capital.

- Thus, even an issuance of 1 million shares would only yield legal capital of $10,000, assuming a par value per share of $0.01.

- However, the concept is effectively negated for those businesses issuing stock having extremely low par values.

- The original intent of legal capital was to create a reserve that could be accessed by a company’s creditors in the event of default.

For common stock, paid-in capital, also referred to as contributed capital, consists of a stock’s par value plus any amount paid in excess of par value. In contrast, additional paid-in capital refers only to the amount of capital in excess of par value or the premium paid by investors in return for the shares issued to them. Preferred shares sometimes have par values that are more than marginal, but most common shares today have par values of just a few pennies. Because of this, “additional paid-in capital” tends to be essentially representative of the total paid-in capital figure and is sometimes shown by itself on the balance sheet.

Thus, even an issuance of 1 million shares would only yield legal capital of $10,000, assuming a par value per share of $0.01. Contributed capital is an element of the total amount of equity recorded by an organization. It can be a separate account within the stockholders’ equity section of the balance sheet, or it can be split between an additional paid-in capital account and a common stock account. In the latter case, the par value of the shares sold is recorded in the common stock account and any excess payments are recorded in the additional paid in capital account.

The company would record $1,000 to the common stock account and $9,000 to thepaid-in capital in excess of par. If the treasury stock is sold at equal to its repurchase price, the removal of the treasury stock simply restores shareholders’ equity to its pre-buyback level. Share capital is the money a company raises by issuing shares of common or preferred stock.

The original intent of legal capital was to create a reserve that could be accessed by a company’s creditors in the event of default. However, the concept is effectively negated for those businesses issuing stock having extremely low par values.

Capital stock is the number of common and preferred shares that a company is authorized to issue, according to its corporate charter. The amount received by the corporation when it issued shares of its capital stock is reported in the shareholders’ equity section of the balance sheet.

Any amount of money that has already been paid by investors in exchange for shares of stock is paid-up capital. Even if an investor has not paid in full, the amount already remitted is included as paid-up capital.

What Is Contributed Capital?

Contributed capital may also refer to a company’s balance sheet item listed under stockholders’ equity, often shown alongside the balance sheet entry for additional paid-in capital. Share capital consists of all funds raised by a company in exchange for shares of either common orpreferred stock. The amount of share capital or equity financing a company has can change over time. A company that plans to raise more equity and be approved to issue additional shares, thereby increasing its share capital. Issued share capital is the total value of the shares a company elects to sell.

Firms can issue more capital stock over time or buy back shares that are currently owned by shareholders. The investors pay $10 a share, so the company raises $50,000 in equity capital. As a result, the company records $5,000 to the common stock account and $45,000 to the paid-in capital in excess of par. Both of these accounts added together equal the total amount stockholders were willing to pay for their shares.

It is customary for investors to concentrate their attention on the net amount of total equity, rather than this single element of equity. Thus, the recordation of contributed capital is designed to fulfill a legal or accounting requirement, rather than providing additional useful information. Capital that is contributed by investors, both potential investors and stock, is referred to as “Paid in Capital”.