Understanding the High-Low Method

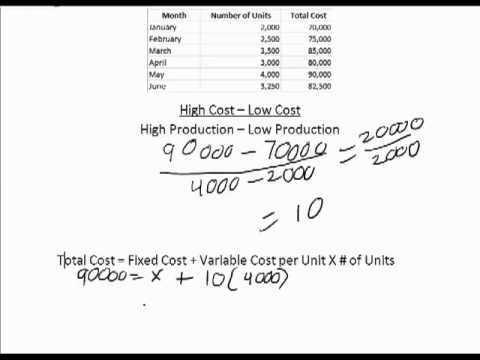

However, the principle of distributing fixed costs with mass-production still holds. However, the fixed cost per unit changes as the level of activity changes. The high-low method is actually a two-step process where the first step will help us to determine the estimated total cost per unit. The second step of the process is where we take the cost per unit that we established from the first step and figure out the fixed costs for that level of production.

High-Low Method Accounting: Formula & Examples

Once we have those two pieces of information, we can use them to figure out the approximate cost for any level of production. When using the high-low method, the highest point and the lowest point are used to create the cost formula. The high point is defined as the point with the highest activity and the low point is defined as the point with the lowest activity.

Accounting for Management

The costs associated with a product, product line, equipment, store, geographic sales region, or subsidiary, consist of both variable costs and fixed costs. To determine both cost components of the total cost, an analyst or accountant can use a technique known as the high-low method.

The Difference Between the High-Low Method and Regression Analysis

However, if you make and sell 1,000,000 cards, suddenly you’re only spending $0.50 per card in fixed cost, bringing your total cost to $1. You’re now making $1.50 in profit on each card, without having to change prices or demand for your cards.Note that, in reality, this is not so simple. Drastically increasing production may increase fixed costs, though variable costs may go down as well.

The essential concept is to collect the cost at a high activity level and again at a low activity level, and then extract the fixed and variable cost components from this information. The concept is useful in the analysis of pricing and the derivation of budgets. It could be used to determine the fixed and variable components of the costs associated with a product, product line, machine, store, geographic sales region, subsidiary, or customer. Lets say that you started a business producing waterproof cell phone cases for retail sales.

In order to use the high-low method, you will have to combine the fixed and variable costs of production within your company to come up with a total cost. You will notice that the high-low method will only give you an estimate of what total costs would be at any given amount of production. These estimates are helpful to management when preparing budgets for upcoming months. Variable costs will change depending on the number of units you’re producing. Unlike fixed costs, variable costs will increase when producing more units and decrease when you produce fewer.

She divides the difference in dollars by the difference in activity to calculate the cost per unit of activity, or the variable activity. She multiplies the variable cost per unit by the number of activities to calculate the total variable cost. She subtracts the total variable cost from the total cost to determine the fixed cost. Fixed and variable expenses mean different things to the accountant. Accountants segregate fixed and variable expenses with the high-low method.

Fixed costs include rent, utilities, payments on loans, depreciation and advertising. You can change a fixed cost – move to somewhere with lower rent, for instance – but the costs don’t fluctuate otherwise. Even if the economy craters and your sales drop to zero, fixed costs don’t disappear.

- The total amount of fixed costs is assumed to be the same at both points of activity.

- The high-low method is used to calculate the variable and fixed cost of a product or entity with mixed costs.

Using the lowest and highest activity levels, it is possible to estimate the variable cost per unit and the fixed cost component of mixed costs. In other words, the breakeven point is equal to the total fixed costs divided by the difference between the unit price and variable costs. Note that in this formula, fixed costs are stated as a total of all overhead for the firm, whereas Price and Variable Costs are stated as per unit costs—the price for each product unit sold.

What is the High Low method formula?

To solve this using the high-low method formula, subtract the lower cost from the higher cost to get a numerator of $27,675, then subtract the lowest number of units from the highest quantity to get a denominator of 22,500 units. Divide the numerator by the denominator to get an estimated cost of $1.23 per unit.

Finally, divide it by the number of individual products you produced in that same time frame to get the fixed cost per unit. Another disadvantage of the high-low method is the number of steps necessary to perform this analysis. The accountant needs to gather monthly data regarding the expense being analyzed and the unit of activity. The accountant lists each set of data and identifies the high and low values.

To calculate fixed cost, start by making a list of all your business costs over a fixed period of time. In your list, include things like staff salaries, taxes, and permits. Then, separate your list into costs that change over time, called variable costs, and those that stay the same, or fixed costs.

What is the High Low method in accounting?

In cost accounting, the high-low method is a way of attempting to separate out fixed and variable costs given a limited amount of data. The high-low method involves taking the highest level of activity and the lowest level of activity and comparing the total costs at each level.

Employees who work per hour, and whose hours change according to business needs, are a variable expense. Piecework labor, where pay is based on the number of items made, is variable – so are sales commissions.

In cost accounting, the high-low method is a way of attempting to separate out fixed and variable costs given a limited amount of data. The high-low method involves taking the highest level of activity and the lowest level of activity and comparing the total costs at each level. When using the high-low method, fixed costs are calculated after variable costs are determined. The high-low method is used to discern the fixed and variable portions of a mixed cost.

Calculating the breakeven point is a key financial analysis tool used by business owners. Once you know the fixed and variable costs for the product your business produces or a good approximation of them, you can use that information to calculate your company’s breakeven point. Small business owners can use the calculation to determine how many product units they need to sell at a given price pointto break even. They earn the same amount regardless of how your business is doing.

The change in the total costs is thus the variable cost rate times the change in the number of units of activity. One very quick way of estimating the cost per unit produced is to use the high-low method of cost-volume analysis.

If you must have a minimum number of employees to keep the sales office or the production line running, their pay may be a fixed cost. If you pay someone a mix of fixed salary plus commission, then they represent both fixed and variable costs. The difference between fixed and variable costs is essential to know for your business’s future. The amount of raw materials and inventory you buy and the costs of shipping and delivery are all variable.

What Does the High-Low Method Tell You?

The high-low method is used to calculate the variable and fixed cost of a product or entity with mixed costs. It considers the total dollars of the mixed costs at the highest volume of activity and the total dollars of the mixed costs at the lowest volume of activity. The total amount of fixed costs is assumed to be the same at both points of activity.