Definition

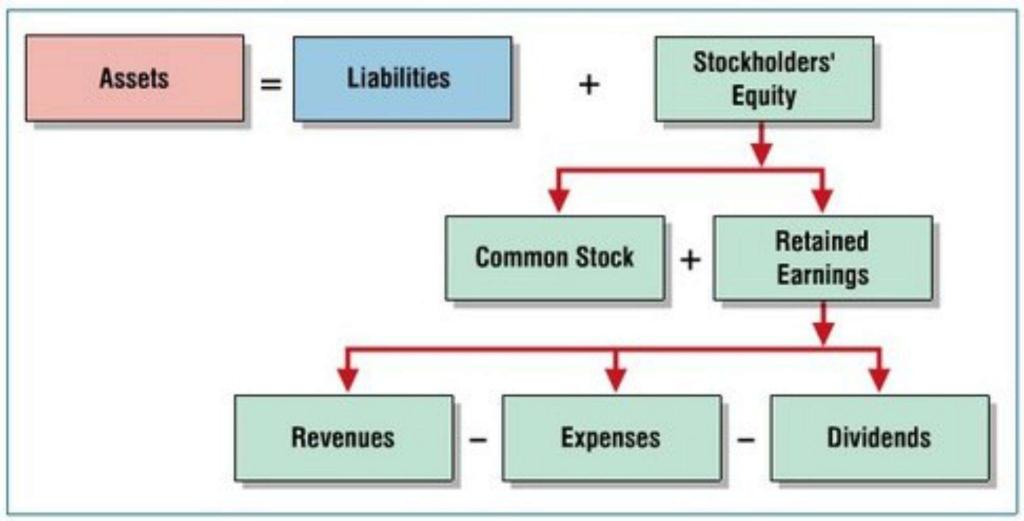

The basic accounting equation states that the assets of a company are made up of debt obligations and funds invested by shareholders. The balance equation, as it is also known, looks as follows: Assets = Liabilities + Equity (owner’s/shareholders’ investments). Thus, the total assets of the enterprise are equal to the sum of the total debt and capital.

Balance

Every transaction that happens within a business has an effect on its financial position. The accounting equation is what keeps all of the transactions in balance and helps users of the information make sense of what areas each transaction affects.

Any transaction that affects the Balance sheet of the enterprise entails an equal entry on both sides of the equation, or proportional changes on one side of the equation to maintain equality of the parts of the equation. This balance provides good control of the funds invested by the owner, reflecting data on the organization’s business operations and ending balances at the end of the reporting period.

The following variation of this equation is often used:

This equation reflects the fact that a company can acquire assets from its own funds or debt obligations or shareholders’ funds. Debt obligations can also be repaid from their own funds, or by accepting new debt obligations, for example, using a loan.

Examples

- A business received the money in the current bank account from debtors as a repayment of the previously formed debt in the amount of $3,500. The amount of money in the current bank account increases by $3,500. At the same time, the accounts receivable are reduced by $3,500. Both changes occur on the assets side of the Balance sheet, but this does not create an unbalance in the accounting equation.

- At the expense of undistributed income, a reserve was created in the amount of $10,000. In this case, the item “Retained earnings” decreases by this amount, while the item “Reserved capital” increases by $10,000. These changes occur within the equity items, so the Balance sheet’s balance does not change.

- The company received goods from suppliers in the amount of $8,800. The item “Supplies” increases under the assets of the Balance sheet by $8,800. At the same time, under liabilities, the accounts payable increase by the amount specified in the invoice or $8,800. Consequently, both sides of the accounting equation are increased by the same amount, and the balance is maintained.

- The company transferred $2,400 from the current bank account to various creditors to repay the previously formed debt. The item “Bank ” decreases under the assets by $2,400, while under liabilities, the accounts payable decreased by the same amount.

All business transactions, similar to the above examples, cause certain changes in the final balance of the Balance sheet. The first and second types of Balance sheet changes occur either in assets or in equity/ liabilities, therefore, they do not affect the final balance.

The third and fourth types of changes cause changes simultaneously in assets and equity/liabilities, respectively, the Balance sheet’s balance either increases or decreases, always maintaining equality between the two sides of the Balance sheet.