Companies may return a portion of stockholders’ equity back to stockholders when unable to adequately allocate equity capital in ways that produce desired profits. This reverse capital exchange between a company and its stockholders is known as share buybacks. Shares bought back by companies become treasury shares, and their dollar value is noted in the treasury stock contra account. Paid-in capital is the money that a company receives when investors buy shares of its stock. In exchange for that capital, investors claim an equity stake in the company. Retained earnings are the part of a company’s profits that it keeps for reinvestment after dividends and other distributions are paid to investors.

A number of accounts comprise stockholders’ equity, which are noted below. Shareholder equity is one of the important numbers embedded in the financial reports of public companies that can help investors come to a sound conclusion about the real value of a company. If the company ever needs to be liquidated, SE is the amount of money that would be returned to these owners after all other debts are satisfied.

AccountingTools

Shareholder equity alone is not a definitive indicator of a company’s financial health. A balance sheet can’t predict changes in the value of a company’s assets or changes to its liabilities that haven’t occurred yet. Increases or decreases on either side could shift the needle substantially when it comes to the direction in which stockholders’ equity moves. Whether negative stockholder’s equity is indicative of a larger problem usually requires taking a closer look at the company’s financials.

If it’s positive, the company has enough assets to cover its liabilities. Every company has an equity position based on the difference between the value of its assets and its liabilities. A company’s share price is often considered to be a representation of a firm’s equity position. In most cases, retained earnings are the largest component of stockholders’ equity. This is especially true when dealing with companies that have been in business for many years. When examined along with these other benchmarks, the stockholders’ equity can help you formulate a complete picture of the company and make a wise investment decision.

To calculate retained earnings, the beginning retained earnings balance is added to the net income or loss and then dividend payouts are subtracted. A summary report called a statement of retained earnings is also maintained, outlining the changes in retained earnings for a specific period. Retained Earnings (RE) are business’ profits that are not distributed as dividends to stockholders (shareholders) but instead are allocated for investment back into the business. Retained Earnings can be used for funding working capital, fixed asset purchases, or debt servicing, among other things.

Calculating stockholders’ equity can give investors a better idea of what assets might be left (and paid out to shareholders) once all outstanding liabilities or debts are satisfied. Stockholders’ equity is the amount of assets remaining in a business after all liabilities have been settled. It is comprised of common stock, preferred stock additional paid-in capital, retained earnings, and treasury stock. Investors and analysts look to several different ratios to determine the financial company. This shows how well management uses the equity from company investors to earn a profit.

What is Stockholders Equity?

Shareholder equity represents the total amount of capital in a company that is directly linked to its owners. Stockholders’ equity is also referred to as shareholders’ or owners’ equity. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.

- When shareholders’ equity is positive, this indicates that the company has sufficient assets to cover all of its liabilities.

- These are current assets, which means they are either cash or are expected to be converted to cash within one year.

- Retained earnings are part of shareholder equity as is any capital invested in the company.

- This is usually one of the last steps in forecasting the balance sheet items.

- It is comprised of common stock, preferred stock additional paid-in capital, retained earnings, and treasury stock.

Long-term liabilities are obligations that are due for repayment over periods longer than one year. Companies may have bonds payable, leases, and pension obligations under this category. Retained earnings are part of shareholder equity as is any capital invested in the company. Looking at the same period one year earlier, we can see that the year-over-year (YOY) change in equity was an increase of $9.5 billion. The balance sheet shows this decrease is due to a decrease in assets, but a larger decrease in liabilities.

5.2 Liabilities

Shareholders, however, are concerned with both liabilities and equity accounts because stockholders equity can only be paid after bondholders have been paid. Stockholders Equity provides highly useful information when analyzing financial statements. In events of liquidation, equity holders are last in line behind debt holders to receive any payments. For this reason, many investors view companies with negative shareholder equity as risky or unsafe investments.

- This is the percentage of net earnings that is not paid to shareholders as dividends.

- This balance will fluctuate over time, especially if cash reserves are being drained away by issuing dividends or buying back shares from investors.

- Stockholders’ equity shows the quality of a firm’s economic stability; it also provides insights into its capital structure.

- Where the difference between the shares issued and the shares outstanding is equal to the number of treasury shares.

- SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments.

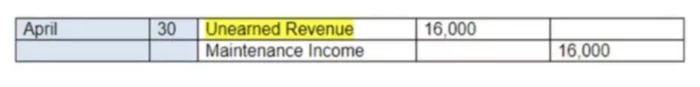

Dividend payments by companies to its stockholders (shareholders) are completely discretionary. Companies have no obligation whatsoever to pay out dividends until they have been formally declared by the board. There are four key dates in terms of dividend payments, two of which require specific accounting treatments in terms of journal entries. There are various kinds of dividends that companies may compensate its shareholders, of which cash and stock are the most prevalent. Stockholders’ equity is equal to a firm’s total assets minus its total liabilities.

Components of Stockholders Equity

Cash Dividends is a temporary account that substitutes for a debit to Retained Earnings and is classified as a contra (opposite) stockholders’ equity account. This is ultimately accom- plished by closing the Cash Dividends balance into Retained Earnings at the end of the accounting period. Since equity accounts for total assets and total liabilities, cash and cash equivalents would only represent a small piece of a company’s financial picture.

Alternative Method to Calculate Stockholders’ Equity

You can calculate this by subtracting the total assets from the total liabilities. These earnings, reported as part of the income statement, accumulate and grow larger over time. At some point, accumulated retained earnings may exceed the amount of contributed equity capital and can eventually grow to be the main source of stockholders’ equity. At a glance, stockholders’ equity can give you an idea of how well a company is doing financially and how likely it is to be able to pay its debts. That, in turn, can help you to decide if a company is worth investing in, based on your goals and risk tolerance.

Stockholders’ Equity: What It Is, How to Calculate It, Examples

Stockholders’ equity shows the quality of a firm’s economic stability; it also provides insights into its capital structure. Finding it on the balance sheet is one way you can learn about the financial health of a firm. The retained earnings portion reflects the percentage of net earnings that were not paid to shareholders as dividends and should not be confused with cash or other liquid assets. Let’s assume that ABC Company has total assets of $2.6 million and total liabilities of $920,000.