It refers to all activities a company performs to generate economic benefits to the business and its customers. Service revenue doesn’t include interest income or income earned from product shipments. Typically, service businesses have to employ a different strategy from product-based business to get good returns. It has also been revealed that there are many ways to calculate service revenues so business owners need to know how they should be doing this calculation to get an accurate picture of their financial situation. From there, it gets added to the revenue from product earnings as a way to show the company’s total revenue during a specific period.

Service revenue is a business’s earnings from providing a service to its customers. Therefore, service revenue is categorized as an income or revenue rather than an asset and belongs on the income statement rather than the balance sheet. This distinction sometimes confuses businesses trying to understand their financial health. Under this method of accounting, service revenue recognition happens as soon as the work has been completed and billed, even if payments are released in different accounting periods. From software implementation to consulting, there are plenty of sources of service revenue. Understanding the proportion of service revenue to total sales can help a business understand its financial health and uncover investment opportunities.

Service revenue refers more to income – reflected on the income statement – unless a payment is outstanding. If a payment is outstanding, the transaction becomes a temporary liability until such a time as payment is received. The definition of equity is a stakeholders’ stake in the company, which is located on the balance sheet, not the income statement like the service revenue. The company has a total revenue of $125,000, comprised of $120,000 in service revenue and $5,000 in non-operating revenue. After accounting for all the expenses, the net income amounts to $31,000, indicating a profitable business.

A service provider can be a company, individual, nonprofit organization, government agency, etc. Companies need to have this account because it helps them plan how much they need in order to provide their services and stay profitable. This step takes care of explaining and presenting your annual service revenue to the public. It’s crucial to include this number on your income statement because it can help investors pinpoint where they should focus their money if they want to make a difference in your business’s finances.

What is service revenue?

This number gives an overall picture of a company’s financial health—making operational and investment decisions easier. Service revenue can be a highly profitable revenue stream, even for businesses that sell physical or software products. Ask a question about your financial situation providing as much detail as possible.

Service revenue is an account that is used to record the total amount of money received from providing services and is typically considered an operating expense, not a permanent account. The accrual accounting approach allows service-based businesses to recognize service revenue more accurately by matching it with the corresponding cost of providing services to customers. Service revenue is a type of income that an organization earns from rendering a service.

Service revenue definition

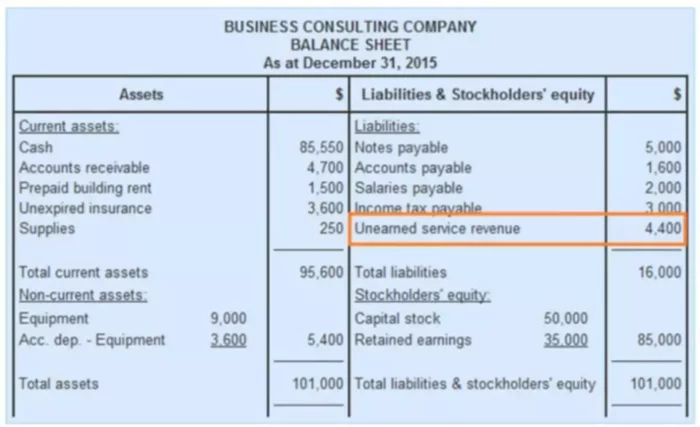

Effectively, all services which raise a company’s income qualify as service revenue. A good example is someone hiring a person to mow their lawn or a customer hiring an electrician to fix the wiring in their home. A company can even provide different skills, such as information about certain products, how they work, and the ability to fix them. The total service revenue recognized by CloudTech Solutions for January 2023 is $2,200, with an additional $7,200 recorded as deferred revenue (from Gamma Ltd.) on the balance sheet. Service revenue is part of the operating activities, affecting the retained earnings in the balance sheet.

- A current asset is any asset that will provide an economic value for or within one year.

- This is a stark contrast to the global average revenue mix, which is typically around 50/50.

- Though service revenue is included on the income statement, this information trickles down to the rest of the statements companies need to make crucial decisions.

- This sample income statement overviews the business’s financial performance, including the breakdown of revenues and expenses.

Service revenue is the sales reported by a business that relate to services provided to its customers. This revenue has usually already been billed, but it may be recognized even if unbilled, as long as the revenue has been earned. Service revenue does not include any income from the shipment of goods, nor does it include any interest income.

Sales Revenue Vs Service Revenue

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. View this Balance Sheet Example to understand other items that are recorded on the balance sheet. Accounts receivable are funds that a company is owed by clients who have received a good or service, such as a handyman who performs a service for a client and sends an invoice, but has not been paid. This is typically done through a double entry system which uses debits and credits.

Service revenue is what type of account?

When an invoice is created, it should be accounted for through a debit entry to the accounts receivable account and a credit to the sales account. Software solutions can help businesses stay compliant, recognize revenue on-time, and give them better visibility into the financial health of their business. The accrual method uses a double-entry system, creating an entry in your general ledger to account for the service revenue. To calculate the percentage of service revenue against total sales, take your service revenue and divide it by total sales. When the invoice is paid, a credit will be added to accounts receivable and a debit entry will be made for cash. Service revenue bookkeeping entries get entered into the ledger based on the method chosen, such as the accrual accounting method.

Step-by-step how to record service revenue

This example highlights how service revenue recognition can be based on when the service is rendered, even if the payment is received upfront or spread out over time. It ensures that revenue is matched with the corresponding period in which the service was provided. For service-based businesses (e.g., agencies, consulting firms), most or all of the total revenue earned will fall into the “service revenue” category.

Service revenue is recorded on an income statement as revenue, which is subtracted from the cost of goods sold and other expenses to determine a company’s net income. The second step includes recording the double entry of debit and credit as revenue into the company’s general ledger using the double-entry system, which allows the financial statement to balance. On the other hand, an asset is something like a resource owned by the company that adds value to the business.