When applying for a loan, be sure to read all of the documentation carefully. Imagine a first-time home buyer purchasing a home and using a 3% down Freddie Mac Home Possible mortgage to finance it. Stack Exchange network consists of 183 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

- You are making a down payment of twenty percent and using a 30-year conventional fixed-rate mortgage.

- In the first few years of the mortgage, because of amortization schedules, the buyer’s monthly payments mainly pay for interest and only marginally reduce the principal balance.

- Your lender then charges a fixed annual interest rate of 3% on that $200,000 across a 30-year mortgage.

- That’s because your outstanding principal is being multiplied by a different (usually higher) interest rate.

- However, the bank also charges a fee for lending you those funds, which is represented by the interest portion of your payment.

That’s because your outstanding principal is being multiplied by a different (usually higher) interest rate. The reason that’s not the case is that lenders use amortization when calculating your payment, which is a way of keeping your monthly bill consistent. As a result, your monthly payment is comprised of mostly interest in the early years with a smaller portion of the payment going toward reducing the principal. The principal is the original loan amount not including any interest. For example, let’s suppose you purchase a $350,000 home and put down $50,000 in cash. That means you’re borrowing $300,000 of principal from the lender, which you’ll need to pay back over the length of the loan.

How Is My Interest Payment Calculated?

In 15 years, you would have a remaining balance of approximately $193,000 of the principal on your loan. You may also wonder why your payment stays remarkably consistent, even though your outstanding balance keeps going down. If you understand the basic concept of how lenders calculate your payment, however, the process is simpler than you might think. Using our mortgage example from earlier, by the last month of your loan repayment, $2 will go toward interest and $841 toward the principal.

The APR and the actual interest rate that the lender is charging you are two separate things, so it’s important to understand the distinction. If you own a home, you probably know that a portion of what you pay the lender each month goes toward the original loan amount while some gets applied to the interest. But figuring out how banks actually divvy those up can seem confusing. In a loan with compound interest, the amount of interest that accrues each month is added, or compounded, to the amount of the principal. This means that the principal amount will actually go up, and the interest will be calculated based on that new, higher amount.

What is a Principal Balance?

You are making a down payment of twenty percent and using a 30-year conventional fixed-rate mortgage. You earn a low-to-moderate household income relative to your area. Principal balance usually has to do with the original loan amount or the remaining principal after re-amortization. The outstanding balance usually implies that extra interest/fees has been accrued.

She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate. Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

Where To Expect Loan Principal

When they are deciding how much money to lend you, and what interest rate to charge, lenders consider whether the payments are reasonable for you after looking at your income and other debts. If you’re wondering how much you’ll pay toward principal versus interest over time, the Investopedia Mortgage Calculator also shows the breakdown of your payments over the length of your loan. You should identify your loan principal on your initial loan disclosure documents and within all monthly statements going forward. If you can’t easily identify your loan principal, contact your lender. With a mortgage calculator you can quickly find out what your monthly payment will be. In mortgage terms, principal balance is the amount of money owed on a mortgage.

How Loan Principal Works

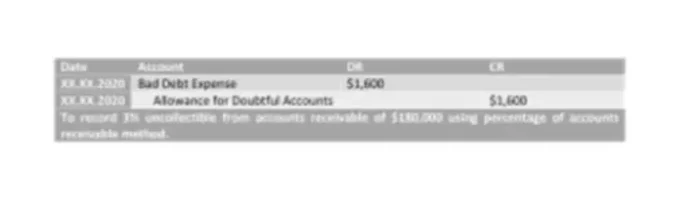

Consider an individual who saved $400,000 to pay for a $1,000,000 home. They would need to borrow $600,000 from the bank to complete the transaction. A bank may require 5% annual interest on the principal amount – the fee paid to borrow the money. In this table the outstanding balance is the principal balance, but between the payments if the bank was to show you the outstanding balance it would include the interest accrued.

The portion of your payment attributed to interest will gradually go down, as more of your payment gets allocated to the principal. When a large loan is amortized, the bulk of your monthly payments will initially go more toward reducing interest rather than reducing the principal. That’s because you’ll owe more interest when your principal is large. As your monthly payments chip away at the principal, the interest charges shrink, and more of your monthly payments go toward reducing the principal.

Your monthly statement will detail exactly how your payment is split. A higher principal payment on a loan reduces the amount of interest owed and, in turn, reduces the total amount paid over the life of the loan. Therefore, principal payments play a significant role in the amount an individual must pay over the lifetime of a loan. This is typically done by making larger or additional payments towards the principal.