Anything Paid in Advance

The following are general rules to qualify for the prepaid expense tax deduction and how they can impact yourbusiness. Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid rent typically represents multiple rent payments, while rent expense is a single rent payment. So, a prepaid account will always be represented on the balance sheet as an asset or a liability.

Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. A prepaid rent asset account is debited for the same amount. As each month passes, one rent payment is credited from the prepaid rent asset account, and a rent expense account is debited.

The prepaids concept is not used under the cash basis of accounting, which is commonly used by smaller organizations. Accelerating deductions for prepaid expenses is a good way to save on your taxes for the current year. The general rule for prepaid expenses is that any prepayment for a service or benefit must be capitalized and amortized over the useful life of such payment. However, the IRS allows the accelerated deduction of certain prepaid expenses, with some complex restrictions involved.

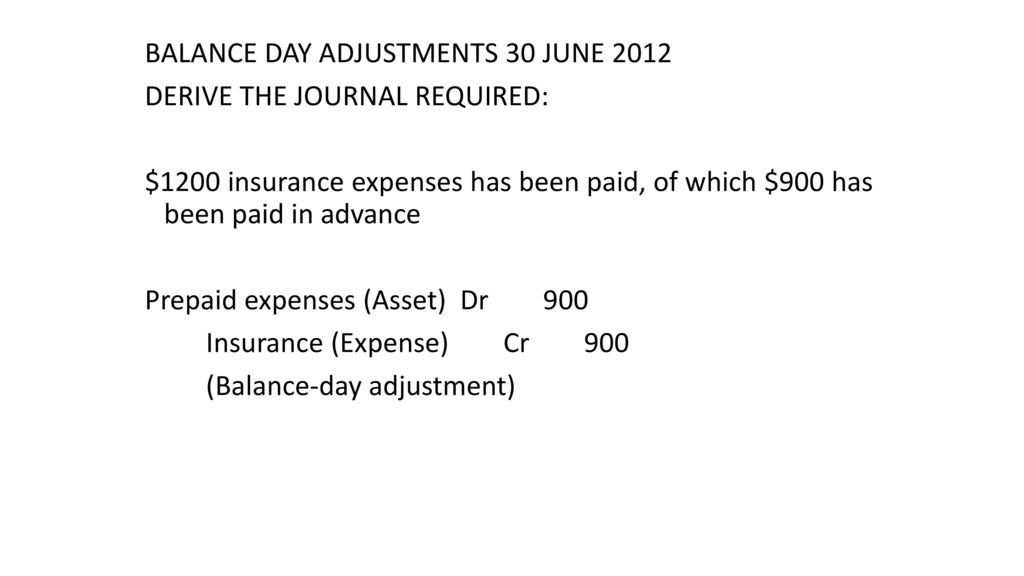

This process is repeated as many times as necessary to recognize rent expense in the proper accounting period. For example, assume ABC Company purchases insurance for the upcoming twelve month period. ABC Company will initially book the full $120,000 as a debit to prepaid insurance, an asset on the balance sheet, and a credit to cash. In the twelfth month, the final $10,000 will be fully expensed and the prepaid account will be zero. According to generally accepted accounting principles (GAAP), expenses should be recorded in the same accounting period as the benefit generated from the related asset.

Since the rent is spread equally over the full year, you use straight-line amortization to calculate the monthly adjustments. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or decrease a company’s balance sheet.

Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods. Businesses make advance payments for a variety of different expenses. Any expense that is paid in advance of actually receiving the benefit of the payment is considered a prepaid expense for accounting purposes.

Most corporate insurance policy premiums are paid in full for the year before the policy year begins. Prepaid insurance premiums are classified as a current asset, because their benefit will be realized in full within the next 12 months. When you pay the insurance premium, post the prepaid expense as a debit to a prepaid insurance account and then credit the cash account. If accelerating the deduction of prepaid expenses was not a strategy in the past, there could be opportunities to do so this year.

What qualifies as a prepaid expense?

A prepaid asset is an expense that has already been paid for, but which has not yet been consumed. Once the asset has been consumed, it is charged to expense. For example, a business pays $12,000 in advance for one year of property insurance. The payment is initially recorded as a prepaid asset.

Debit the related prepaid account for the amount of the advanced payment, and credit the cash account for an equal amount. When the services are rendered or the expense is incurred, credit the prepaid account and then debit the corresponding expense account in the ledger. Prepaid rent is recorded as an asset when an organization makes a prepayment of rent to a landlord or a third-party. A liability is recorded when a company receives a prepayment of rent from a tenant or a third-party.

Companies generally carry a prepaid expense on their balance sheets and designate them as current assets. If the product or service in question is used over a period of time, businesses may make several charges to their expense accounts. You carry prepaid assets, also called prepaid expenses, in the current assets section of the balance sheet. To create a prepaid asset, debit the prepaid account and credit cash.

However, there are various rules as to how the business owner can use prepaid expenses for tax deductions. As they are consumable supplies and services, prepaid expenses are different from a company’s inventory. Unused supplies or services are recorded as assets, while the used or consumed parts of the supplies or services are recorded as expenses. However, in government accounts, they are usually treated under the purchase method.

Prepaid asset

One of the basic rules is that the business cannot deduct the prepaid expense in the current year. Therefore, if you pay maintenance for your vehicles for five years, you can only deduct a portion of the tax-deductible this year and not the entire deduction. Prepaid expenses basically offer the same benefits for businesses in terms of savings. Aside from savings, there is also the benefit of tax deductions. Many businesses, in fact, prepay some of their future expenses if they need additional business deductions.

This means the supply or service is listed as an expenditure instead of an asset. Instead, they provide value over time—generally over multiple accounting periods. Because the expense expires as you use it, you can’t expense the entire value of the item immediately.

- A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future.

- The asset column on a balance sheet represents items the company owns.

- Prepaid expenses are also considered assets and may include prepaid insurance, rent security deposits and prepaid inventory — a deposit made on inventory not yet received.

Prepaid Asset Manipulation

Prepaid expenses are recorded on a company’s balance sheet as a current asset, and then recognized as an expense when it is incurred. There are many categories of prepaid expenses including legal fees, insurance premiums and estimated taxes. When the check for the deposit is cut and sent to the vendor, the business records the transaction on the balance sheet by debiting prepaid inventory and crediting cash. This will increase the value of assets and lower the amount of available cash.

For example, if you pay $12,000 in advance for a year’s rent, debit prepaid rent and credit cash for $12,000. This requires you to enter a month-end adjustment in which you debit prepaid rent and credit rent expense for $1,000.

When the prepaid is reduced, the expense is recorded on the income statement. While prepaids and expenses are related, they are distinctly different. Short-term assets are typically defined as assets that will be used within a 12-month period.

Retainer for Legal Expenses

This account is an asset account, and assets are increased by debits. Credit the corresponding account you used to make the payment, like a Cash or Checking account. Crediting the account decreases your Cash or Checking account. Any business contract agreements that require a deposit or payment in advance are prepaid expenses.

If the deposit will be used as a long-term security deposit, nothing else needs to be done until that money is applied against a final invoice or is returned to the business. This will create the expense for the balance of the invoice.

The asset column on a balance sheet represents items the company owns. Prepaid expenses are also considered assets and may include prepaid insurance, rent security deposits and prepaid inventory — a deposit made on inventory not yet received. A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement.

Record a prepaid expense in your business financial records and adjust entries as you use the item. A prepaid asset is an expenditure of money in advance of when the money is due. For example, you might pay up front for a year’s rent or insurance, even though the payments are due monthly. Under accrual accounting, you convert part of your prepaid assets to actual expenses monthly. The quarterly estimated taxes paid by corporations throughout the year are a prepaid tax, because they are an estimated payment made in advance of the actual tax liability.

The balance of the invoice should be paid the same way that bills are typically paid. If the money is returned to the company, credit prepaid inventory and debit the cash account, reversing the original entry. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days. Businesses may have different methods of reporting prepaid expenses on their balance sheets.

It is important for accountants, business owners and managers to understand this distinction. Failure to classify prepaids accurately on the balance sheet can lead to material misstatements of financial information and poor business decision-making. Expenditures are recorded as prepaid expenses in order to more closely match their recognition as expenses with the periods in which they are actually consumed. If a business were to not use the prepaids concept, their assets would be somewhat understated in the short term, as would their profits.

What are prepaid expenses?

For example, if a large Xerox machine is leased by a company for a period of twelve months, the company benefits from its use over the full time period. Recording an advanced payment made for the lease as an expense in the first month would not adequately match expenses with revenues generated from its use. Therefore, it should be recorded as a prepaid expense and allocated out to expense over the full twelve months. To create your first journal entry for prepaid expenses, debit your Prepaid Expense account.

If this is the initial year of a business, the business can simply take the accelerated deductions for prepaid expenses on the tax return. However, if prepaid expenses were capitalized in the past, a method of accounting has already been established.