What is owner’s equity?

Assets, liabilities, and subsequently the owner’s equity can be derived from a balance sheet, which shows these items at a specific point in time. Business owners and other entities, such as banks, can look at a balance sheet and owner’s equity to analyze a company’s change between different points in time. Companies typically prepare a number of financial documents for federal regulators, lenders, shareholders or potential investors. Included in the balance sheet is the owner’s capital, commonly referred to as the owner’s equity.

Owner’s equity can be calculated by taking the total assets and subtracting the liabilities. Owner’s equity can be reported as a negative on a balance sheet; however, if the owner’s equity is negative, the company owes more than it is worth at that point in time. represents the owners’ or shareholder’s investment in the business as a capital contribution. This account represents the shares that entitle the shareowners to vote and their residual claim on the company’s assets. The value of common stock is equal to the par value of the shares times the number of shares outstanding.

A company can report a negative amount for the owner’s equity; however, that generally indicates that the company is in financial trouble. It’s important to understand that owner’s equity changes with the assets and liabilities of the company.

Using depreciation, a business expenses a portion of the asset’s value over each year of its useful life, instead of allocating the entire expense to the year in which the asset is purchased. This means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded. The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current market value of the assets.

To illustrate why revenues are credited, let’s assume that a company receives $900 at the time that it provides a service and therefore is earning the $900. The increase in the company’s assets will be recorded with a debit of $900 to Cash. Since every entry must have debits equal to credits, a credit of $900 will be recorded in the account Service Revenues. The credit entry in Service Revenues also means that owner’s equity will be increasing.

They represent returns on total stockholders’ equity reinvested back into the company. At some point, accumulated retained earnings may exceed the amount of contributed equity capital and can eventually grow to be the main source of stockholders’ equity. Companies fund their capital purchases with equity and borrowed capital.

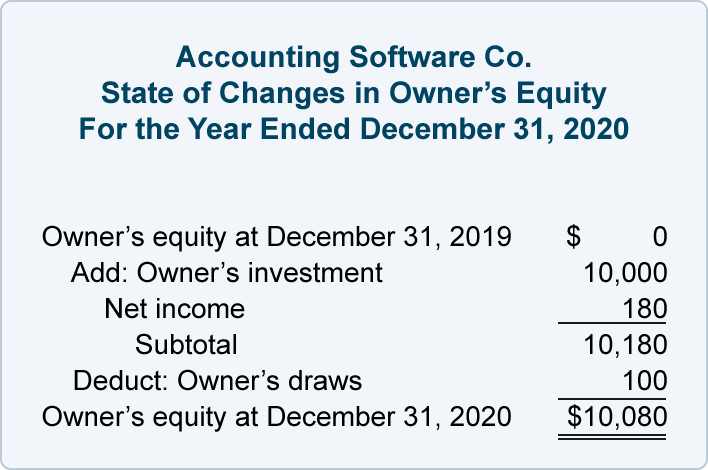

Owner’s Equity: A Real-Life Scenario

The equity capital/stockholders’ equity can also be viewed as a company’s net assets (total assets minus total liabilities). Investors contribute their share of (paid-in) capital as stockholders, which is the basic source of total stockholders’ equity. The amount of paid-in capital from an investor is a factor in determining his/her ownership percentage.

For example, if Sue sells $25,000 of seashells to one customer, her assets increase by the $25,000. The balance sheet, which shows the owner’s equity, is prepared for a specific point in time. For instance, a balance sheet may be prepared every December 31. As a result, it would show the assets, liabilities, and owner’s equity as of December 31.

It is a figure arrived when the liabilities are deducted from the value of total assets. For a sole proprietorship or partnership, the value of equity is indicated as the owner’s or the partners’ capital account on the balance sheet. The balance sheet also indicates the amount of money taken out as withdrawals by the owner or partners during that accounting period. Apart from the balance sheet, businesses also maintain a capital account that shows the net amount of equity from the owner/partner’s investments. In this lesson, you’ll learn how to calculate owner’s equity.

- The assets are shown on the left side, while the liabilities and owner’s equity are shown on the right side of the balance sheet.

- It is obtained by deducting the total liabilities from the total assets.

- The owner’s equity is recorded on the balance sheet at the end of the accounting period of the business.

For example, 1 million shares with $1 of par value would result in $1 million of common share capital on the balance sheet. A balance sheet consists of three components — assets, liabilities and owner’s or stockholders’ equity. The total assets must be equal to the total of the liabilities plus the owner’s equity. Retained earnings are a company’s net income from operations and other business activities retained by the company as additional equity capital.

Free Financial Statements Cheat Sheet

What are examples of owner’s equity?

Owner’s equity represents the owner’s investment in the business minus the owner’s draws or withdrawals from the business plus the net income (or minus the net loss) since the business began. Owner’s equity is viewed as a residual claim on the business assets because liabilities have a higher claim.

Stockholders’ equity, also referred to as shareholders’ equity, is the remaining amount of assets available to shareholders after all liabilities have been paid. It is calculated either as a firm’s total assets less its total liabilities or alternatively as the sum of share capital and retained earnings less treasury shares. Stockholders’ equity might include common stock, paid-in capital, retained earnings and treasury stock. Since the asset amounts report the cost of the assets at the time of the transaction—or less—they do not reflect current fair market values. The amount of money transferred to the balance sheet as retained earnings rather than paying it out as dividends is included in the value of the shareholder’s equity.

The assets are shown on the left side, while the liabilities and owner’s equity are shown on the right side of the balance sheet. The owner’s equity is always indicated as a net amount because the owner(s) has contributed capital to the business, but at the same time, has made some withdrawals. “Owner’s equity” is the term typically used when the company is a sole proprietorship. “Stockholders’ equity” is the term used when the company is a corporation. In both cases, the term refers to the value of the company after assets and liabilities have been reported.

The second source consists of the retained earnings the company accumulates over time through its operations. In most cases, especially when dealing with companies that have been in business for many years, retained earnings is the largest component. Let’s look at the stockholders’ equity section of a balance sheet. There are 10,000 authorized shares, and of those, 2,000 shares have been issued for $50,000. At the balance sheet date, the corporation had cumulative net income after income taxes of $40,000 and had paid cumulative dividends of $12,000, resulting in retained earnings of $28,000.

It can increase or decrease when the company has a profit or a loss, and it decreases when an owner takes money out of the business, such as if he takes an “owner’s draw”. Owner’s equity can also decrease if liabilities increase and assets don’t increase by the same amount. Revenues, gains, expenses, and losses are income statement accounts.

The owner’s equity is recorded on the balance sheet at the end of the accounting period of the business. It is obtained by deducting the total liabilities from the total assets.

If a company performs a service and increases its assets, owner’s equity will increase when the Service Revenues account is closed to owner’s equity at the end of the accounting year. In other words, the owner’s equity is the amount which is invested by the owner in the business less the money which is taken out by the owner of a business.

Stockholders’ equity is often referred to as the book value of the company and it comes from two main sources. The first source is the money originally and subsequently invested in the company through share offerings.