What is net income?

Types of business expenses you might have include operating expenses, payroll costs, rent, utilities, taxes, interest, certain dividends, etc. Net income can be distributed among holders of common stock as a dividend or held by the firm as an addition to retained earnings. As profit and earnings are used synonymously for income (also depending on UK and US usage), net earnings and net profit are commonly found as synonyms for net income.

Net income is the portion of a company’s revenues that remains after it pays all expenses. Owner’s equity is the difference between the company’s assets and liabilities. It is the owner’s share of the proceeds if you were to liquidate the company today.

In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is a measure of the profitability of a venture. It is different from the gross income, which only deducts the cost of goods sold. If a company’s annual revenues are $5 million and its cost of goods sold is $1 million, the gross profit is $4 million.

Net income is usually calculated per annum, for each fiscal year. The items deducted will typically include tax expense, financing expense (interest expense), and minority interest. Likewise,preferred stock dividends will be subtracted too, though they are not an expense.

Then, subtract any deductions from your pay, including eligible contributions to savings plans and insurance costs. Subtract the amount that you pay in taxes to find your final net income. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

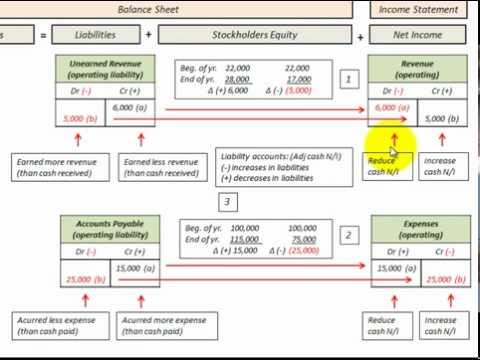

Ties to other financial statements

You can calculate net income by subtracting the cost of goods sold and expenses from your business’s total revenue. For a business, net income equals is the amount remaining after subtracting all costs and expenses from revenue. Publicly traded companies use net income to help calculate their earnings per share (EPS).

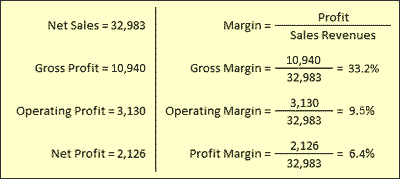

The higher the net margin is, the more effective the company is at converting revenue into actual profit. The net margin is a good way of comparing companies in the same industry, since such companies are generally subject to similar business conditions. However, the net margins are also a good way to compare companies in different industries in order to gauge which industries are relatively more profitable. To calculate your net income, start by finding your gross income by multiplying your pay in one check before taxes by the number of times you get paid per year.

Net income can also be calculated by adding a company’s operating income to non-operating income and then subtracting off taxes. It is a useful number for investors to assess how much revenue exceeds the expenses of an organization. This number appears on a company’s income statement and is also an indicator of a company’s profitability. Net income — also referred to as net profit, net earnings or the bottom line — is the amount an individual earns after subtracting taxes and other deductions from gross income. For a business, net income is the amount of revenue left after subtracting all expenses, taxes and costs.

The difference between taxable income and income tax is an individual’s NI. Net income is what remains after subtracting cost of goods sold, operating expenses and nonoperating expenses from revenues. Successful companies drive revenue growth, manage costs and grow net income. Execution problems and competitive pressures usually lead to declining revenues and profits. GrossNetMeaningGross refers to the total amount before anything is deducted.

Other names for Net Income

The accounting process involves transferring or closing the revenue and expense accounts at period end to a temporary income summary account. After subtracting dividends, the balance in this account is added to the starting retained earnings for the period. The ending retained earnings balance is higher if the net income is positive and lower if the net income is negative or a loss.

In business, net income is also referred to as the bottom line, as it appears as the final item in the income statement. Net income is the total amount a person earns in a given period from all taxable wages, tips, and investment income like dividends and interest.

If operating and nonoperating expenses are $2 million, then the net income is $4 million minus $2 million, or $2 million. If the company pays dividends of $1 million to shareholders, the retained earnings are $2 million minus $1 million, or $1 million. Therefore, the owner’s equity or stockholders’ equity would increase by $1 million.

- If a company’s annual revenues are $5 million and its cost of goods sold is $1 million, the gross profit is $4 million.

- In business and accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is a measure of the profitability of a venture.

Method 2 of 2: Calculating Business Net Income

For a merchandising company, subtracted costs may be the cost of goods sold, sales discounts, and sales returns and allowances. For a product company, advertising,manufacturing, & design and development costs are included.

Many different textbooks break the expenses down into subcategories like cost of goods sold, operating expenses, interest, and taxes, but it doesn’t matter. Next, tally up your total expenses for the month (not including the cost of goods sold).

How do we calculate net income?

What is Net Income? Net income is the amount of accounting profit a company has left over after paying off all its expenses. Net income is found by taking sales revenue. On occasion, it may also include depreciation expense, depreciation, and amortization, interest expense.

To calculate net income for a business, start with a company’s total revenue. From this figure, subtract the business’s expenses and operating costs to calculate the business’s earnings before tax. The concepts of gross and net income have different meanings, depending on whether a business or a wage earner is being discussed. For a company, gross income equates to gross margin, which is sales minus the cost of goods sold.

The net income of a company is the result of a number of calculations, beginning with revenue and encompassing all expenses and income streams for a given period. All the money that flows in and out of a company is accounted for via this sum.

As a result of higher net income, more money is allocated to retained earnings after any money spent on debt reduction, business investment, or dividends. Earnings before interest and taxes is an indicator of a company’s profitability and is calculated as revenue minus expenses, excluding taxes and interest. Net income, also called net earnings, is sales minus cost of goods sold, general expenses, taxes, and interest.

After adding rent, utility, purchase, payroll, and tax expenses, your expenses total $7,200. Now, subtract your total expenses from your gross income to find your net income. To find gross income, you need to know your business’s total revenue and cost of goods sold. Your business’s gross income is the revenue you have after subtracting your cost of goods sold (COGS).

Total revenues, cost of goods sold, gross income, expenses, taxes, and net income are all line items on the income statement. Net income is the final line of the statement, which is why it is also called the bottom line. Net income is what remains of a company’s revenue after subtracting all costs. It is also referred to as net profit, earnings, or the bottom line.

The relationship between net income and owner’s equity is through retained earnings, which is a balance sheet account that accumulates net income. Also called Gross Profit.Net income is what remains after subtracting all the costs (namely, business, depreciation, interest, and taxes) from a company’s revenues. Any aspect of business that increases or decreases net income will impact retained earnings, including revenue, sales, cost of goods sold, operating expenses, depreciation, and additional paid-in capital. The net income formula is calculated by subtracting total expenses from total revenues.

COGS is how much it costs you to make a product or perform a service. Also called earnings or net profit.Gross vs Net MarginGross margin is gross income divided by net sales, expressed as a percentage. It reveals how much a company earns taking into consideration the costs that it incurs for producing its products and/or services. It is a good indication of how profitable a company is at the most fundamental level. This number is an indication of how effective a company is at cost control.

Often, the term income is substituted for net income, yet this is not preferred due to the possible ambiguity. Revenue, or sometimes referred to as gross sales, affects retained earnings since any increases in revenue through sales and investments boosts profits or net income.

Thus, gross income is the amount that a business earns from the sale of goods or services, before selling, administrative, tax, and other expenses have been deducted. For a company, net income is the residual amount of earnings after all expenses have been deducted from sales. In short, gross income is an intermediate earnings figure before all expenses are included, and net income is the final amount of profit or loss after all expenses are included. Gross income refers to an individual’s total earnings or pre-tax earnings, and NI refers to the difference after factoring deductions and taxes into gross income. To calculate taxable income, which is the figure used by the Internal Revenue Serviceto determine income tax, taxpayers subtract deductions from gross income.

Difference between net income and cash flow

Net Income that is not paid out in dividends is added to retained earnings. The retained earnings account accumulates the portion of the company’s net income that it does not distribute to shareholders as cash dividends.

For example, a business has sales of $1,000,000, cost of goods sold of $600,000, and selling expenses of $250,000. Add up your cost of goods, administrative expenses, and other deductions. Your first step to calculating your net income is finding out your gross income. Gross income is the total amount of money you make in a year before taking taxes or deductions into account. Gross income is how much money your business has after deducting the cost of goods sold from total revenue.

What is the net income mean?

To calculate your net income, start by finding your gross income by multiplying your pay in one check before taxes by the number of times you get paid per year. Then, subtract any deductions from your pay, including eligible contributions to savings plans and insurance costs.