Usually, blank forms are readily available in the printed form in the market. The documents prepared for the purpose of recording business transactions in the books of accounts are known as vouchers. For recording business transactions in the books of accounts, source documents are further analyzed and conclusion is drawn as to which account is to be debited and which account is to be credited.

As explained in the last paragraph, the purchases invoice is the original of the sales invoice sent by the supplier to the customer. Therefore, the sales invoice and the purchases invoice contains the same details. The only difference is that purchases invoices are in the books of buyer and are received from various customers and therefore will not be re-numbered because goods are purchased from different sources. Cheques and cheque counterfoils are used to record all bank transactions in the Sales Journal,Purchases Journal,General Journal and the Cash Book.

Source documents are used to record transactions because they are original and show an objective report of the economic activities of each transaction. This document gives the buyer’s accounting department an objective and reliable record of the purchase transaction. It also gives the vendor a document that can used to record the sale of goods.

For example when the business returns damaged goods to the supplier (Purchases Returns/Returns Outwards) the supplier issues a credit note to the business and the transaction is recorded in the Purchases Journal. Are used in credit transactions e.g. credit sales (when they are issued to customers and the business retains its own copy) and credit purchases.

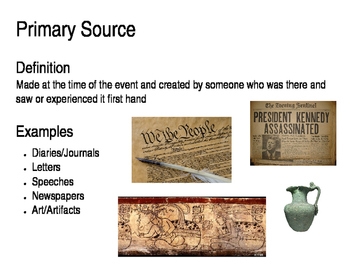

Examples of Source Documents

This is prepared when a firm purchases or sells the goods on credit. At the time, when the goods are sold by the business enterprise on credit, sales invoice is prepared in which all details of the credit sales viz. In this chapter we have discussed source documents, their uses and their relationship to the books of original entry. We also examined the importance of the books of original entry and illustrated how they are to be transferred to the ledger accounts.

These books are also referred to as books of prime entry or subsidiary books or day books or journals. Transactions can be recorded directly to the ledger but the books of original entry are in use because they have the following advantages which the ledger does not have. In most organizations all cash received must be paid to the bank and all cash payments must be made through the bank, (except petty cash that is operated through the imprest system).

The most obvious time to use an in-text citation is when you quote from a source directly or refer to it by title or author. However, you also need to use an in-text citation any time you use information that you got from a source, but which isn’t “common knowledge.”This can be a tricky concept to master. If you can’t determine if information is common knowledge or proprietary (work that belongs to the original author), cite it anyways to be safe. If a consumer is for some reason dissatisfied with the goods sold to him by the business and returns them. The business will issue him/her with a credit note and the transaction will be recorded in the Sales Returns Journal.

The document on which this conclusion is written is known as voucher or accounting voucher. Sales and purchases are the main features of any business enterprise. For recording cash sales and cash purchases, cash memos serve as source documents.

The bank clerk signs, stamps the counterfoil of the pay in slip and returns it to the depositor. Usually, the large business enterprises obtain the complete bunch of pay-in-slips and get them all bound in a book.

Typically if a transaction involves outside parties i.e. people who are not part of the entity, both the entity and the outside party obtain copies of the transaction. A credit note is a document which shows that the business enterprise has given the credit to the party to whom this document is sent in respect of any business transaction other than credit purchase. When a business enterprise receives back the goods sold earlier then it makes a credit note in favour of the purchaser showing that his account has been credited in the books of business enterprise. Invoice or bill records the credit transactions related to sale or purchase.

What does source document mean?

A source document is an original record which contains the detail that supports or substantiates a transaction that will be (or has been) entered in an accounting system. In the past, source documents were printed on paper. Today, the source documents may be an electronic record.

- After deciding the head of accounts to be debited and credited, vouchers are prepared.

- These documents are further analysed and conclusion is to be drawn about which account is to be debited and which account is to be credited.

- Business transactions in the books of accounts are available in the source documents.

Business transactions in the books of accounts are available in the source documents. These documents are further analysed and conclusion is to be drawn about which account is to be debited and which account is to be credited. After deciding the head of accounts to be debited and credited, vouchers are prepared.

date, amount, name of the party and the nature of payment etc. are given in this source document. number or quantity purchased/sold, price, discount received or allowed and sales tax collected or deposited are provided. On the basis of cash memos, these transactions are then recorded in the book of accounts.

The purchases day book is the book of original entry used to record all credit purchases. The total therein is transferred to the debit of the purchases ledger at regular intervals. The period may be daily, weekly or monthly depending on the volume of purchases transactions.

Therefore for many businesses, cheque counterfoils have become major source documents for recording in the bank column of the cash book (Credit side). Source documents constitute the source of all original information on the financial transactions of a business.

Sales day book is the book of original entry that records credit sales. The source document is the duplicate of the invoice issued to the customer. The volume of daily sales normally demands that it is issued first to collate a period’s sale before being transferred to sales ledger accounts. A purchase invoice serves as the source document to record in the purchases day book.

If you have two sources from “James Smith,” an in-text citation of (Smith 235) may confuse the reader. When they look up the source on your Works Cited sheet, they will find two different articles by James Smith. Every single source that contains information you used must be included in your Works Cited and cited in-text.

The book of original entry is the accounting record in which transactions are first recorded from source documents. Source documents detail the particulars of transactions that include the date, name, address, terms, and product description among other relevant pieces of information. Types of source documents include cash receipts, canceled checks, invoices and timesheets. Source documents may be paper-based business forms or electronic documents and are used for initial input to the accounting system.

Cash memo is a source document in which all transactions pertaining to cash sales or purchases are to be recorded. In the last chapter we said that the historical cost concept makes financial transactions to be objective because they can be traced to source documents. In this chapter, we shall explain those source documents, their importance and the books of original entry to which they relate.

What Are the Different Types of Source Documents Used in Accounting?

The counterfoil of the pay in slip becomes a source document, which acts as an evidence for the customer to record this transaction in the books of accounts. The original copy is prepared for giving it to the party who makes the payment and another copy is kept for record. The details about the business transaction on account of which the cash is received viz.

Some common examples of source documents include sales receipts,checks, purchase orders,invoices,bank statements, and payroll reports. These are all original documents that were created from a transaction and the first component in anaccounting system.

Source document definition

To cite an essay using MLA format, include the name of the author and the page number of the source you’re citing in the in-text citation. For example, if you’re referencing page 123 from a book by John Smith, you would include “(Smith 123)” at the end of the sentence.

What does citing a source mean?

You would keep source documents for your business just like you keep receipts for tax-deductible items for your taxes. If your taxes are audited, the source documents provide the proof that you’ve made those purchases. The same holds for your business, but in business, you keep original documents for every financial transaction, not just charitable donations.