Cash Flow Forecast

If you want to better manage your company’s finances, then one of the best ways is to create a budget. A reliable budget will allow you to understand how to control your expenses, so you will spend only when you are clearly aware that you can afford these expenses. The budget will also allow you to see information about your funds in order to create cash reserves for the company.

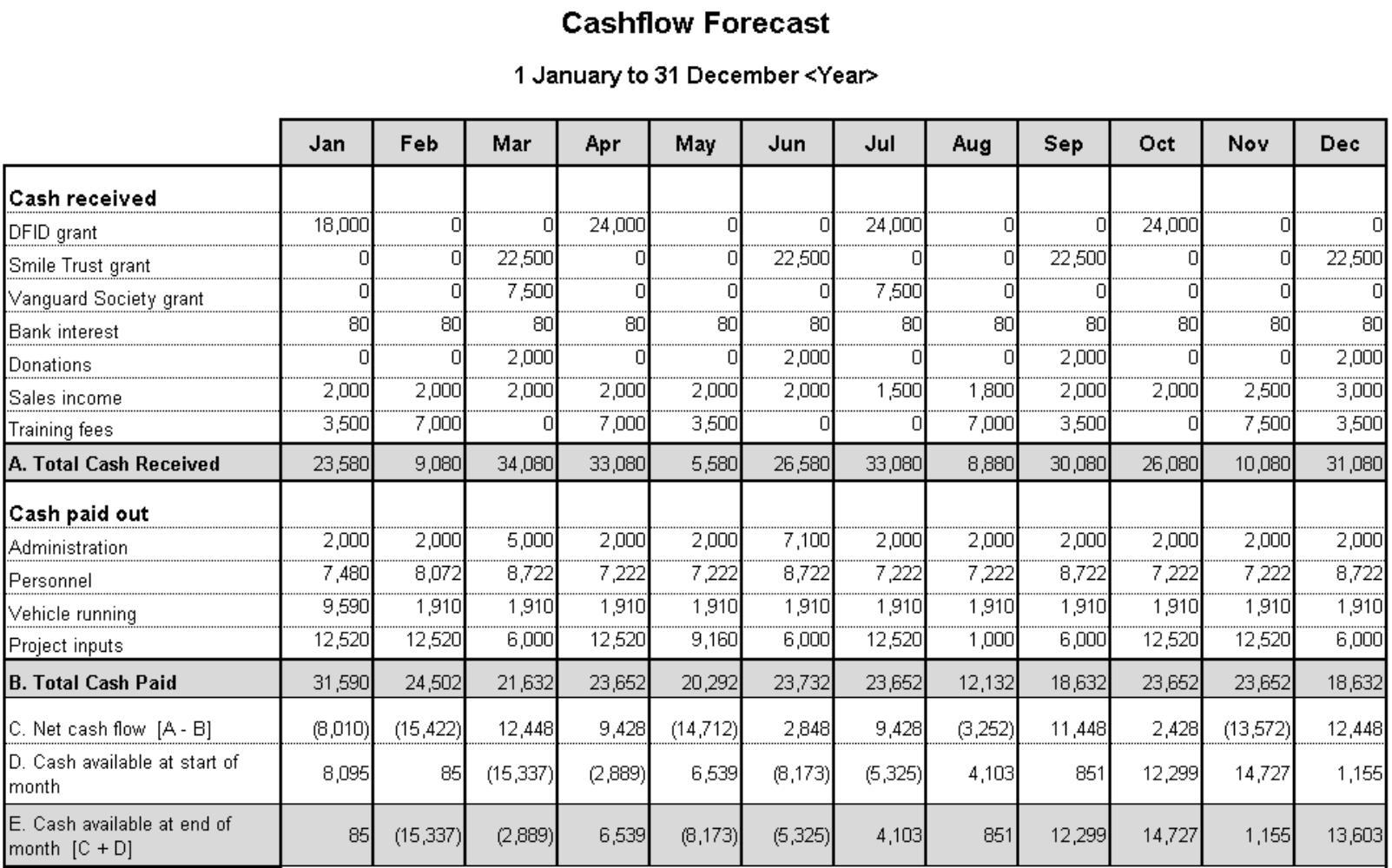

One of the best ways to manage a firm’s budget is to create a cash flow forecast. It is a document that a manager uses to plan how much cash a business will receive and payout over a given period. It assists the finance manager in assessing an entity’s use of cash and identifying its sources.

Such forecasts will be needed to plan finances and allocate resources between different business needs. In addition, forecast data allows you to assess future flows, and therefore, the growth prospects of the company and its future financial needs. With the help of the cash flow forecast, you can determine the future liquidity of the enterprise. In other words, a business can see whether they are going to have enough cash to continue to operate.

Preparation

Let’s take a look at the basic steps you need to take to get the most out of your forecast. When preparing this document, keep in mind that it is unlikely that the forecast will align with a profit and loss statement. The reason for this is that the period when an expense is incurred may not be the same period when the cash is paid out. Similarly, when revenue is earned may not be the same period when cash is received.

The preparation of the cash flow forecast is carried out in three stages.

- Cash inflowsEstimate the volume of sales and all possible cash receipts. Sales statistics of similar companies for the previous year can be used as a benchmark. Be sure to factor in seasonal changes in demand that affect sales by month. Make sure that the calculated revenues fall within the industry average and that your business profitability is comparable to that of other businesses in your industry. That is, it is necessary to analyze the market.At this stage, you should try to determine if there is a positive outlook for your industry. If there is a positive outlook, you will need to make a forecast of how many customers will buy your product and what exactly each group of customers will buy from you. Next, you will need to provide a sales forecast for each product or service. Always estimate your cash inflows lower than you expect. This is the best way to avoid making predictions that are unreasonable or too high.

- Cash outflowsAfter evaluating cash inflows from various sources, determine the costs that are required to achieve the planned sales level. Operating expenses can be expressed in dollars or as a percentage of sales (as an operating ratio). This step is needed to determine where and on what you can save, that is, reduce costs. Pay special attention to the analysis of loan payments, obligations to suppliers of goods and utilities, as well as their timeliness of payment. When planning your spendings for future periods, keep in mind taxes because you will need to pay them with cash when the time comes around.

- Evaluate resultsSubtract the projected cash expenditures from income. The remaining amount will indicate positive or negative cash flow. A positive cash flow at the end of the year is a good indicator, especially if it was observed throughout the entire 12 months and generated high profits. However, this is unlikely. Most start-up companies have negative cash flow in the early stages and only after some time (at best, after a few months) reach the break-even point of operations. A negative cash balance is a poor indicator if you do not have significant financial reserves, investors, and/or evidence that cash flow will become positive over time.