This may seem simple enough, but there could be optimal unit values that aren’t necessarily equal to a single product. For example, a roofing supplier may count a unit as 1,000 shingles. In the service industry, it may be more difficult to define what constitutes a unit. In these instances, metrics such as labor-hours-per-client may replace unit costs. It turns out that halving the production for Company A did not double the unit cost.

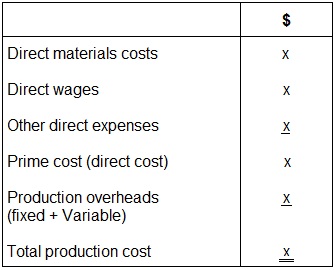

To calculate the cost per unit, add all of your fixed costs and all of your variable costs together and then divide this by the total amount of units you produced during that time period. You may also want to assess fixed costs and the total variable manufacturing cost to make informed decisions regarding your product lines when production expenses climb. For example, further examination of higher direct material costs at your jewelry company may attribute increased expenses to higher gold prices – a variable cost. Both internal management and external investors analyze unit costs.

Typically, it is generated for internal use within a business. The fundamental financial concept behind unit cost is simple. A business takes all costs and expenditures that it needs to produce a quantity of goods or services, and then divides these amounts by that quantity. For example, if 5,000 units will cost a company $10,000 to manufacture, then the unit product cost or price per unit, is $2.00 each. For example, some business costs are constant whether a company sells 1,000 or 10,000 units, so there are standard production cost formulas that are commonly used.

Direct labor and materials are also referred to as variable costs, because they change with the number of units produced. Average price per unit and prices per statistical unit are needed by marketers who sell the same product in different packages, sizes, forms, or configurations at a variety of different prices. As in analyses of different channels, these product and price variations must be reflected accurately in overall average prices. If they are not, marketers may lose sight of what is happening to prices and why. Both of these metrics have value in identifying market movements.

What is an example of cost unit?

Unit cost is a very important pricing and selling tool for any company, because it’s hard to set a profitable price when you don’t know what it costs you to produce a product. Unit cost is determined by adding fixed costs and variable costs (which are direct labor costs and direct material costs lumped together), and then dividing the total by the number of units produced.

What is cost unit with example?

Per unit is a way of expressing the value of a quantity in terms of a reference or base quantity. In a per unit system each system variable or quantity is normalized with respect to its own base value. Calculations are simplified because quantities expressed as per unit are the same regardless of the voltage level.

Average cost per unit of production is equal to total cost of production divided by the number of units produced. Especially over the long-term, average cost normalizes the cost per unit of production. It also smooths out fluctuations caused by seasonal demand changes or differing levels of production efficiency. Once variable and fixed costs are identified, units must be identified.

How Does Cost Per Unit Work?

Successful companies seek ways to improve the overall unit cost of their products by managing the fixed and variable costs. Fixed costs are production expenses that are not dependent on the volume of units produced. Fixed costs, such as warehousing and the use of production equipment, may be managed through long-term rental agreements. From the company’s overall financial perspective, this may be accurate, but it doesn’t reflect the efficiency of production during the period in which the capital purchase is made. This variation of unit cost is often called the cost of goods sold, or COGS.

However, another portion of the bill may be directly related to how long your production equipment is running. To ensure you get a clear picture of your cost per unit, break down your mixed costs into their fixed and variable components. Fixed costs represent expenses that stay constant no matter how many units you produce. Rent on a building, for example, needs to be paid whether you are producing anything or not and is therefore a fixed cost. Property tax, insurance, computer systems and other administrative expenses can also be considered fixed costs, as are the salaries of office staff who aren’t involved in production.

To calculate the monthly cost of equipment purchases, divide the cost of the equipment by its estimated life cycle. The calculation of the unit cost of production is a breakeven point. This cost forms the base level price that a company uses when determining its market price value. Overall a unit must be sold for more than its unit cost to generate a profit. For example, a company produces 1,000 units that cost $4 per unit and sells the product for $5 per unit.

- Unit cost is determined by adding fixed costs and variable costs (which are direct labor costs and direct material costs lumped together), and then dividing the total by the number of units produced.

- Unit cost is a very important pricing and selling tool for any company, because it’s hard to set a profitable price when you don’t know what it costs you to produce a product.

- Fixed costs do not change with production levels, while variable costs do fluctuate.

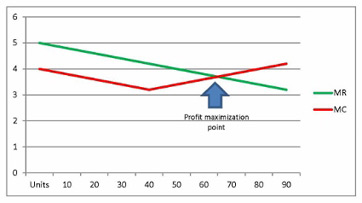

Up to a certain point, more production volume reduces the cost per unit of production. The more output that is produced, the more thinly spread the fixed costs of production across the units of output are. Furthermore, production economies of scale can lower the threat of new entrants (competitors) into the industry.

Fixed costs do not change with production levels, while variable costs do fluctuate. Understanding the cost of each unit you produce is essential to ensure your business remains profitable.

Businesses with high fixed costs generally operate differently than those with high variable costs. When fixed costs are high, you need more volume to break even, but your profits will be higher when you continue to increase that volume. If your business relies completely on variable costs, aside from discounts you may get from suppliers, your cost per unit will be the same whether you produce one unit each month or 10,000. A portion of an electric bill is usually a service fee with the cost of lighting and powering office equipment.

If a unit were priced at $3 per unit, there would be a loss because $3 minus $4 (cost) is a loss of $1 per unit. Unit costs will vary over time and as the scale of a business’ operation changes.

Identifying and analyzing a company’s unit costs is a quick way to check if a company is producing a product efficiently. Total cost (TC) in the simplest terms is all the costs incurred in producing something or engaging in an activity. In economics, total cost is made up of variable costs + fixed costs.

In accounting, to find the average cost, divide the sum of variable costs and fixed costsby the quantity of units produced. In this sense, compute it as cost of goods available for sale divided by the number of units available for sale. This will give you the average per-unit value of the inventory of goods available for sale. The minimum efficient scale is scale of production at which average cost of production reaches its minimum point.

This is because a significant percentage of the unit cost is fixed costs. Fixed costs are all costs that go into the making of a product that do not vary with the number of units produced. No, he’s going to expect a rent check regardless of what is happening in your factory.

Definition of ’per unit’

Unit costs are particularly sensitive to the effect of significant operational scale and to the relationship between fixed and variable costs for a business. There are some fixed costs that change month-to-month, such as a phone bill or utilities. The phrase “variable costs” refers to variances in production, not any changes in the expenses’ dollar amounts. Direct material costs are also limited to materials purchased and used in making the product.

These allow an “apples to apples” type of comparison that’s easier to see. This accounting measure includes all of the fixed and variable costs associated with the production of a good or service. Unit cost is a crucial cost measure in the operational analysis of a company.

Managers closely monitor these costs to mitigate rising expenses and seek out improvements to reduce the unit cost. Typically, the larger a company grows, the lower the unit cost of production becomes. Production at the lowest possible cost will maximize profits.

What does per unit mean?

Cost per unit is a measure of a company’s cost to build or create one unit of product.