Overview

There are several key financial reports that one should be familiar with. What is a Trial Balance? It is a record of the account balances received from the ledger at one point time. It has a very immense importance in accounting. What is a Trial Balance used for?

The Trial Balance is a report that bookkeepers and business owners use to check the mathematical accuracy of the ledger accounts. Moreover, it helps the accounting specialists to prepare the other accounting reports in less time and more accurately. After all, they have totals of each account already checked and ready to be used for inputting into other reports and calculating important financial metrics.

It is prepared periodically, usually at the end of each month and/or year. The Trial Balance is compiled only after the ledger accounts are closed. It verifies that all assets, expenses, losses, and drawings are equal to all revenues, gains liabilities, capital and reserves because the books are prepared according to the double-entry system.

Example

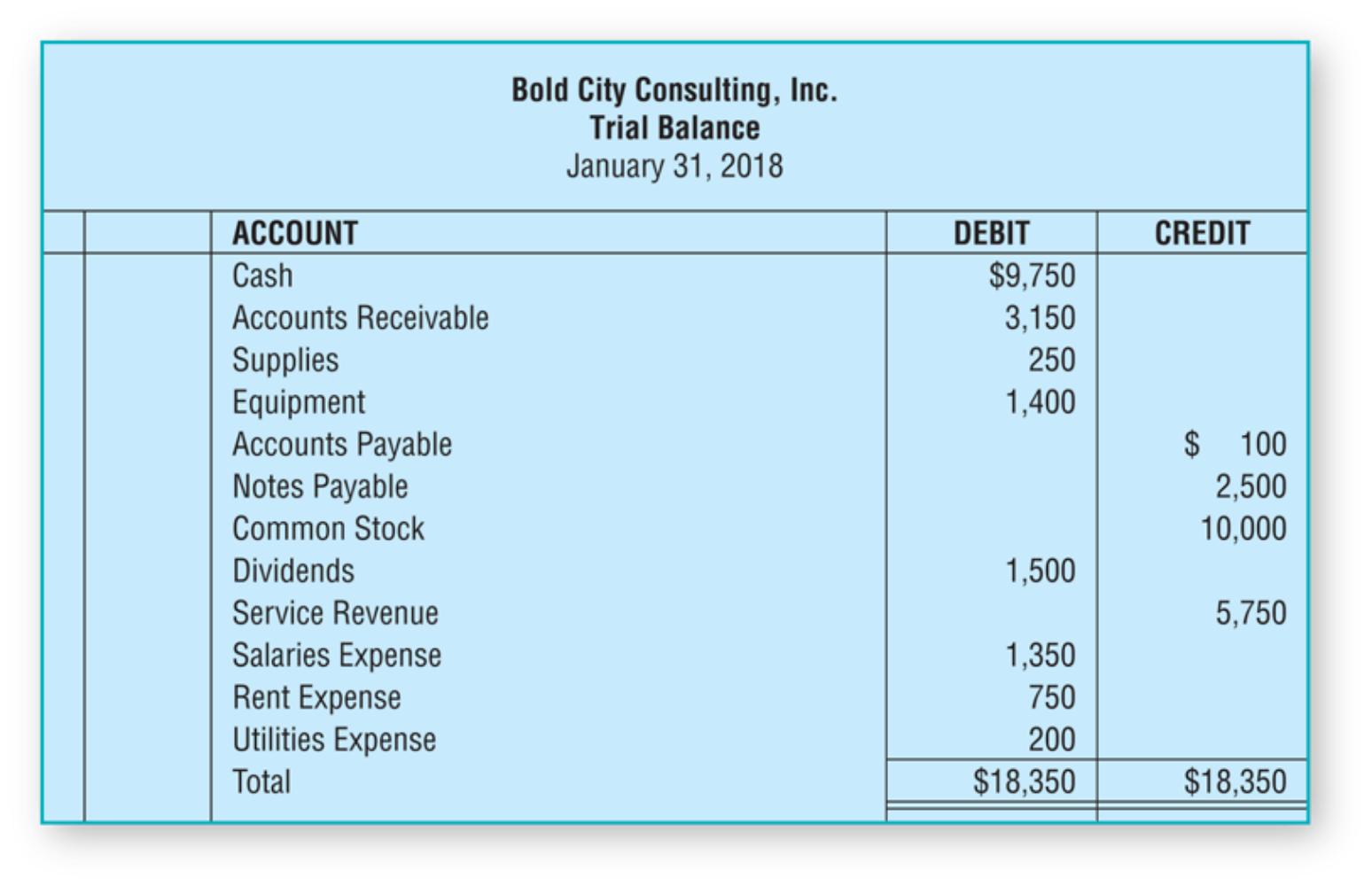

Above, you can see a Trial Balance of Bold City Consulting, Inc. This report shows that the balances of the ledger are arranged in separate columns and then totaled. The Trial Balance of this particular company balances. If you have a business and want to prepare such a statement, follow these steps:

- Take a general ledger and make sure all accounts are balanced.

- Transfer the final amounts of every single account to the respective column.

- Summarize the amounts of each column.

- If it matches, then you are good to go and close this statement.

- If it is not equal, you would need to search for and correct the mistake.

Shortcomings

Even if both columns of the statement have the same numbers, it does not mean that it reflects a completely correct position of your company. Recording both aspects of a transaction twice in the books of accounts, and posting the correct amount on the correct side but in the wrong account is not reflected by this report.

Errors that are not accounted for in the Trial Balance include errors that arise due to incorrect application of the accounting principles or several mistakes that were made in such a way that one mistake is compensated by the other so the final totals do not differ.

It also does not prove that did not forget to add a transaction or two to the book of first entry in the first place. Even if everything was recorded there, something might have been purposefully or unintentionally omitted when creating the general ledger or the Trial Balance itself.