When you figure the residual value of an object, the answer relates to the depreciation of the initial value. After calculating the depreciation of an item, the residual value is then figured from a base price. Additionally, consider the example of a business owner whose desk has a useful life of seven years.

You need to determine a suitable way to allocate cost of the asset over the periods during which the asset is used. Generally, the method of depreciation to be used depends upon the patterns of expected benefits obtainable from a given asset.

This graph is deduced after plotting an equal amount of depreciation for each accounting period over the useful life of the asset. Under this method, an equal amount is charged for depreciation of every fixed asset in each of the accounting periods.

How much the desk is worth at the end of seven years (its fair market value as determined by agreement or appraisal) is its residual value, also known as salvage value. The residual value, also known as salvage value, is the estimated value of a fixed asset at the end of its lease term or useful life.

In depreciation the residual value is the estimated scrap or salvage value at the end of the asset’s useful life. In the accounting equation, owner’s equity is considered to be the residual of assets minus liabilities. In investment evaluations, the residual value is the profit minus the cost of capital. Depreciation expense is estimated based on actual cost and the estimated useful life of an asset. The original cost of the asset does not change over the life of its use in the business.

This uniform amount is charged until the asset gets reduced to nil or its salvage value at the end of its estimated useful life. In using the declining balance method, a company reports larger depreciation expenses during the earlier years of an asset’s useful life. Assume this value is zero and the company uses the straight-line method to amortize the software. If the residual value were $2,000, the yearly amortization would be $1,600 ($10,000 – $2,000 / 5 years).

Calculating Depreciation/Amortization Using Residual Value

As an example of a residual value calculation, a company purchases a truck for $100,000, which it assumes will be used for 80,000 miles over the next five years. Based on that usage level, the market prices of similar vehicles indicate that a reasonable residual value would be $25,000. In accounting, the residual value could be defined as an estimated amount that an entity can obtain when disposing of an asset after its useful life has ended. When doing this the estimated costs of disposing of the asset should be deducted. Salvage value is the estimated resale value of an asset at the end of its useful life.

It’s the anticipated value of the car at the end of the lease and is used to determine your monthly lease payments. If you decide to buy your leased car, the price is the residual value plus any fees.

The residual value of an asset is based on what a company expects to receive in exchange for selling or parting out the asset at the end of its lease term or useful life. For example, let’s say the car you’re leasing has a sticker price (MSRP) of $25,000 and its residual value is 50% after a 36 month lease. The car will have a residual value of $12,500 at the end the lease – pretty simple.

The depreciation expense would be completed under the straight line depreciation method, and management would retire the asset. Any gain or loss above or below the estimated salvage value would be recorded, and there would no longer be any carrying value under the fixed asset line of the balance sheet. The default method used to gradually reduce the carrying amount of a fixed asset over its useful life is called Straight Line Depreciation.

Accounting rules dictate that expenses and sales are matched in the period in which they are incurred. Depreciation is a solution for this matching problem for capitalized assets. Take the purchase price or acquisition cost of an asset, then subtract the salvage value at the time it’s either retired, sold, or otherwise disposed of.

New Wheels: Lease or Buy?

Each full accounting year will be allocated the same amount of the percentage of asset’s cost when you are using the straight-line method of depreciation. When it comes to the residual value of a leased car, for example, it equals the estimated value of the car at the end of the lease. It is the price at which the car’s lessee can purchase the car from the leasing company if the lessee decides to keep the car at the end of the lease. In accounting, the residual value is an estimated amount that a company can acquire when they dispose of an asset at the end of its useful life.

- In depreciation the residual value is the estimated scrap or salvage value at the end of the asset’s useful life.

- In investment evaluations, the residual value is the profit minus the cost of capital.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

In order to find an asset’s residual value, you must also deduct the estimated costs of disposing the asset. Although there are several types of depreciation methods, the most common method is the straight-line method of depreciation. In it, the company divides the original cost of an asset by its estimated useful life to determine the amount to depreciate every year. The residual value is set at the start of your lease by the leasing company, which may be the car dealership or another financer.

What is residual value in depreciation?

residual value definition. The remainder or difference. In depreciation the residual value is the estimated scrap or salvage value at the end of the asset’s useful life. In the accounting equation, owner’s equity is considered to be the residual of assets minus liabilities.

The residual value of an asset is determined by considering the estimated amount that an asset’s owner would earn by disposing of the asset, less any disposal cost. With residual value, it is assumed that the asset has reached the end of its useful life and is in the condition the asset was expected to be in at the end of its life.

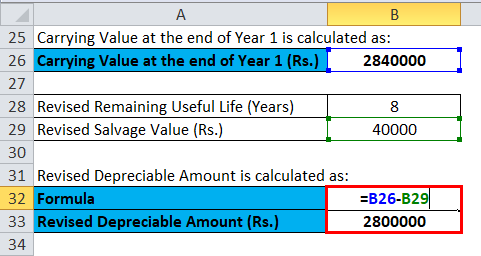

However, the estimated useful life can change from year to year depending on usage and production rates. The cumulative depreciation of an asset up to a single point in its life is called accumulated depreciation. The carrying value of an asset on a balance sheet is the difference between its purchase price and accumulated depreciation. A business buys and holds an asset on the balance sheet until the salvage value matches the carrying value. The carrying value would be $200 on the balance sheet at the end of three years.

This means different methods would apply to different types of assets in a company. Thus, the amount of depreciation is calculated by simply dividing the difference of original cost or book value of the fixed asset and the salvage value by useful life of the asset.

It is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated. Thus, salvage value is used as a component of the depreciation calculation. The residual value, or salvage value, of property relates to the future value of an asset or the amount it costs to dispose of an asset after it is no longer useful.

In lease situations, the lessor uses residual value as one of its primary methods for determining how much the lessee pays in periodic lease payments. As a general rule, the longer the useful life or lease period of an asset, the lower its residual value.

Now divide this figure by the total product years the asset can reasonably be expected to benefit your company. Residual value is your car’s estimated worth at the end of your lease term. It helps determine your monthly payment and the price to purchase the vehicle after your lease is up. As with most things involving value, it’s usually ideal to lease a vehicle with a high residual value.

How do you calculate residual value for depreciation?

The formula to figure residual value follows: Residual Value = The percent of the cost you are able to recover from the sale of an item x The original cost of the item. For example, if you purchased a $1,000 item and you were able to recover 10 percent of its cost when you sold it, the residual value is $100.

By law, if lease buyout is an option the leasing company must disclose the residual value of the vehicle when you lease your car. In fact, every lease where buyout is available will specifically include the residual value of the vehicle. But you typically can’t negotiate it like you can with other lease terms (although you can try). The difference with a lease is that the lion’s share of your monthly payment is for the cost of vehicle depreciation.