This would allow you to see if a company can meet its short-term obligations. However, being solvent requires a company to meet both their short and long-term debts, which you wouldn’t be able to accurately forecast using the balance sheet alone. While a company’s financial statements can say a lot about their solvency that doesn’t mean there aren’t potential issues. One of the most glaring issues with over-analyzing a company’s financial statements is the underlying accounting methods used on a company’s balance sheet.

On the other hand, a low solvency ratio can indicate a weaker financial position, with the company potentially relying more on debt capital to meet its obligations. This may indicate a higher risk to investors and creditors, as the company may struggle to repay its debts if it runs into financial difficulties. This means the company may also find it harder to take advantage of forms of financing such as factoring. With a low solvency ratio, it is a good idea to look at how to improve solvency. It represents the financial health and stability of a company, and determines its ability to meet its obligations.

What is solvency?

The Interest Coverage Ratio is a much more nuanced ratio and it measures a company’s ability to meet its scheduled interest payments. The Interest Coverage Ratio is calculated by dividing a company’s operating income by their scheduled interest expense. This ratio answers the question of whether a company will meet its interest obligation through normal operating income.

The cash flow also offers insight into the company’s history of paying debt. It shows if there is a lot of debt outstanding or if payments are made regularly to reduce debt liability. The cash flow statement measures not only the ability of a company to pay its debt payable on the relevant date but also its ability to meet debts that fall in the near future. Liquidity refers to the ability of a company to pay off its short-term debts; that is, whether the current liabilities can be paid with the current assets on hand.

EU institutions

Every business needs to have solvency, or it’s game over very quickly, but just what does that mean in practical terms? Explore everything you need to know, starting with our solvency definition. The discussions took particular importance in the wake of the 2008 financial crisis.

- The crisis showed the importance of a harmonised understanding of the risks by all involved actors, and the need for considering wider implications for financial stability.

- With a low solvency ratio, it is a good idea to look at how to improve solvency.

- It analyzes the company’s ability to pay its debts when they fall due, having cash readily available to cover the obligations.

- The interest coverage ratio divides operating income by interest expense to show a company’s ability to pay the interest on its debt.

The income statement shows a company’s revenues, expenses, and profits or losses. By subtracting the expenses from the revenues you’re left with a positive number – the profits, or a negative number – the losses. If a company is constantly incurring losses, their ability to meet their long-term debts would come into question. In the same respect, if a company was constantly profiting from their normal business operations, it would be expected that they will have an easier time meeting their long-term obligations. To work out if a company is financially solvent, look at the balance sheet or cash flow statement. A cash flow statement should reflect timely payment of debt, as well as the company’s ability to pay those debts.

Solvency II

It is an important measure for investors, creditors and other stakeholders to assess a company’s risk and its ability to meet its financial obligations. Solvency refers to the financial health of an individual or business, usually regarding whether the party has more assets than debt. More often, the word is used in the negative, termed insolvent, to refer to a business that is worth less than its debts.

- Solvency ratios are financial measurements that usually look at a company’s total assets, total debt, or total equity to better understand the company’s financing structure.

- While solvency is mostly used as a barometer of financial health and higher is good, it is also used to evaluate some of the operational efficiencies where higher is not always better.

- If a business does not have the capital to pay off their debts, it means they are at risk of defaulting, which can severely cripple, or even end their business operations.

- Double entry bookkeeping will make it easy to see if money management needs to be tightened up.

- More often, the word is used in the negative, termed insolvent, to refer to a business that is worth less than its debts.

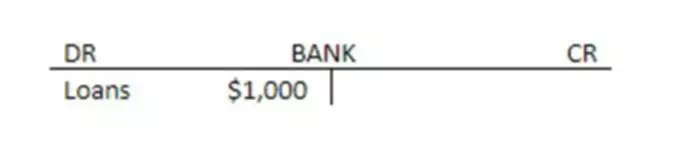

Liquidity also measures how fast a company is able to covert its current assets into cash. Many companies have negative shareholders’ equity, which is a sign of insolvency. Solvency is usually expressed in the form of a solvency ratio, such as the equity/total assets ratio. This ratio indicates what proportion of a company’s total capital comes from equity (e.g. contributed capital and profit reserves) compared to debt capital (such as loans and debt).

Is Solvency the Same as Debt?

This is why it can be especially important to check a company’s liquidity levels if it has a negative book value. Whether you’re an investor looking to purchase shares from a company or a manager working within a company, you will want to know whether your company will be able to meet its debts going forward. When considering a company’s long-term solvency using their income statements it’s important to take note of a few key numbers. If you’re trying to gauge whether a company will meet their long-term debt obligations, you’ll need to look at their income from business operations. This includes the company’s Total Revenue, Marginal Revenue, Output, and Profit. The four most important ratios that measure a company’s solvency are the Current Ratio, the Quick Ratio, the Interest Coverage Ratio and the Debt-to-Equity Ratio.

Without getting too complex, a company can manipulate the depreciation – known as the decrease in value of an asset due to time – of certain assets on their balance sheet statements. Due to certain Generally Accepted Accounting Principles (GAAP), companies can use various methods to change the value of their assets that appear on the balance sheet. If a company chooses to accelerate the depreciation of an asset, it defers the tax liability of that asset.

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Due to its simplicity, lack of an economic risk-based approach and differences in implementation across the European Union, the existing regulation needed revision. EIOPA issues opinions, decisions and protocols to increase the convergence of supervisory practices. EIOPA issues guidelines and recommendations to establish consistent, efficient and effective supervisory practices and to ensure common and consistent application of Union law.

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.