Unlike a sole proprietorship or general partnership, a corporation is a separate legal entity, separate and distinct from its owners. It can be created for a limited duration, or it can have perpetual existence. Since it is a separate legal entity, a corporation has continuity regardless of its owners. Entrepreneurs who are now dead founded many modern companies, and their companies are still thriving. Similarly, in a publicly traded company, the identity of shareholders can change many times per hour, but the corporation as a separate entity is undisturbed by these changes and continues its business operations.

Example sentences from the Web for proprietor

Furthermore, operating as either type of business structure means that you will need to pay taxes on the company’s profits. A partnership operates as a pass-through tax entity, meaning that the profits and losses pass through to the owners who report it on their personal income tax returns.

If you don’t have any partners, you must operate as a sole proprietorship, unless you incorporate or set up a limited liability company. If you have one or more business partners, you cannot operate as a sole proprietor. Unlike corporations and partnerships, sole proprietors are not required to file any articles of incorporation, exhibits or annual reports when they start businesses. You do not have to pay legal fees to a lawyer to get your business started. The operations of the business are private and not subject to public disclosure because a sole proprietorship does not file any registration documents or annual reports with federal or state governments.

The choice between operating as a sole proprietorship or a partnership is not interchangeable. By law, a sole proprietorship is a single-owner business, while the law requires a partnership to have two or more owners.

These restrictions ensure that “S” tax treatment is reserved only for small businesses. Owners of corporations are known as shareholders and can range from a few in closely held corporations to millions in publicly held corporations.

An S corporation (the name comes from the applicable subsection of the tax law) can choose to be taxed like a partnership or sole proprietorship. In other words, it is taxed only once, at the shareholder level when a dividend is declared, and not at the corporate level. Shareholders then pay personal income tax when they receive their share of the corporate profits.

As previously noted, however, the sole proprietorship can only involve one person. Once this occurs, you must formally register as some other type of legal business structure, whether it is a corporation, partnership, or limited liability company (LLC). Of course, this has its disadvantages, as you are personally liable for the debts your business incurs.

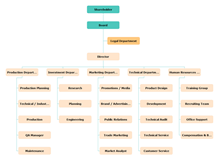

Shareholders of corporations have limited liability, but most are subject to double taxation of corporate profits. Certain small businesses can avoid double taxation by electing to be treated as S corporations under the tax laws. Shareholders elect a board of directors, who in turn appoint corporate officers to manage the company. The owner of a sole proprietorship typically signs contracts in his or her own name, because the sole proprietorship has no separate identity under the law.

However, a sole proprietor may be able to register as a limited liability company in order to limit his or her personal liability. Be sure to seek professional advice as to the appropriate form of business for your situation and location. A Limited Liability Company, or LLC, is a new form of an unincorporated business structure available in most states. It limits the liability of the owner in some of the ways that a corporation does, while providing the owner with the tax advantages and the ease of operation of a sole proprietorship or partnership.

proprietor

- An S corporation (the name comes from the applicable subsection of the tax law) can choose to be taxed like a partnership or sole proprietorship.

An S corporation is formed and treated just like any other corporation; the only difference is in tax treatment. S corporations provide the limited liability feature of corporations but the single-level taxation benefits of sole proprietorships by not paying any corporate taxes. They cannot have more than one hundred shareholders, all of whom must be U.S. citizens or resident aliens; can have only one class of stock; and cannot be members of an affiliated group of companies.

If a court agrees, then limited liability disappears and those creditors can reach the shareholder’s personal assets. Essentially, creditors are arguing that the corporate form is a sham to create limited liability and that the shareholder and the corporation are indistinguishable from each other, just like a sole proprietorship. For example, if a business owner incorporates the business and then opens a bank account in the business name, the funds in that account must be used for business purposes only. If the business owner routinely “dips into” the bank account to fund personal expenses, then an argument for piercing the corporate veil can be easily made.

Similarly, a sole proprietor will report all of the business income on his own personal income tax return, using his own social security number on all documentation related to the business. Regardless of who the other person is, you cannot start a sole proprietorship with anyone. If you do choose to begin a business with your spouse, then you will have to form a general partnership. However, if you are looking for personal limited liability protection, then neither the sole proprietorship nor general partnership are good choices for you. Both of these entities provide that the owners will be personally liable for the debts and obligations of the business.

Derived forms of proprietor

The individual entrepreneur owns the business and is fully responsible for all its debts and legal liabilities. The owner receives all profits (subject to taxation specific to the business) and has unlimited responsibility for all losses and debts. Every asset of the business is owned by the proprietor, and all debts of the business are the proprietor’s. This means that the owner has no less liability than if they were acting as an individual instead of as a business. More than 75% of all United States businesses are sole proprietorships.

That means if you fail to pay up on time, debt execution may be carried out on your personal property, up to and including your house. This is transposed by the unlimited liability attached to a sole proprietary business. The owner carries the financial responsibility for all debts and/or losses suffered by the business, to the extent of using personal or other assets to discharge any outstanding liabilities. The owner is exclusively liable for all business activities conducted by the sole proprietorship and accordingly, entitled to full control and all earnings associated with it. Sole proprietorships are the smallest form of business organization, and also the most common in the United States.

Sole proprietors need not observe formalities such as voting and meetings associated with the more complex business forms. Sole proprietorships can bring lawsuits (and can be sued) using the name of the sole proprietor owner. Many businesses begin as sole proprietorships and graduate to more complex business forms as the business develops. A sole proprietorship is not legally separate from its owner (as would be the case with a corporation).

How to say proprietor in sign language?

What does proprietor name mean?

noun. the owner of a business establishment, a hotel, etc. a person who has the exclusive right or title to something; an owner, as of real property. a group of proprietors; proprietary.

The sole proprietor owner will typically have customers write checks in the owner’s name, even if the business uses a fictitious name. Sole proprietor owners can, and often do, commingle personal and business property and funds, something that partnerships, LLCs and corporations cannot do. Sole proprietorships often have their bank accounts in the name of the owner.

Who is called proprietor?

proprietor(Noun) A sole owner of an unincorporated business, also called a sole proprietor. proprietor(Noun) One of the owners of an unincorporated business, a partner.