A document similar to the normal invoice, which provides information to the agent regarding the particulars of the goods to be delivered, is known as proforma invoice. On the other hand, invoice refers to a commercial instrument delivered to the buyer containing the details of products or services provided by the seller. Proforma invoices are preliminary invoices that inform clients about the terms of sale.

Such a change in form may occur due to changes in financial structure resulting from the disposition of a long-term liability or asset, or due to a combination of two or more businesses. With the passage of the Sarbanes-Oxley Act of 2002, modifying accounting and disclosure statements, the SEC has begun issuing new requirements related to pro forma statements.

Although the invoice due date is always set by the finalised invoice, proforma invoices can speed up the payment process by letting your customer know how much they owe in advance. This gives your customer time to make any necessary arrangements, such as transferring money or getting approval from a manager or business partner. Like a quote, the price stated on a proforma invoice isn’t final, but it is important that you provide the best estimate possible so that your customer isn’t surprised when they receive the real invoice. A proforma invoice is usually sent when a customer has committed to a purchase but cannot be sent an official invoice because the final details haven’t been confirmed. On the other hand, a quote is sent to a customer who has made an enquiry but wants more information before making a commitment to buy anything.

Most specifically, the SEC has found that pro forma statements, which are not required to follow Generally Accepted Accounting Principles (GAAP), may give a false impression of the company’s actual financial status. For this reason, SEC requires that all pro forma statements be accompanied with forms that do conform to GAAP, the company required to select those versions of formal statements most closely resembling the pro forma. The pro forma adjustments, directly attributable to the proposed change or transaction, which are expected to have a continuing impact on the financial statements. A pro forma condensed balance sheet and a pro forma condensed income statement, in columnar form, showing the condensed historical amounts, the pro forma adjustments, and the pro forma amounts. Footnotes provide justification for the pro forma adjustments and explain other details pertinent to the changes.

It’s good form to include a proforma invoice whether or not it is requested. A proforma invoice is a document that is issued from the seller, the exporter, to the buyer, the importer, to confirm the buyer’s intentions of purchasing the order. This is different from a purchase order, in that the purchase order is issued from the buyer to the seller. This guide covers the essential components of a proforma invoice, several tips on how to create and use one, and free proforma invoice templates. Try Debitoor free for seven days, and find out how invoicing software can make it easy to add proforma invoices to your invoicing process.

When a company changes an accounting method, it uses pro forma financial statements to report the cumulative effect of the change for the period during which the change occurred. Pro forma, a Latin term meaning “as a matter of form,” is applied to the process of presenting financial projections for a specific time period in a standardized format. Businesses use pro forma statements for decision-making in planning and control, and for external reporting to owners, investors, and creditors. Pro forma statements can be used as the basis of comparison and analysis to provide management, investment analysts, and credit officers with a feel for the particular nature of a business’s financial structure under various conditions.

What is the difference between proforma and Performa?

The term pro forma (Latin for “as a matter of form” or “for the sake of form”) is most often used to describe a practice or document that is provided as a courtesy or satisfies minimum requirements, conforms to a norm or doctrine, tends to be performed perfunctorily or is considered a formality.

When presenting the historical operations of a business previously operated as a partnership, the financial information is adjusted to bring the statement in line with the acquiring corporation. Historical data listed in these instances includes net sales; cost of sales; gross profit on sales; selling, general, and administrative expenses; other income; other deductions; and income before taxes on income.

Business

Proforma applies to invoices that are not yet completed which means that the invoices do not have an invoice number that is needed for every legal invoice. Unlike an invoice, a proforma invoice is an estimate or a quote that outlines the goods and services that a seller commits to selling. It is a voluntary document, and it is the preferred method in the exporting business.

Proforma Invoice Meaning

If so, they may issue pro forma financial statements that include the corrections they believe are necessary to provide a better view of the business. The Securities and Exchange Commission takes a dim view of this kind of adjusted reporting, and has issued regulations about it in their Regulation G. Both proforma invoices and quotations let a customer know how much an order might cost, and both are sent at a similar point in the sales process – i.e. before a sale is entirely finalised. A quicker, easier way to create a proforma invoice is with invoicing software like Debitoor. Invoicing software comes with a pre-built proforma invoice template and lets you send your proforma invoice to your customer in just a few clicks.

For example, it’s sometimes neccessary to issue a sales document before the details of a sale are completely finalised. A proforma invoice declares the seller’s commitment to provide the goods or services specified to the buyer at certain prices, but is not recorded in your accounts until a true invoice is issued to confirm the final prices and information. Pro forma analysis typically includes sections that forecast operating expenses, forecasts any changes in total assets, changes in total equities and analyzes the cost of financing versus the long-term financial reward (or loss) of the proposed change. A pro forma analysis concludes with forecast income statements and forecast balance sheets that incorporates changes in taxes and interest.

- They might also include payment details or terms and conditions – such as which methods of payment you accept and when payment is expected.

- The purpose of a proforma invoice is to streamline the sales process.

- Like a regular invoice, proforma invoices should include contact details, a date of issue, a description of the goods or services provided, the total amount due, and any VAT.

Pro Forma Statements

Pro forma adjustments would restate partnership operations on a corporate basis, including estimated partnership salaries as officers and estimated federal and state taxes on income, as well as pro forma net income and pro forma net income per share. Accountants make similar adjustments to pro forma statements for businesses previously operated as sole proprietorships and Subchapter S corporations. The purpose of pro forma financial statements is to facilitate comparisons of historic data and projections of future performance. In these circumstances users of financial statements need to evaluate a new or proposed business entity on a basis comparable to the predecessor business in order to understand the impact of the change on cash flow, income, and financial position. Pro forma adjustments to accounting principles and accounting estimates reformat the statements of the new entity and the acquired business to conform with those of the predecessor.

What do you mean by proforma?

Forma is a Latin and Italian word meaning “form, shape, appearance”.

A proforma invoice is a commercial pre-shipment document prepared by the seller and delivered to the buyer/agent, to convey information of the goods to be delivered. The instrument contains a description of goods, i.e. quantity, price, weight, kind and other specifications. It is a declaration by the seller to provide the products and services to the buyer on the specified date and price.

However, even though they should state details about VAT, according to HMRC, proforma invoices are not considered commercial invoices or VAT invoices. This means that you cannot use proforma invoices you receive to reclaim VAT, and you should include the words ‘This is not a VAT invoice’ on any proforma invoices you issue. You could also issue a proforma invoice if you need to provide a sales document for goods or services that you have not yet supplied, or to declare the value of goods for customs purposes. Now when we create a proforma invoice, it wont have any accounting documents created, hence proforma invoices cannot be cancelled.

The preliminary invoices are created for internally checking invoices or for enabling customers to check their invoices. While an invoice is a commercial instrument that states the total amount due, the proforma invoice is a declaration by the seller to provide products and services on a specified date and time.

A company uses pro forma statements in the process of business planning and control. Because pro forma statements are presented in a standardized, columnar format, management employs them to compare and contrast alternative business plans. By arranging the data for the operating and financial statements side-by-side, management analyzes the projected results of competing plans in order to decide which best serves the interests of the business. A company may be seeking funding, and wants to show investors how the company’s results will change if they invest a certain amount of money in the business.

As a planning tool, pro forma statements help small business owners minimize the risks associated with starting and running a new business. The data contained in pro forma statements can also help convince lenders and investors to provide financing for a start-up firm. The FASB, the AICPA, and the SEC have provided significant directives to the form, content, and necessity of pro forma financial statements in situations where there has been a change in the form of a business entity.

Quotes and proforma invoices are often used at similar points in the invoicing process, and they both tell a customer how much they might expect to pay for a particular order. However, while quotes and proforma invoices can be used in similar ways, they aren’t exactly the same. Although pro forma statements have a wide variety of applications for ongoing, mature businesses, they are also important for small businesses and start-up firms, which often lack the track record required for preparing conventional financial statements.

A proforma invoice is a useful addition to any company’s invoicing process – unfortunately, they’re often overlooked or misunderstood, which means that many small businesses and freelancers aren’t getting the most out of their invoicing software. A company prepares pro forma financial statements when it expects to experience or has just experienced significant financial changes. The pro forma financial statements present the impact of these changes on the company’s financial position as depicted in the income statement, balance sheet, and the cash-flow statement. For example, management might prepare pro forma statements to gauge the effects of a potential merger or joint venture. It also might prepare pro forma statements to evaluate the consequences of refinancing debt through issuance of preferred stock, common stock, or other debt.

In business, pro forma financial statements are prepared in advance of a planned transaction, such as a merger, an acquisition, a new capital investment, or a change in capital structure such as incurrence of new debt or issuance of stock. The pro forma models the anticipated results of the transaction, with particular emphasis on the projected cash flows, net revenues and taxes. Consequently, pro forma statements summarize the projected future status of a company, based on the current financial statements. Pro forma figures should be clearly labeled as such and the reason for any deviation from reported past figures clearly explained.

Unlike invoice, which is a true invoice and as it results in a financial transaction, hence so it serves as a basis for accounting entry to be made in the books of both the parties. While you may not need to send a proforma invoice, it’s best practice to always send one so that both the client and you have a baseline for sale. The proforma invoices also help in ensuring that the clients pay on time. At the end of the year, the invoices are used to calculate the profitability of the business.

Pro forma statements are an integral part of business planning and control. Managers use them in the decision-making process when constructing an annual budget, developing long-range plans, and choosing among capital expenditures. For a company that decided to acquire part of a new business or dispose of part of its existing business, a meaningful pro forma statement should adjust the historical figures to demonstrate how the acquired part would have fared had it been a corporation. Pro forma statements should also set forth conventional financial statements of the acquiring company, and pro forma financial statements of the business to be acquired. Notes to the pro forma statements explain the adjustments reflected in the statements.

This approach may result in several different sets of pro forma financial statements, each designed for a different investment amount. Invoicing software lets you create and send proforma invoices in less than a minute, and you can finalise your proforma invoices with a single click. One way of creating a proforma invoice is to adjust an invoice template in Word or Excel to become a proforma invoice template by removing the invoice number and changing the title of the document. A proforma invoice is a document sent to a buyer under certain circumstances – usually before all details of the sale are known. As proforma invoice is a dummy invoice and used for the purpose of creating sales, therefore no entry is made in the books of accounts for the financial transaction.

Proforma Invoice

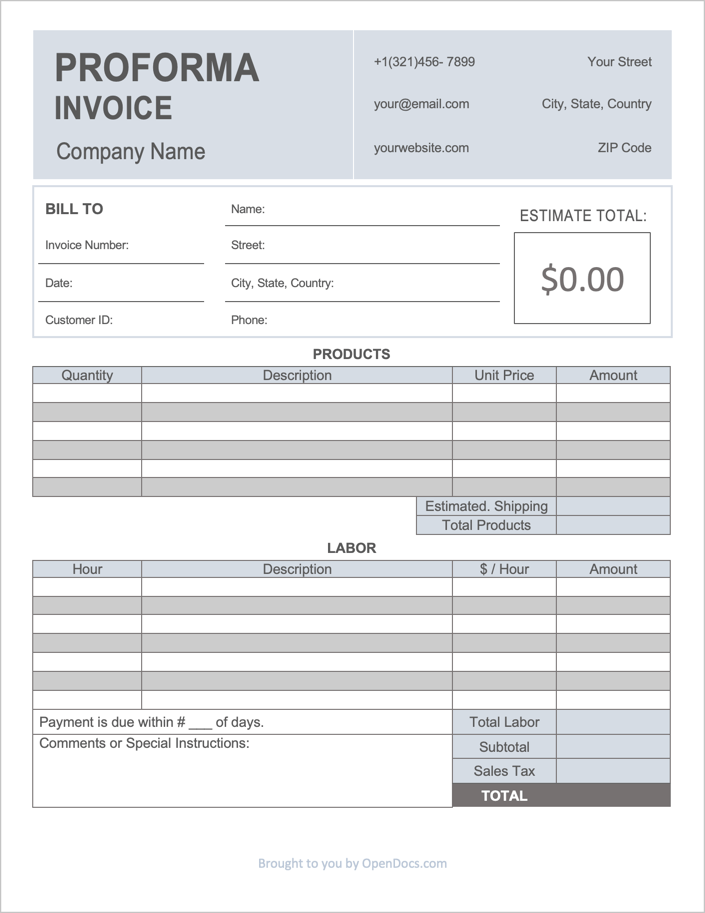

Like a regular invoice, proforma invoices should include contact details, a date of issue, a description of the goods or services provided, the total amount due, and any VAT. They might also include payment details or terms and conditions – such as which methods of payment you accept and when payment is expected. The purpose of a proforma invoice is to streamline the sales process. Once you send the proforma invoice, the customer agrees to the price and then you send the goods or services. Instead of being a demand for payment, proforma invoices are good faith estimates that lets the customer know exactly what to expect.