EBIT vs. Operating Income: What’s the Difference?

Earnings before interest, depreciation, and amortization (EBIDA) is a measure of the earnings of a company that adds the interest expense, depreciation, and amortization back to the net income number. This measure is not as well known or used as often as its counterpart—earnings before interest, taxes, depreciation, and amortization (EBITDA). Earnings before interest, depreciation, and amortization (EBIDA) is an earnings metric that adds interest and depreciation/amortization back to net income. EBIDA is said to be more conservative compared to its EBITDA counterpart, as the former is generally always lower. The EBIDA measure removes the assumption that the money paid in taxes could be used to pay down debt.

However, EBIDA is not often used by analysts, who instead opt for either EBITDA or EBIT. Understanding Earnings Before Interest, Depreciation and Amortization (EBIDA) There are various ways to calculate EBIDA, such as adding interest, depreciation, and amortization to net income. Another other way to calculate EBIDA is to add depreciation and amortization to earnings before interest and taxes (EBIT) and then subtract taxes.

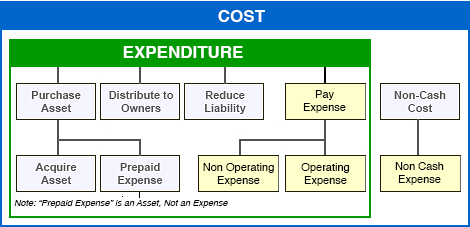

Operating income is similar to a company’searnings before interest and taxes (EBIT) and is also referred to as the operating profit or recurring profit. The one big difference between operating income and EBIT is that EBIT includes any non-operating income the company generates. Operating income–also called income from operations–takes a company’s gross income, which is equivalent to total revenue minus COGS, and subtracts all operating expenses. A business’s operating expenses are costs incurred from normal operating activities and include items such as office supplies and utilities. Revenue, as we said, refers to earnings before the subtraction of any costs or expenses.

And like other popular metrics (such as EBITDA and EBIT), EBIDA isn’t regulated by Generally Accepted Accounting Principles (GAAP), thus, what’s included is at the company’s discretion. Along with the criticism of EBIT and EBITDA, the EBIDA figure does not include other key information, such as working capital changes and capital expenditures (CapEx). This can include many nonprofits, such as non-for-profit hospitals or charity and religious organizations. Operating income is a measurement that shows how much of a company’s revenue will eventually become profits.

Operating income excludes items such as investments in other firms (non-operating income), taxes, and interest expenses. Also, nonrecurring items such as cash paid for a lawsuit settlement are not included. Operating income is also calculated by subtracting operating expenses from gross profit.

What is included in operating income?

Operating expenses include selling, general, and administrative expense (SG&A), depreciation, and amortization, and other operating expenses. Operating income excludes items such as investments in other firms (non-operating income), taxes, and interest expenses.

And interest expenses depend on whether the company is financed with debt or equity. But the financial structure of the company doesn’t say anything about how well it is run from an operational perspective. EBIT stands for Earnings Before Interest and Taxes and is one of the last subtotals in the income statement before net income. EBIT is also sometimes referred to as operating income and is called this because it’s found by deducting all operating expenses (production and non-production costs) from sales revenue.

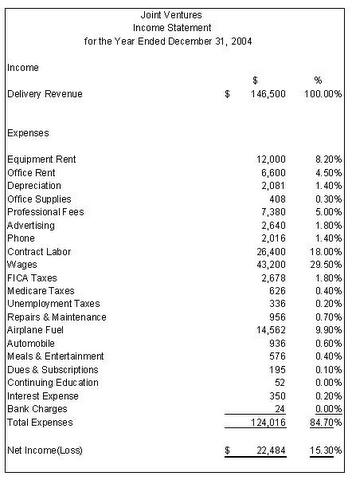

When looking at a company’s income statement from top to bottom, operating expenses are the first costs displayed just below revenue. The company starts the preparation of its income statement with top-line revenue.

How to Calculate Operating Income

- When looking at a company’s income statement from top to bottom, operating expenses are the first costs displayed just below revenue.

- The company starts the preparation of its income statement with top-line revenue.

In contrast, operating incomeis a company’s profit after subtractingoperating expenses, which are the costs of running the daily business. Operating income helps investors separate out the earnings for the company’s operating performance by excluding interest and taxes. Non-operating expenses are recorded at the bottom of a company’s income statement. The purpose is to allow financial statement users to assess the direct business activities that appear at the top of the income statement alone.

This debt payment assumption is made because interest payments are tax deductible, which, in turn, may lower the company’s tax expense, giving it more money to service its debt. EBIDA, however, does not make the assumption that the tax expense can be lowered through the interest expense and, therefore, does not add it back to net income. Criticism of EBIDA EBIDA as an earnings measure is very rarely calculated by companies and analysts. It serves little purpose, then, if EBIDA is not a standard measure to track, compare, analyze and forecast. As well, EBIDA can be deceptive as it’ll still always be higher than net income, and in most cases, higher than EBIT as well.

Operating Income

How do you calculate operating income?

Operating Income = Gross income – Operating expenses. Operating expenses include selling, general and administrative expense (SG&A), depreciation, and amortization, and other operating expenses. Operating income excludes taxes and interest expenses, which is why it’s often referred to as EBIT.

It does not include the direct effects of financing, where taxes a company pays are a direct result of its use of debt. The EBIDA measure removes the assumption that the money paid in taxes could be used to pay down debt, an assumption made in EBITDA.

Operating income, often referred to as EBIT or earnings before interest and taxes, is a profitability formula that calculates a company’s profits derived from operations. In other words, it measures the amount of money a company makes from its core business activities not including other income expenses not directly related to the core activities of the business. Operating income is a company’s profit after subtracting operating expenses and the other costs of running the business from total revenue.

Then, after operating profit has been derived, all non-operating expenses are recorded on the financial statement. Non-operating expenses are subtracted from the company’s operating profit to arrive at its earnings before taxes (EBT). Operating expenses include selling, general & administrative expense (SG&A), depreciation and amortization, and other operating expenses.

Gross Profit, Operating Profit and Net Income

Losses from taxes — or income from tax refunds — generally are not considered an operating activity, even though businesses pay taxes or claim tax credits in every accounting year. The term “earnings before interest and taxes” is often used interchangeably with net operating income. In some cases, taxes will be separated between operating and non-operating income statements, with taxes on activities like owning property and making sales included as an operating item. Other taxes, like income, franchise and excise taxes, are itemized as as non-operating expense.

Operating profit – gross profit minus operating expenses or SG&A, including depreciation and amortization – is also known by the peculiar acronym EBIT (pronounced EE-bit). (Remember, earnings is just another name for profit.) What has not yet been subtracted from revenue is interest and taxes. Because operating profit is the profit a business earns from the business it is in – from operations. Taxes don’t really have anything to do with how well you are running your company.

The firm’s cost of goods sold (COGS) is then subtracted from its revenue to arrive at its gross income. After gross income is calculated, all operating costs are then subtracted to get the company’s operating profit, or earnings before interest, tax, depreciation, and amortization (EBITDA).

It is important for a business’ future outlook that its core business operations generate a profit. Identify the line called “operating income” and its dollar amount, which is located directly below the operating expenses section, which is below the revenues section on an income statement.