Depending on the industry in practice, accounts receivable payments can be received up to 10 – 15 days after the due date has been reached. These types of payment practices are sometimes developed by industry standards, corporate policy, or because of the financial condition of the client. Accounts receivable are amounts that customers owe the company for normal credit purchases. Since accounts receivable are generally collected within two months of the sale, they are considered a current asset.

Accounts receivable usually appear on balance sheets below short-term investments and above inventory. Receivables can be classified as accounts receivables, notes receivable and other receivables ( loans, settlement amounts due for non- current asset sales, rent receivable, term deposits). Other receivables can be divided according to whether they are expected to be received within the current accounting period or 12 months (current receivables), or received greater than 12 months ( non-current receivables).

Notice that the entry does not include interest revenue, which is not recorded until it is earned. Booking a receivable is accomplished by a simple accounting transaction. However, the process of maintaining and collecting payments on the accounts receivable is more complex.

If your customers owe debts that have promissory notes attached, you record the debts under notes receivable. This goes on the balance sheet separately from accounts receivable, though it still counts as an asset. You offer three months extra time to pay, in return for a promissory note, and the customer agrees. You subtract the $1,100 from accounts receivable and enter it into notes receivable. Notes receivable refers to an asset of a bank, company, or another organization that holds a written promissory note from another party.

Receivables represent money owed by entities to the firm on the sale of products or services on credit. In most business entities, accounts receivable is typically executed by generating an invoice and either mailing or electronically delivering it to the customer; who, in turn, must pay it within an established time frame. Accounts receivable (AR) is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivables are listed on the balance sheet as a current asset. AR is any amount of money owed by customers for purchases made on credit.

If significant, these nontrade receivables are usually listed in separate categories on the balance sheet because each type of nontrade receivable has distinct risk factors and liquidity characteristics. Two methods are available to calculate the amount of bad debt expense and allowance of doubtful accounts at the end of an accounting period — percentage of accounts receivable or percentage of sales. Companies record accounts receivable as assets on their balance sheets since there is a legal obligation for the customer to pay the debt. Furthermore, accounts receivable are current assets, meaning the account balance is due from the debtor in one year or less. If a company has receivables, this means it has made a sale on credit but has yet to collect the money from the purchaser.

Notes Receivable Explained

Essentially, the company has accepted a short-term IOU from its client. While AP is the debt a company owes to its suppliers or vendors, accounts receivable is the debt of the buyers to the company. Accounts Receivables are important assets to a firm, while Accounts Payable are liabilities that must be paid in the future by the company. Basically, firms choose to offer receivables to encourage customers to choose their products over the competitor’s products. Accounts receivable are the expected future receipts when a company permits its customers to buy now and pay later.

These are two principal types of receivables for a company and will be recorded as assets in the statement of financial position. Accounts receivable and notes receivable play an important role in deciding the liquidity position in the company. Accounts receivable and notes receivable that result from company sales are called trade receivables, but there are other types of receivables as well. For example, interest revenue from notes or other interest-bearing assets is accrued at the end of each accounting period and placed in an account named interest receivable. Wage advances, formal loans to employees, or loans to other companies create other types of receivables.

- Accounts receivable and notes receivable play an important role in deciding the liquidity position in the company.

- These are two principal types of receivables for a company and will be recorded as assets in the statement of financial position.

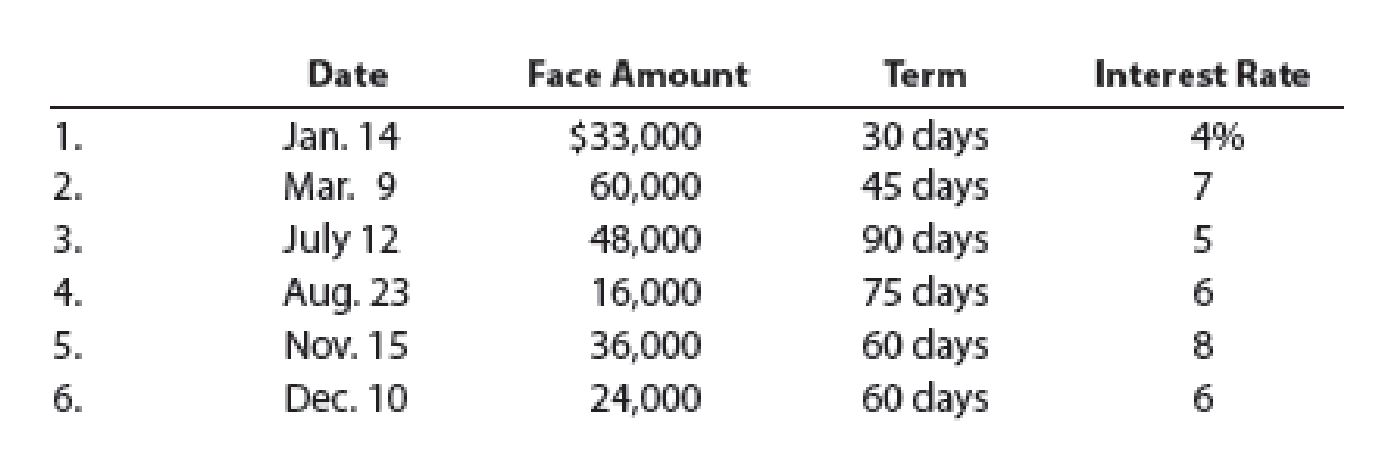

Notes Receivable Example

It is one of a series of accounting transactions dealing with the billing of a customer for goods and services that the customer has ordered. Accounts receivable is an asset which is the result of accrual accounting. In this case, the firm has delivered products or rendered services (hence, revenue has been recognized), but no cash has been received, as the firm is allowing the customer to pay at a later point in time. 1) a receivable is a monetary claim against a business or an individual.

Definition of Notes Receivable

When the customer pays off their accounts, one debits cash and credits the receivable in the journal entry. The ending balance on the trial balance sheet for accounts receivable is always debit. A receivable is money owed to a business by its clients and shown on its balance sheet as an asset.

Notes Receivable usually have longer terms to maturity than accounts receivable and are legal documents that have specific items which must be in writing on the document. The note specifies the maturity date, interest rate, and other credit terms.

Is Notes Receivable an asset?

The notes receivable is an account on the balance sheet usually under the current assets section if its life is less than a year. Specifically, a note receivable is a written promise to receive money at a future date. The money is usually made up of interest and principal.

Accounts receivable refers to the outstanding invoices a company has or the money clients owe the company. The phrase refers to accounts a business has the right to receive because it has delivered a product or service. Accounts receivable, or receivables represent a line of credit extended by a company and normally have terms that require payments due within a relatively short time period. If your business extends credit to its customers, charging and collecting interest is well within your right. Most businesses with account receivables don’t charge interest unless payment is really late, such as 90 days or more past due.

However, in the case of a note payable, collecting interest on the amount financed makes sense because it could be a rather large chunk of revenue that you’re agreeing to collect over a period of time. So, if you sell $5,000 in furniture and agree to get $500 a month for 10 months, then charging a little more for the convenience isn’t unreasonable. But when you choose to do this, you are creating financial situations that require specific journal entries, including adjusting entries.

Difference Between Accounts Receivable and Notes Receivable

Most businesses operate by enabling their clients to buy goods in credit. The cost of sales on credit is what is referred to as Accounts Receivable. Generally, Accounts Receivable (AR), are the amount of money owed to the company by buyers for goods and services rendered. Account receivables are classified as current assets assuming that they are due within one year. To record a journal entry for a sale on account, one must debit a receivable and credit a revenue account.

Accounts Receivable – represents to receive cash in the future from customers for goods sold or for service performed. Note Receivable – represents a written promise that the customer will pay a fixed amount of principal plus interest by a certain date in the future. Other Receivables – a miscellaneous category that includes any other type of receivables where there is a right to receive cash in the future.

Notes receivable carry interest charges; thus, when the maturity date approaches, it can be extended if the company wish to accumulate more interest. Customers frequently sign promissory notes to settle overdue accounts receivable balances. Brown signs a six‐month, 10%, $2,500 promissory note after falling 90 days past due on her account, the business records the event by debiting notes receivable for $2,500 and crediting accounts receivable from D.