How to File a Tax Extension

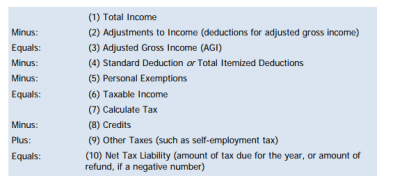

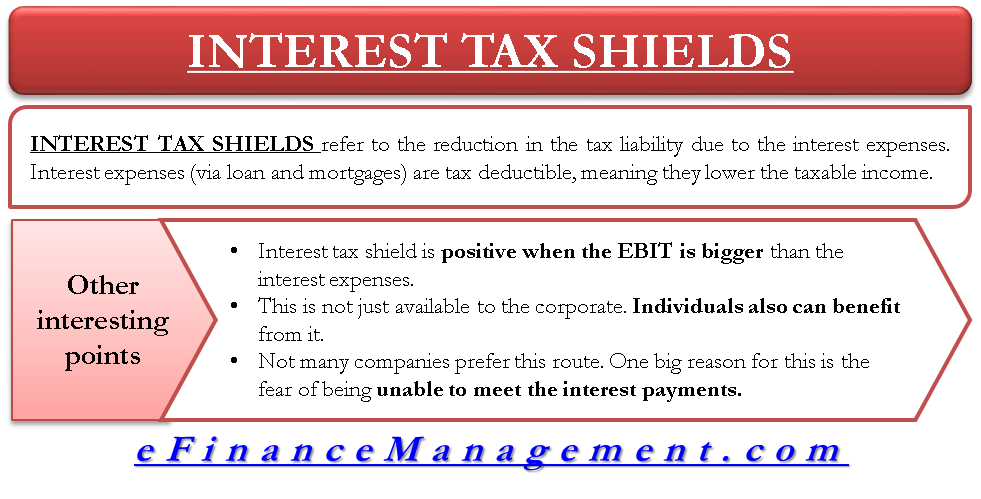

The Internal Revenue Service (IRS) offers tax filers the option to claim thestandard deductionor a list of itemized deductions. Itemized deductions include contributions to individual retirement accounts (IRAs), interest paid on mortgages, some medical expenses, and a range of other expenses. The standard deduction is a set amount tax filers can claim if they don’t have enough itemized deductions to claim. For 2019 individual tax filers can claim a $12,200 standard deduction ($24,400 for married filing jointly). An exemption is money you earn but don’t have to pay taxes on.

How do I know if my tax liability was zero?

Line 23 of Form 1040. Two lines on Form 1040 actually refer to your tax liability. Line 16 tells you the total tax you owe for the year, then line 23 tells you how much of that amount is still outstanding. Payments you’ve already made appear on line 19.

Additional training or testing may be required in CA, OR, and other states. Valid at participating locations only. This course is not open to any persons who are either currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may not be refundable.

A deduction lowers the amount of your income you have to pay taxes on by lowering your taxable income. There are two main types of tax deductions—the standard deduction and itemized deductions. Taxpayers must use one or the other, and the IRS notes it’s generally best to itemize deductions if your total itemized deductions are greater than the standard deduction. If you’re entitled to more than one allowance and only claim one, you’ll probably have a refund coming. For example, if you qualify for a large earned income credit, that will reduce your tax liability and increase your refund.

Compare your mortgage interest deduction amount to the standard deduction. Property taxes, state income taxes or sales taxes, and charitable donations can be deductible, too, if you itemize.

Examples of Tax Liability

If you overpaid, you end up with a refund. On the other hand, if you paid too little, you’ll owe the IRS some more. A tax credit is a dollar-for-dollar reduction of the tax you owe, and a refundable tax credit will allow you to have a credit beyond your tax liability. The earned income tax credit is worth up to $6,557 for a family with three or more children. One out of five taxpayers who are eligible for the credit fails to claim it, according to the IRS.

Taxable income is the amount of income used to calculate how much tax an individual or a company owes to the government in a given tax year. It is generally described asadjusted gross income(which is your total income, known as “gross income,” minus any deductions or exemptions allowed in that tax year). Taxable income includes wages, salaries, bonuses, and tips, as well as investment income and unearned income.

Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products and services such as Refund Transfer. Available at participating U.S. locations.

Line 16 vs. Line 23 of Form 1040

Depending upon your specific situation, however, the federally mandated standard deduction may be more financially advantageous for you. You may not have had to file an income tax return for the prior tax year if your gross income was below a certain threshold. See Who Must File in Publication 501, Dependents, Standard Deduction and Filing Information, for information on filing requirements for most taxpayers. You can use IRS Form 1040 to complete your federal tax requirements.

Line of credit subject to credit and underwriting approval. Products offered only at participating offices. Promotional period 11/14/2019 – 1/10/2020. Emerald Financial Services, LLC is a registered agent of Axos Bank. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Form 1040 will provide opportunities to take advantage of all deductions and credits that apply to you. Filling our the form will also let you know if you will owe any additional taxes or receive a refund. While claiming one allowance on your W-4 means your employer will take less money out of your paycheck for federal taxes, it does not impact how much taxes you’ll actually owe. Depending on your income and any deductions or credits that apply to you, you may receive a tax refund or have to pay a difference. Another common source of deferred tax liability is an installment sale, which is the revenue recognized when a company sells its products on credit to be paid off in equal amounts in the future.

Visit hrblock.com/ez to find the nearest participating office or to make an appointment. Line 16, which appears on page two of Form 1040, is your total tax liability to the IRS.

Emerald Advance℠ line of credit is a tax refund-related credit product. Emerald Card® is a tax refund-related deposit product. This is an optional tax refund-related loan from Axos Bank®, Member FDIC; it is not your tax refund.

- Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products and services such as Refund Transfer.

- Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations.

Just make sure you’re eligible to claim it before you mark your income tax return. If you are close to the standard deduction thresholds, don’t forget about some additional expenses that may push you over the standard deduction.

This creates a temporary positive difference between the company’s accounting earnings and taxable income, as well as a deferred tax liability. For tax year 2019, Joe claimed an above-the-line adjustment to income for $3,000 in contributions he made to a qualifying retirement account. He then claimed the $12,200 standard deduction for his single filing status. While he had $60,000 in overall income, he will only pay taxes on this amount. If you are married, your best option is usually tofile jointly.

What Is Tax Liability?

Sometimes that sum might make your stomach turn because it can appear high. However, when your tax liability is calculated, you adjust it for federal income tax withheld, deductions, exemptions, and tax credits in order to compute the amount of taxes currently due and unpaid.

Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials, which may be non-refundable.

How do I know if I have tax liabilities?

Tax liability is the total amount of tax debt owed by an individual, corporation, or other entity to a taxing authority like the Internal Revenue Service (IRS). In other words, it is the total amount of tax you’re responsible for paying to the taxman.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services.

Gross income is the starting point from which the Internal Revenue Service (IRS) calculates an individual’s tax liability. It’s all your income from all sources before allowable deductions are made. This includes both earned income from wages, salary, tips, and self-employment and unearned income, such as dividends and interest earned on investments, royalties, and gambling winnings.

No tax liability means a taxpayer’s total tax was zero in the prior year, or they did not have to file a tax return. According to the IRS, 70% of all taxpayers are eligible to file their taxes free.

So it’s worth looking into your options. Check out the ultimate guide to filing your taxes for free. As the IRS points out on its website, a tax deduction won’t provide a dollar-for-dollar reduction of your income tax liability. A tax deduction lowers your taxable income and is equal to the percentage of your tax bracket. It may increase your refund and can reduce the amount of tax that you owe.

Some taxpayers miss this valuable credit because they are newly qualified due to changes in their income. Or they chose not to file their taxes if their income is below the IRS income-filing threshold ($12,200 if you’re single or $24,400 if you’re married filing jointly).

If you file your taxes jointly with your spouse, you are required to add all of your income together to determine the total. You can combine your deductions, and you pay your taxes jointly. Tax liability is the total amount of tax debt owed by an individual, corporation, or other entity to a taxing authority like the Internal Revenue Service (IRS). In other words, it is the total amount of tax you’re responsible for paying to the taxman. Tax liabilities are incurred when income is earned, there is a gain on the sale of an asset, or another taxable event occurs.

Taxable income is a layman’s term that refers to your adjusted gross income (AGI) less any itemized deductions you’re entitled to claim or your standard deduction. Try this quick check.Although using the standard deduction is easier than itemizing, if you have a mortgage or home equity loan it’s worth seeing if itemizing would save you money. Use the numbers you find on IRS Form 1098, the Mortgage Interest Statement (you typically get this from your mortgage company at the end of the year).

Discount is off course materials in state where applicable. Discount must be used on initial purchase only. CTEC# 1040-QE-2127 ©2019 HRB Tax Group, Inc. All products subject to ID verification. If approved for an Emerald Advance℠, your credit limit could be between $350-$1000.