Federal wage rates and overtime requirements apply to qualifying employees. The Arkansas Dep’t of Labor website may have additional specific information on wage laws in the state. $8.75 an hour for employers with 6 or more employees at a single location.

The New York Department of Labor website may have additional specific information on wage laws in the state. $9.00 an hour for employers with four or more employees. The Nebraska Department of Labor website may have additional specific information on wage laws in the state.

Should the federal minimum wage be increased to match or exceed that of the state, Connecticut’s minimum wage automatically increases by .5% above the federal wage. Dep’t of Labor website may have additional specific information on wage laws in the state.

$10, which applies only to employers with 4 or more employees. Overtime pay is required for employees who work over 40 hours in a given week.

Subscribe today to stay up-to-date on payroll, compliance and benefit trends, tools and resources.

$7.25 per hour, with an automatic increase should the federal minimum wage rise. Overtime pay is required for employees working over 40 hours in a week, and also for any employees who work 7 days in a single work week (overtime will apply on 7th day). The Kentucky Labor Cabinet website may have additional specific information on wage laws in the state. $12.75 with an automatic 10 cent increase in the event that the federal minimum wage equals or exceeds the state rate.

Employers covered by the FLSA are excluded unless the state rate is higher. Overtime pay is required for hours worked over 40 in a week. The Hawaii Dep’t of Labor website may have additional specific information on wage laws in the state. Retail and other specified businesses must also pay overtime for work on Sundays and holidays.

How to Calculate Overtime for an Employee on Salary

The Massachusetts Executive Office of Labor & Workforce Development website may have additional specific information on wage laws in the state. $11 per hour, with an automatic increase should the federal minimum wage rise. The Maryland Department of Labor , Licensing and Regulation website may have additional specific information on wage laws in the state. $10.10, but any employees guaranteed $2,000/month or more are exempted from the state’s minimum wage and overtime law.

The Maine Department of Labor website may have additional specific information on wage laws in the state. $10.25 per hour, varying annually based on an inflation calculation. A few industries, including factories and manufacturing establishments, also have overtime pay required after 10 hours worked in a workday. The Oregon Bureau of Labor and Industries website may have additional specific information on wage laws in the state. $8.65 an hour, but $4.00 per hour for employers with gross sales of less than $110,000 per year.

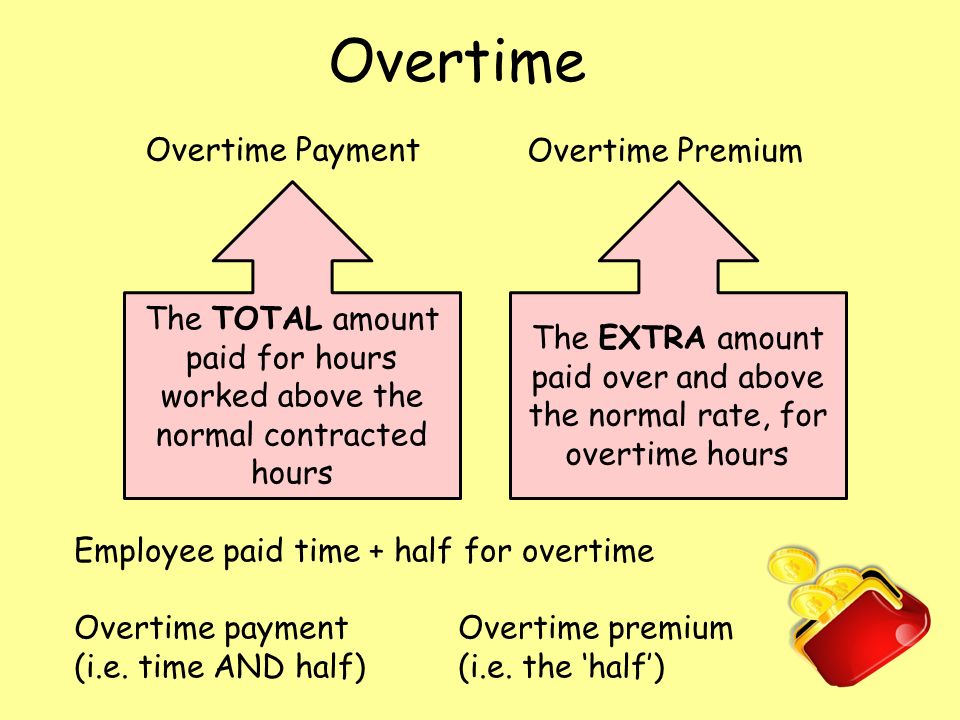

What is the difference between overtime and premium time?

overtime premium definition. The additional amount given to employees for the overtime hours. Usually this is the “half-time” in time and one-half. For example, if an employee’s hourly pay rate is $10 per hour and the employee works 41 hours in a week, the overtime premium is $5 per hour.

- Overtime pay is required for time worked over 40 hours, but state law exempts a variety of industries, including retailers, hotels, and restaurants, from the overtime rule.

- $10.96 per hour for employers with 2 or more employees, with a yearly increase.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

The Montana Department of Labor and Industry website may have additional specific information on wage laws in the state. Minnesota establishes two minimum wage rates lower than the federal minimum. For employers with annual receipts of $500,000 or more, the minimum wage is $10 an hour. For those with receipts of less than that amount, the minimum wage is $8.15 per hour.

Overtime is required for time worked in excess of 40 hours in a week. The West Virginia Division of Labor website may have additional specific information on wage laws in the state.

$10.96 per hour for employers with 2 or more employees, with a yearly increase. The minimum wage is also set to match the federal minimum should it exceed Vermont’s.

Premium Pay Law and Legal Definition

Overtime is required for time worked beyond 40 hours in a week or 8 hours in a given day. The Nevada Office of the Labor Commissioner website may have additional specific information on wage laws in the state. $12 an hour, with a maximum $1 automatic increase should the federal minimum wage be higher than this rate. Overtime is required for time worked in excess of 40 hours.

$11.80 per hour, with an automatic increase should the federal minimum wage rise above the state rate. Overtime is required for time worked beyond 40 hours in a week.

A temporary, training wage of $7.87 per hour is also allowed in specific circumstances. Overtime is required after 48 hours worked in a given week. Federal wage and overtime laws supersede the state’s laws for qualified employees. The Minnesota Department of Labor and Industry website may have additional specific information on wage laws in the state. The Michigan Dept. of Licensing & Regulatory Affairs website may have additional specific information on wage laws in the state.

Overtime pay is required for time worked over 40 hours, but state law exempts a variety of industries, including retailers, hotels, and restaurants, from the overtime rule. Federal overtime requirements may nevertheless apply. The Vermont Department of Labor website may have additional specific information on wage laws in the state.

The Rhode Island Department of Labor and Training website may have additional specific information on wage laws in the state. The North Dakota Department of Labor website may have additional specific information on wage laws in the state. The North Carolina Department of Labor website may have additional specific information on wage laws in the state. $7.25 an hour for employees who are receiving employer-provided health benefits.