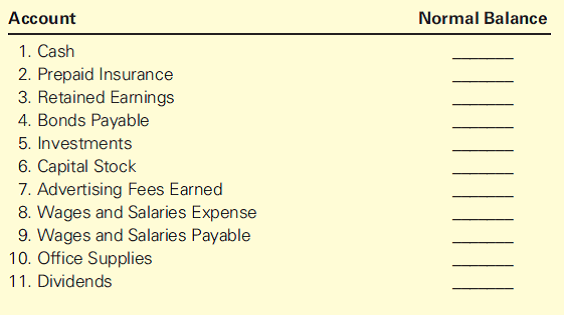

Normal Balances

Liability, revenue, and owner’s capital accounts normally have credit balances. You may find the following chart helpful as a reference.

Since both are on the debit side, they will be added together to get a balance on $24,000 (as is seen in the balance column on the January 9 row). On January 12, there was a credit of $300 included in the Cash ledger account.

Expenses and Losses are Usually Debited

This is posted to the Dividends T-account on the debit side. This is posted to the Cash T-account on the credit side. You will notice that the transactions from January 3, January 9, and January 12 are listed already in this T-account. The next transaction figure of $100 is added directly below the January 12 record on the credit side. In the journal entry, Utility Expense has a debit balance of $300.

A balance sheet on January 12 would include cash for the indicated amount (and, so forth for each of the other accounts comprising the entire financial statements). Notice that column headings for this illustrative Cash account included “increase” and “decrease” labels. In actuality, these labels would instead be “debit” and “credit.” The reason for this distinction will become apparent in the following discussion. In other words, a business would maintain an account for cash, another account for inventory, and so forth for every other financial statement element. All accounts, collectively, are said to comprise a firm’s general ledger.

You will notice that the transaction from January 3 is listed already in this T-account. The next transaction figure of $4,000 is added directly below the $20,000 on the debit side. This is posted to the Unearned Revenue T-account on the credit side. Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry.

Expenses drain a company of an asset, like cash, or add to a liability, like accounts payable. In an expense transaction, a debit increases the expense account balance, and a credit decreases the balance. On this transaction, Accounts Receivable has a debit of $1,200. The record is placed on the debit side of the Accounts Receivable T-account underneath the January 10 record.

Assets, which are on the left of the equal sign, increase on the left side or DEBIT side. Liabilities and stockholders’ equity, to the right of the equal sign, increase on the right or CREDIT side. In the journal entry, Dividends has a debit balance of $100.

By examining the account, one can see the various transactions that caused increases and decreases to the $50,000 beginning- of-month cash balance. Asset accounts normally have debit balances, while liabilities and capital normally have credit balances. Income has a normal credit balance since it increases capital . On the other hand, expenses and withdrawals decrease capital, hence they normally have debit balances. Petty cash is a current asset and should be listed as a debit on the company balance sheet.

In a T-account, their balances will be on the right side. This is posted to the Cash T-account on the debit side beneath the January 17 transaction. Accounts Receivable has a credit of $5,500 (from the Jan. 10 transaction).

- An account’s assigned normal balance is on the side where increases go because the increases in any account are usually greater than the decreases.

This is posted to the Equipment T-account on the debit side. This is posted to the Accounts Payable T-account on the credit side. This is posted to the Cash T-account on the debit side (left side). This is posted to the Common Stock T-account on the credit side (right side). On January 3, there was a debit balance of $20,000 in the Cash account.

The world of accounting revolves around, not surprisingly, accounts. The accounts listed on an income statement record a company’s income and expenses for a specified period. Income statement accounts are temporary because they are reset to zero at the end of each reporting period. Debits and credits change account balances, and they follow very specific rules. In many respects, this Cash account resembles the “register” one might keep for a wallet-style checkbook.

An account’s assigned normal balance is on the side where increases go because the increases in any account are usually greater than the decreases. Therefore, asset, expense, and owner’s drawing accounts normally have debit balances.

AccountingTools

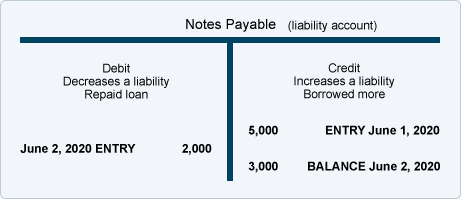

We know from the accounting equation that assets increase on the debit side and decrease on the credit side. If there was a debit of $5,000 and a credit of $3,000 in the Cash account, we would find the difference between the two, which is $2,000 (5,000 – 3,000). The debit is the larger of the two sides ($5,000 on the debit side as opposed to $3,000 on the credit side), so the Cash account has a debit balance of $2,000.

In a manual processing system, imagine the general ledger as nothing more than a notebook, with a separate page for every account. Thus, one could thumb through the notebook to see the “ins” and “outs” of every account, as well as existing balances. The following example reveals that cash has a balance of $63,000 as of January 12.

Rules of Debit and Credit: Left versus Right

The record is placed on the credit side of the Service Revenue T-account underneath the January 17 record. In the journal entry, Accounts Receivable has a debit of $5,500. This is posted to the Accounts Receivable T-account on the debit side. This is posted to the Service Revenue T-account on the credit side.

The record is placed on the credit side of the Accounts Receivable T-account across from the January 10 record. Type of balance expected of a particular account based on its balance sheet classification. Normally, asset and expense accounts have debit balances, and equity, liability, and revenue accounts have credit balances. In all cases, a credit increases the income account balance, and a debit decreases the balance. The asset account and the income account both increase by $100.

The journal entry on the balance sheet should list a debit to the business bank account and a credit to the petty cash account. When petty cash is used for business expenses, the appropriate expense account — such as office supplies or employee reimbursement — should be expensed. This is posted to the Cash T-account on the credit side beneath the January 18 transaction. This is placed on the debit side of the Salaries Expense T-account. In the journal entry, Equipment has a debit of $3,500.

Balance Sheet accounts are assets, liabilities and equity. Recording transactions into journal entries is easier when you focus on the equal sign in the accounting equation.

This is posted to the Utility Expense T-account on the debit side. You will notice that the transactions from January 3 and January 9 are listed already in this T-account. The next transaction figure of $300 is added on the credit side.

This is posted to the Cash T-account on the debit side. You will notice that the transactions from January 3, January 9, January 12, and January 14 are listed already in this T-account. The next transaction figure of $2,800 is added directly below the January 9 record on the debit side. The new entry is recorded under the Jan 10 record, posted to the Service Revenue T-account on the credit side.