In other words, your ending balance in your cash account as of December 31 will be your beginning cash balance as of January 1. Financial statements are usually prepared in accordance with generally accepted accounting principles (GAAP). Accrual accounting states revenues and expenses should be recognized when they are incurred, and not when cash changes hands. Reversing entries are an optional feature of accrual accounting.

Under the accrual method of accounting, a business is to report all of the revenues (and related receivables) that it has earned during an accounting period. A business may have earned fees from having provided services to clients, but the accounting records do not yet contain the revenues or the receivables. If that is the case, an accrual-type adjusting entry must be made in order for the financial statements to report the revenues and the related receivables.

Why are reversing entries used?

What is a Reversing Entry? Reversing entries, or reversing journal entries, are journal entries made at the beginning of an accounting period to reverse or cancel out adjusting journal entries made at the end of the previous accounting period.

Accrual accounting method measures the financial performance of a company by recognizing accounting events regardless of when corresponding cash transactions occur. Accrual follows the matching principle in which the revenues are matched (or offset) to expenses in the accounting period in which the transaction occurs rather than when payment is made (or received).

Your balance sheet captures the information as of the date you choose to print the report. Balance sheet accounts do carry forward to the next accounting period, because they are perpetual accounts.

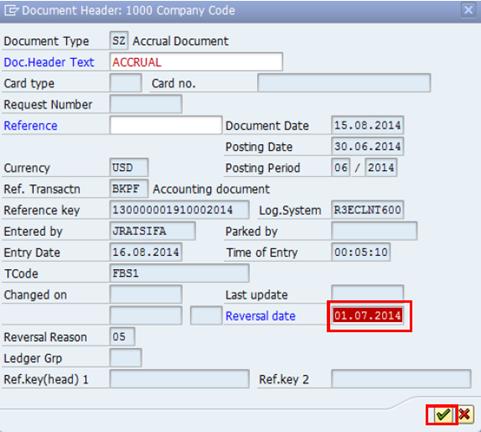

They are accrued revenues, accrued expenses, deferred revenues and deferred expenses. Reversing entries will be dated as of the first day of the accounting period immediately following the period of the accrual-type adjusting entries. In other words, for a company with accounting periods which are calendar months, an accrual-type adjusting entry dated December 31 will be reversed on January 2.

Reversing entries simplify recordkeeping and reduce the number of mistakes in the monthly accounting process. They are recorded in response to accrued assets and accrued liabilities created by adjusting entries at the end of the reporting period. Account adjustments are entries made in the general journal at the end of an accounting period to bring account balances up-to-date. They are the result of internal events, which are events that occur within a business that don’t involve an exchange of goods or services with another entity. There are four types of accounts that will need to be adjusted.

Reversing accruals are optional and can be implemented at any time because they do not affect the financial statements. Accruals can be used to match revenue, expenses and prepaid items to the current accounting period. Accruals cannot be made for depreciation or bad debt expense. Therefore, reversing accruals cannot be used for reversing depreciation or bad debt expenses.

What entries are reversed?

Definition: A reversing entry is an optional journal entry that is recorded at the beginning of an accounting period to undo the prior period’s adjusting entries. In other words, these entries cancel out or reverse the adjusting journal entries recorded at the end of the prior accounting period.

According to “Intermediate Accounting,” by Donald E. Kieso, Jerry J. Weygandt and Terry D. Warfield, reversing accruals simplify the accrual by eliminating the prior month’s accrual. In the event of an accrual error, reversing accruals eliminate the need to make adjusting entries because the original entry is canceled at the beginning of the next accounting period. An adjusting journal entry is an entry in a company’s general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. When a transaction is started in one accounting period and ended in a later period, an adjusting journal entry is required to properly account for the transaction. Adjusting journal entries can also refer to financial reporting that corrects a mistake made previously in the accounting period.

An adjusting journal entry involves an income statement account (revenue or expense) along with a balance sheet account (asset or liability). It typically relates to the balance sheet accounts for accumulated depreciation, allowance for doubtful accounts, accrued expenses, accrued income, prepaid expenses,deferred revenue, and unearned revenue. Income statement accounts that may need to be adjusted include interest expense, insurance expense, depreciation expense, and revenue. The entries are made in accordance with the matching principle to match expenses to the related revenue in the same accounting period. The adjustments made in journal entries are carried over to the general ledger which flows through to the financial statements.

Research Schools, Degrees & Careers

- It typically relates to the balance sheet accounts for accumulated depreciation, allowance for doubtful accounts, accrued expenses, accrued income, prepaid expenses,deferred revenue, and unearned revenue.

- An adjusting journal entry involves an income statement account (revenue or expense) along with a balance sheet account (asset or liability).

- Income statement accounts that may need to be adjusted include interest expense, insurance expense, depreciation expense, and revenue.

Reversing entries can be set to automatically reverse in a future period, thereby eliminating this risk. Reversing accruals cancel the prior month’s accruals. Accrual-based accounting matches revenue and expenses to the current accounting period. Accruals accumulate until an adjusting entry is made.

Estimates are adjusting entries that record non-cash items, such as depreciation expense, allowance for doubtful accounts, or the inventory obsolescence reserve. The use of accruals allows a business to look beyond simple cash flow. In a cash-based accounting approach, a company records only the transactions where cash changes hands. Accruals form the base for accrual accounting and incorporate all transactions, including accounts receivable, accounts payable, employee salaries, etc.

In order for a company’s financial statements to include these transactions, accrual-type adjusting entries are needed. Some of these accounting adjustments are intended to be reversing entries – that is, they are to be reversed as of the beginning of the next accounting period. In particular, accrued revenue and expenses should be reversed. Otherwise, inattention by the accounting staff may leave these adjustments on the books in perpetuity, which may cause future financial statements to be incorrect.

Reversing a Journal Entry

In summary, adjusting journal entries are most commonly accruals, deferrals, and estimates. Accruals are revenues and expenses that have not been received or paid, respectively, and have not yet been recorded through a standard accounting transaction. Deferrals refer to revenues and expenses that have been received or paid in advance, respectively, and have been recorded, but have not yet been earned or used.

AccountingTools

An accrued expense is an expense that has been incurred, but for which there is not yet any expenditure documentation. In the absence of a journal entry, the expense would not appear at all in the entity’s financial statements in the period incurred, which would result in reported profits being too high in that period. In short, accrued expenses are recorded to increase the accuracy of the financial statements, so that expenses are more closely aligned with those revenues with which they are associated. Use of Reversing Entries makes it easier to record subsequent transactions by eliminating the possibility of duplication.

Recording an amount as an accrual provides a company with a more comprehensive look at its financial situation. It provides an overview of cash owed and credit given, and allows a business to view upcoming income and expenses in the following fiscal period. These categories are also referred to as accrual-type adjusting entries or simply accruals. Accrual-type adjusting entries are needed because some transactions had occurred but the company had not entered them into the accounts as of the end of the accounting period.

Since the firm is set to release its year-end financial statements in January, an adjusting entry is needed to reflect the accrued interest expense for December. The adjusting entry will debit interest expense and credit interest payable for the amount of interest from December 1 to December 31.

Accounting Topics

Income statements show the revenue and expenses for a given accounting period. The difference between the two categories is your profit or loss for that period. Income statements display only the activity for the selected period; the ending balance from the previous accounting period does not carry forward to the next. It includes the assets your company owns, such as equipment, automobiles, cash and inventory, and the company’s liabilities, or money that you owe.

Why are Reversal Entries Used?

We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, and Payroll Accounting.