These are business activities that are capitalized over more than one year. The purchase of long-term assets is recorded as a use of cash in this section. The line item “capital expenditures” is considered an investing activity and can be found in this section of the cash flow statement. These line items impact the net income on the income statement but do not result in a movement of cash in or out of the company.

Cash Flow from Investing Activities

If it’s coming from normal business operations, that’s a sign of a good investment. If the company is consistently issuing new stock or taking out debt, it might be an unattractive investment opportunity. The company engaged in a number of financing activities during 2014 after announcing intentions to acquire other businesses.

This section of the statement of cash flows measures the flow of cash between a firm and its owners and creditors. This information shows both companies generated significant amounts of cash from daily operating activities; $4,600,000,000 for The Home Depot and $3,900,000,000 for Lowe’s. It is interesting to note both companies spent significant amounts of cash to acquire property and equipment and long-term investments as reflected in the negative investing activities amounts. For both companies, a significant amount of cash outflows from financing activities were for the repurchase of common stock.

Any time your company spends or gains money by investing, you report it on the cash flow statement. Add up any money received from the sale of assets, paying back loans or the sale of stocks and bonds. Subtract money paid out to buy assets, make loans or buy stocks and bonds.

The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through the capital markets. These activities also include paying cash dividends, adding or changing loans, or issuing and selling more stock.

Financing activities include transactions involving debt, equity, and dividends. Investing activities often refers to the cash flows from investing activities, which is one of the three main sections of the statement of cash flows (or SCF or cash flow statement). Investing activities are in the second section of the statement of cash flows.

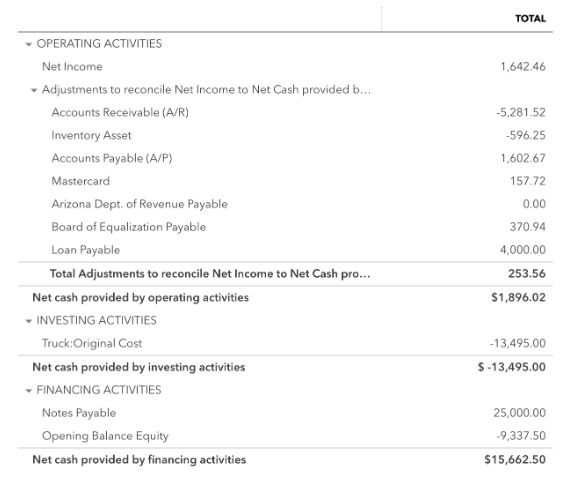

This typically includes net income from the income statement, adjustments to net income, and changes in working capital. The three categories of cash flows are operating activities, investing activities, and financing activities. Investing activities include cash activities related to noncurrent assets. Financing activities include cash activities related to noncurrent liabilities and owners’ equity. Cash flow from financing activities (CFF) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company.

BUSINESS IDEAS

If cash flows from operating business activities are negative, it means the company must be financing its operating activities through either investing activities or financing activities. Routinely negative operating cash flow is not common outside of nonprofits.

These are the company’s core business activities, such as manufacturing, distributing, marketing, and selling a product or service. Operating activities will generally provide the majority of a company’s cash flow and largely determine whether it is profitable. Some common operating activities include cash receipts from goods sold, payments to employees, taxes, and payments to suppliers.

- If you’ve made significant expenditures for fixed assets, the opposite could happen, and it would make your cash flow from operations look worse than it is.

- Operational cash flow shows how much money you generate from your company’s core purpose.

- The cash flow statement separates operational and investment income because income from profitable investments could hide that your company doesn’t get much revenue the regular way.

Through this section of a cash flow statement, one can learn how often (and in what amounts) a company raises capital from debt and equity sources, as well as how it pays off these items over time. Investors are interested in understanding where a company’s cash is coming from.

Cash Flow from Investing Activities Example

Cash flow from investing activities includes any inflows or outflows of cash from a company’s long-term investments. Cash flow from investing activities is a line item on a business’s cash flow statement, which is one of the major financial statements that companies prepare. Cash flow from investing activities is the net change in a company’s investment gains or losses during the reporting period, as well as the change resulting from any purchase or sale of fixed assets. Cash flows from operating activities is a section of a company’s cash flow statement that explains the sources and uses of cash from ongoing regular business activities in a given period.

A company’s CFF activities refer to the cash inflows and outflows resulting from the issuance of debt, the issuance of equity, dividend payments and the repurchase of existing stock. A firm’s cash flow from financing activities relates to how it works with the capital markets and investors.

These activities can be found on a company’s financial statements and in particular the income statement and cash flow statement. When a company sells any of its long-term investments or sells any of its property, plant and equipment, it is assumed to be providing or increasing the company’s cash and cash equivalents. Therefore, the cash received from the sale of these long-term assets will be reported as positive amounts in the cash flows from investing activities section of the SCF.

Apparently, both companies chose to return cash to owners by repurchasing stock. The negative amount informs the reader that cash was used and thereby reduced the company’s cash and cash equivalents. Operating activities are the functions of a business directly related to providing its goods and/or services to the market.

It is separate from the sections on investing and financing activities. Many line items in the cash flow statement do not belong in the operating activities section.

How do you calculate net cash from investing activities?

Cash Flow from Investing Activities is the section of a company’s cash flow statement. that displays how much money has been used in (or generated from) making investments during a specific time period. Investing activities include purchases of long-term assets (such as property, plant, and equipment)

FINANCE YOUR BUSINESS

This equals dividends paid during the year, which is found on the cash flow statement under financing activities. Cash flows from operating activities are among the major subsections of thestatement of cash flows.

The total is the figure that gets reported on your cash flow statement. To summarize other linkages between a firm’s balance sheet and cash flow from financing activities, changes in long-term debt can be found on the balance sheet, as well as notes to the financial statements. Dividends paid can be calculated from taking the beginning balance of retained earnings from the balance sheet, adding net income, and subtracting out the ending value of retained earnings on the balance sheet.

It is particularly important in capital-heavy industries, such as manufacturing, that require large investments in fixed assets. Cash flow from investing is listed on a company’s cash flow statement.

Operational cash flow shows how much money you generate from your company’s core purpose. The cash flow statement separates operational and investment income because income from profitable investments could hide that your company doesn’t get much revenue the regular way. If you’ve made significant expenditures for fixed assets, the opposite could happen, and it would make your cash flow from operations look worse than it is. Cash flow from investing activities is critical because it shows you have resources, even if cash flow from operations is low. If you’re in an industry that requires substantial investment in fixed assets, negative cash flow from investments can be a good sign that shows you’re investing in your business’s equipment.