Their role is to define how your company’s money is spent or received. Business owners either handle their accounting themselves or they hire someone else to do it. In general, startups and sole proprietors choose the first option to reduce their expenses. Even if you do hire an accountant, it’s important that you have a basic understanding of what is involved. Start by learning about the five major accounts, so you know how to read financial reports.

The company’s total costs are a combination of the fixed and variable costs. If the bicycle company produced 10 bikes, its total costs would be $1,000 fixed plus $2,000 variable equals $3,000, or $300 per unit.

Of course, the exposure isn’t free; advertising costs money and just like every other financial transaction, it has to be recorded in the accounting system. Any product or service that your company purchases to generate income or manufacture goods is considered an expense. This may include advertising costs, utilities, rent, salaries and others. Economies of scale are another area of business that can only be understood within the framework of fixed and variable expenses. Economies of scale are possible because in most production operations the fixed costs are not related to production volume; variable costs are.

How to Credit & Debit Your Advertising Expenses

When you’re starting a business, it’s your responsibility to list the types of assets that your company has. Let your accountant know about it so he or she can deduct any expenses that are considered necessary for your business. There are five main types of accounts in accounting, namely assets, liabilities, equity, revenue and expenses.

A liability is not paid or created, but it will also subtract the same amount from owners’ equity to show the loss in overall business value. Businesses need a way to let potential customers know they exist, as well as a vehicle to let current customers know what additional products and services they offer. Whether it’s a couple of radio sports during drive time, a commercial during the ballgame or an ad in the local paper, advertising helps a business get its name out there.

Is prepaid advertising a debit or credit?

Prepaid advertising is a current asset account, in which is stored all advertising that was paid for in advance but not yet consumed. As these costs are consumed (such as through the running of television or Internet ads), the applicable portion of this asset is recognized as advertising expense.

Total variable costs increase proportionately as volume increases, while variable costs per unit remain unchanged. For example, if the bicycle company incurred variable costs of $200 per unit, total variable costs would be $200 if only one bike was produced and $2,000 if 10 bikes were produced. However, variable costs applied per unit would be $200 for both the first and the tenth bike.

But if 10,000 pages are printed, each page carries only 0.55 cents of set-up cost. This is important because most business planning activities require that expenses be easily segregated into these two categories. Those managing businesses soon learn how crucial it is to track expenses in a way that helps to make planning, forecasting and bidding as easy as possible. When a business pays for services or goods in advance, it is a prepaid expense.

Record the Purchase of the Advertising

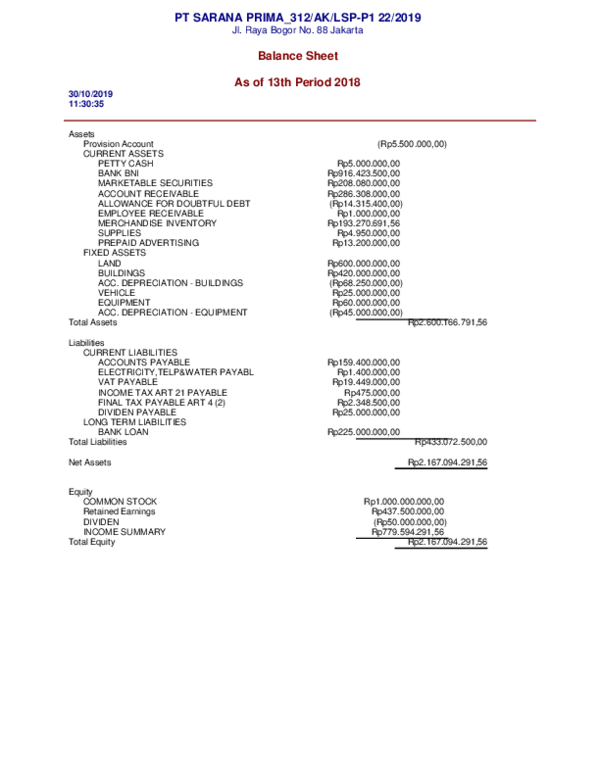

Advertising costs are sometimes recorded as a prepaid expense on the balance sheet and then moved to the income statement when sales that are directly related to those costs come in. For a company to record advertising expenses as an asset, it must have reason to believe those specific expenses are tied to specific future sales. Then, as those sales occur, those advertising expenses are moved from the balance sheet (prepaid expenses) to the income statement (SG&A).

Costs like payroll, utilities, and rent are necessary for business to operate. Expenses arecontra equity accountswith debit balances and reduce equity. The balance sheet is an “equal sign” with company assets on one side, liabilities plus owners’ equity on the other. It shows readers the value of your assets – cash, real estate, equipment – and how much the company would be worth after you pay off all your debts. You pay your insurance for the year on January 1, or pay for the next six months of office cleaning services ahead of time.

- Advertising costs are sometimes recorded as a prepaid expense on the balance sheet and then moved to the income statement when sales that are directly related to those costs come in.

It is very important for small business owners to understand how their various costs respond to changes in the volume of goods or services produced. The breakdown of a company’s underlying expenses determines the profitable price level for its products or services, as well as many aspects of its overall business strategy.

The cost of setting up will be the same whether the printer produces one copy or 10,000. If the set-up cost is $55 and the printer produces 500 copies, each copy will carry 11 cents worth of the setup cost-;the fixed costs.

Over time, as customers respond to the campaign, those direct mail expenses will be moved from the prepaid expense category to the advertising cost category. It is important to understand the behavior of the different types of expenses as production or sales volume increases. Total fixed costs remain unchanged as volume increases, while fixed costs per unit decline. For example, if a bicycle business had total fixed costs of $1,000 and only produced one bike, then the full $1,000 in fixed costs must be applied to that bike. On the other hand, if the same business produced 10 bikes, then the fixed costs per unit decline to $100.

Advertising expenses are signified by revenue leaving the business to pay for marketing strategies. In this case there is a particular account in the income statement known as advertising expenses, which will hold any outflow of cash for advertising costs. Because it is cash leaving the business, this will subtract the cost from the assets side of the equation.

Prepaid advertising

The Overall Subtopic addresses the accounting and reporting for certain deferred costs and prepaid expenses. The guidance in this Subtopic is limited to a discussion of the nature of prepaid expenses and preproduction costs related to long-term supply arrangements. The specific guidance for many other costs that have been deferred is included in various other financial, broad, and industry Topics. Advertising costs are a category in financial accounting associated with promoting an industry, entity, brand, product, or service.

When a company is paid before performing the work, that’s prepaid revenue. They both go on the balance sheet, but in different accounts under prepaid expenses on the asset side and unearned revenue on the liability side.

Advertising costs are a type of financial accounting that covers expenses associated with promoting an industry, entity, brand, product, or service. They cover ads in print media and online venues, broadcast time, radio time, and direct mail advertising. Advertising costs will in most cases fall under sales, general, and administrative (SG&A) expenses on a company’s income statement. Although fixed costs do not vary with changes in production or sales volume, they may change over time. Some fixed costs are incurred at the discretion of a company’s management, such as advertising and promotional expense, while others are not.

It is important to remember that all non-discretionary fixed costs will be incurred even if production or sales volume falls to zero. For example, a company may pay a sales person a monthly salary (a fixed cost) plus a percentage commission for every unit sold above a certain level (a variable cost). Advertising costs are sometimes recorded as a prepaid expense on the balance sheet and then moved to the income statement when sales relate to those costs come in.

What is advertising expense classified as?

Record the Purchase of the Advertising

This is done by debiting Prepaid Advertising and crediting the appropriate account. If you paid for the advertising outright, then you would credit the Cash account. If you are paying for the advertising in installments, then you would credit Accounts Payable.