Banks, for example, want to know before extending credit whether a company is collecting—or getting paid—for its accounts receivables in a timely manner. On the other hand, on-time payment of the company’s payables is important as well. Both the current and quick ratios help with the analysis of a company’s financial solvency and management of its current liabilities.

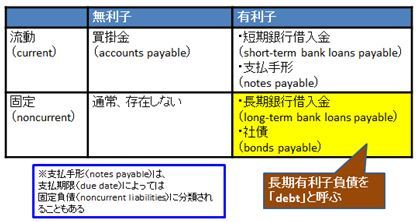

The source of the company’s assets are creditors/suppliers for $40,000 and the owners for $60,000. The creditors/suppliers have a claim against the company’s assets and the owner can claim what remains after the Accounts Payable have been paid. Noncurrent liabilities include debentures, long-term loans, bonds payable, deferred tax liabilities, long-term lease obligations, and pension benefit obligations. The portion of a bond liability that will not be paid within the upcoming year is classified as a noncurrent liability. Warranties covering more than a one-year period are also recorded as noncurrent liabilities.

The ratio, which is calculated by dividing current assets by current liabilities, shows how well a company manages its balance sheet to pay off its short-term debts and payables. It shows investors and analysts whether a company has enough current assets on its balance sheet to satisfy or pay off its current debt and other payables. Current liabilities are a company’s short-term financial obligations that are due within one year or within a normal operating cycle.

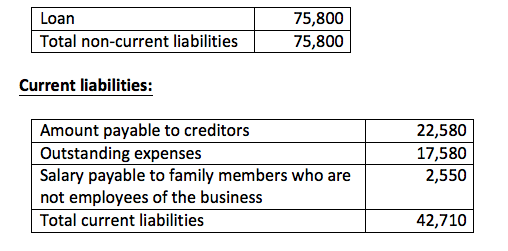

Items like rent, deferred taxes, payroll, and pension obligations can also be listed under long-term liabilities. Non-current liabilities are long-term liabilities, which are financial obligations of a company that will come due in a year or longer. Non-current liabilities are reported on a company’s balance sheet along with current liabilities, assets, and equity. Examples of non-current liabilities include credit lines, notes payable, bonds and capital leases. In order to assess the financial health of a company we need to look at its component parts.

Understanding Noncurrent Liabilities

A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, earned premiums, unearned premiums, and accrued expenses. The current ratio measures a company’s ability to pay its short-term financial debts or obligations.

An operating cycle, also referred to as the cash conversion cycle, is the time it takes a company to purchase inventory and convert it to cash from sales. An example of a current liability is money owed to suppliers in the form of accounts payable.

Current liabilities are typically settled using current assets, which are assets that are used up within one year. Current assets include cash or accounts receivables, which is money owed by customers for sales. The ratio of current assets to current liabilities is an important one in determining a company’s ongoing ability to pay its debts as they are due. Current liabilities of a company consist of short-term financial obligations that are due typically within one year.

Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income taxes owed. Investors and creditors use numerous financial ratios to assess liquidity risk and leverage.

The debt ratio compares a company’s total debt to total assets, to provide a general idea of how leveraged it is. The lower the percentage, the less leverage a company is using and the stronger its equity position. The higher the ratio, the more financial risk a company is taking on. Other variants are the long term debt to total assets ratio and the long-term debt to capitalization ratio, which divides noncurrent liabilities by the amount of capital available.

Liabilities occur to assist in the financing of a company’s operations or expansion. Liabilities can either be the short term which is due and payable within the next 12 months or long term which is due and payable in excess of 12 months. Short term liabilities are items such as accounts payable, taxes payable, and wages payable which are not charged a stated interest. All liabilities are paid through the use of cash or sale/reduction of other assets. Short-term debts can include short-term bank loans used to boost the company’s capital.

Current liabilities could also be based on a company’s operating cycle, which is the time it takes to buy inventory and convert it to cash from sales. Current liabilities are listed on the balance sheet under the liabilities section and are paid from the revenue generated from the operating activities of a company. When presenting liabilities on the balance sheet, they must be classified as either current liabilities or long-term liabilities. A liability is classified as a current liability if it is expected to be settled within one year.

- Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash.

- Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses.

Accounts payable, accrued liabilities, and taxes payable are usually classified as current liabilities. If a portion of a long-term debt is payable within the next year, that portion is classified as a current liability. Liabilities are obligations of the company; they are amounts owed to creditors for a past transaction and they usually have the word “payable” in their account title. Along with owner’s equity, liabilities can be thought of as a source of the company’s assets. For example, a company’s balance sheet reports assets of $100,000 and Accounts Payable of $40,000 and owner’s equity of $60,000.

Liabilities are simply something of value a business owes to another person or organization. In this lesson, we’ll be looking specifically at non-current liabilities, which are the long-term financial obligations of a business that do not come due for payment for a year or more. If the money owed is for repayment of a loan, such as a mortgage or an equipment lease, then the liability is a debt.

What are some examples of non current liabilities?

Noncurrent liabilities are those obligations not due for settlement within one year. These liabilities are separately classified in an entity’s balance sheet, away from current liabilities. Examples of noncurrent liabilities are: Long-term portion of debt payable.

Noncurrent liabilities

Deferred revenue is typically reported as a current liability on a company’s balance sheet, as prepayment terms are typically for 12 months or less. Commercial paper is also a short-term debt instrument issued by a company. The debt is unsecured and is typically used to finance short-term or current liabilities such as accounts payables or to buy inventory. Accrued expenses are listed in the current liabilities section of the balance sheet because they represent short-term financial obligations.

Does the Balance Sheet Always Balance?

What are current liabilities and noncurrent liabilities?

Examples of Noncurrent Liabilities Noncurrent liabilities include debentures, long-term loans, bonds payable, deferred tax liabilities, long-term lease obligations, and pension benefit obligations.

Overdraft credit lines for bank accounts and other short-term advances from a financial institution might be recorded as separate line items, but are short-term debts. The current portion of long-term debt due within the next year is also listed as a current liability. Accounts payables are obligations of a company to vendors, suppliers, etc. Such obligations are normally settled with current assets (e.g. cash), and thus, they are considered current liabilities. The analysis of current liabilities is important to investors and creditors.

Other examples include deferred compensation, deferred revenue, and certain health care liabilities. Current liabilities are those line items of the balance sheet which are liable for the company within a one-year time frame. The calculation for the current liabilities formula is fairly simple. The current liabilities of a company are notes payable, accounts payable, accrued expenses, unearned revenue, current portion of long term debt, and other short term debt.

Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash. Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses. In contrast, analysts want to see that long-term liabilities can be paid with assets derived from future earnings or financing transactions.