While direct labor comprises work done on certain products or services, indirect labor is employee work that can’t be traced back or billed to services or goods produced. Advertising represents a discretionary fixed cost, meaning the level of spending is up to company management and the spending level can change from one budget period to the next. There’s an ongoing process of evaluating how well advertising spending is working, and how advertising is affecting sales. Advertising can target customers with information about specific products, services and promotions, or it can simply give the company general exposure in the marketplace. As a small business owner, it’s important to set the prices of your services and product high enough to cover your production costs, turn a profit, and still remain competitive.

If the bicycle company produced 10 bikes, its total costs would be $1,000 fixed plus $2,000 variable equals $3,000, or $300 per unit. Although fixed costs do not vary with changes in production or sales volume, they may change over time.

But if 10,000 pages are printed, each page carries only 0.55 cents of set-up cost. Although direct costs are typically variable costs, they can also include fixed costs.

If Company XYZ decides to produce 2,000,000 widgets next year, its total production costs may only rise to $1,500,000 ($0.75 per widget) because it can spread its fixed costs over more units. Although Company XYZ’s total costs increase from $1,000,000 to $1,500,000, each widget becomes less expensive to produce and therefore more profitable.

Rent for a factory, for example, could be tied directly to the production facility. However, companies can sometimes tie fixed costs to the units produced in a particular facility. Fixed costs are business expenses that remain constant, regardless of the business activity. For example, the salary of the manager is fixed and has to be paid irrespective of the business activity. They are usually split into direct and indirect labor costs, based on the worker’s contribution to the production process.

This cost may be directly attributed to the project and relates to a fixed dollar amount. Materials that were used to build the product, such as wood or gasoline, might be directly traced but do not contain a fixed dollar amount.

Setting up the run requires burning a plate after a photographic process, mounting the plate on the printing press, adjusting ink flow, and running five or six pages to make sure everything is correctly set up. The cost of setting up will be the same whether the printer produces one copy or 10,000. If the set-up cost is $55 and the printer produces 500 copies, each copy will carry 11 cents worth of the setup cost-;the fixed costs.

Variable Costs

This is because the quantity of the supervisor’s salary is known, while the unit production levels are variable based upon sales. Direct costs are fairly straightforward in determining their cost object. For example, Ford Motor Company(F)manufactures automobiles and trucks.

What is an example of a mixed cost?

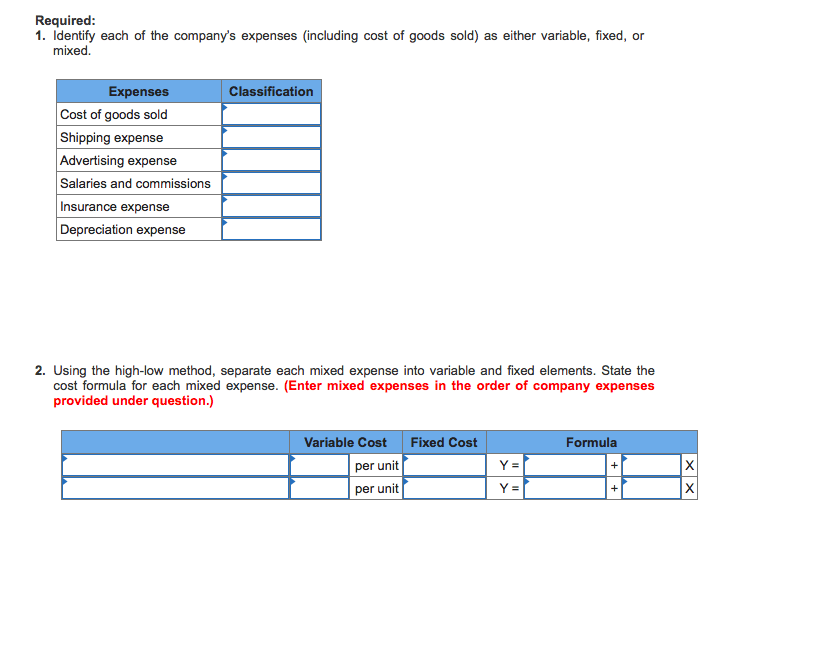

Mixed expenses consist of a constant or fixed portion and a variable portion. For example, sales salaries would be a mixed expense if each sales person’s compensation is $2,000 per month plus 3% of the sales generated by the employee. Automobile expense is a mixed expense in relationship to miles driven.

Keeping a tab on the direct and indirect labor costs will help you exercise a strict control over labor cost and identify potential areas for cost improvement. Overhead covers the costs of running a business that is not directly associated with making a product or offering a service. It is the aggregate sum of indirect expenses, indirect labor and indirect material. Conversion costs are the expenses (direct and indirect) that are required to convert the raw materials into finished products.

You can categorize your business costs as fixed, variable and mixed based on how they change in response to your sales or production output. Fixed costs remain the same no matter how many units you produce or sell. Direct costs do not need to be fixed in nature, as their unit cost may change over time or depending on the quantity being utilized. An example is the salary of a supervisor that worked on a single project.

- It is very important for small business owners to understand how their various costs respond to changes in the volume of goods or services produced.

- The breakdown of a company’s underlying expenses determines the profitable price level for its products or services, as well as many aspects of its overall business strategy.

Example of Mixed Costs

Direct and indirect costs are the two major types of expenses or costs that companies can incur. Direct costs are often variable costs, meaning they fluctuate with production levels such as inventory.

However, some costs, such as indirect costs are more difficult to assign to a specific product. Examples of indirect costs include depreciation and administrative expenses. Economies of scale are another area of business that can only be understood within the framework of fixed and variable expenses. Economies of scale are possible because in most production operations the fixed costs are not related to production volume; variable costs are. Large production runs therefore “absorb” more of the fixed costs.

General Mixed Cost Examples

On the other hand, if the same business produced 10 bikes, then the fixed costs per unit decline to $100. Total variable costs increase proportionately as volume increases, while variable costs per unit remain unchanged. For example, if the bicycle company incurred variable costs of $200 per unit, total variable costs would be $200 if only one bike was produced and $2,000 if 10 bikes were produced. However, variable costs applied per unit would be $200 for both the first and the tenth bike. The company’s total costs are a combination of the fixed and variable costs.

It is very important for small business owners to understand how their various costs respond to changes in the volume of goods or services produced. The breakdown of a company’s underlying expenses determines the profitable price level for its products or services, as well as many aspects of its overall business strategy. It is important to understand the behavior of the different types of expenses as production or sales volume increases. Total fixed costs remain unchanged as volume increases, while fixed costs per unit decline. For example, if a bicycle business had total fixed costs of $1,000 and only produced one bike, then the full $1,000 in fixed costs must be applied to that bike.

Although the electricity expense can be tied to the facility, it can’t be directly tied to a specific unit and is, therefore, classified as indirect. Determining your fixed and variable expenses is paramount to effectively building a budget. But while accounting for necessary costs is a simple and straightforward task, including discretionary expenses in your budget can present a challenge. The overheads costs that are constant when totaled but variable in nature when calculated per unit are known as fixed overheads. Fixed costs tend to decrease per unit with the increase in the production output.

In contrast to fixed costs, variable costs vary (in total) directly with changes in volume of production or sales. In particular, total variable costs change as total volume changes. If pizza production increases from inch pizzas to inch pizzas per day, the amount of dough required per day to make 10-inch pizzas would double.

For example, a company may pay a sales person a monthly salary (a fixed cost) plus a percentage commission for every unit sold above a certain level (a variable cost). A direct cost is a price that can be directly tied to the production of specific goods or services. A direct cost can be traced to the cost object, which can be a service, product, or department.

Since indirect labor cannot be traced back to a specific product or service, the related cost can’t be billed to the goods produced or the services rendered. It represents the overhead to the business needed to support the level of operations. This idea is also referred to as diminishing marginal cost.For example, let’s assume it costs Company XYZ $1,000,000 to produce 1,000,000 widgets per year ($1 per widget). This $1,000,000 cost includes $500,000 of administrative, insurance, and marketing expenses, which are generally fixed.

Are utilities a mixed cost?

Example of Mixed Costs These include insurance, parking fees, and some depreciation. Some of the expenses are variable since the total amount will increase when more miles are driven and will decrease when fewer miles are driven. The variable expenses include gas, oil, tires, and some depreciation.

Definition of Mixed Costs

The steel and bolts needed for the production of a car or truck would be classified as direct costs. However, an indirect cost would be the electricity for the manufacturing plant.

Some fixed costs are incurred at the discretion of a company’s management, such as advertising and promotional expense, while others are not. It is important to remember that all non-discretionary fixed costs will be incurred even if production or sales volume falls to zero.