A long-term investment is an account on the asset side of a company’s balance sheet that represents the company’s investments, including stocks, bonds, real estate, and cash. Long-term investments are assets that a company intends to hold for more than a year. Gross sales are calculated simply by adding up the value of all the invoices for products and services that have been sold — it does not matter whether the accounts are paid.

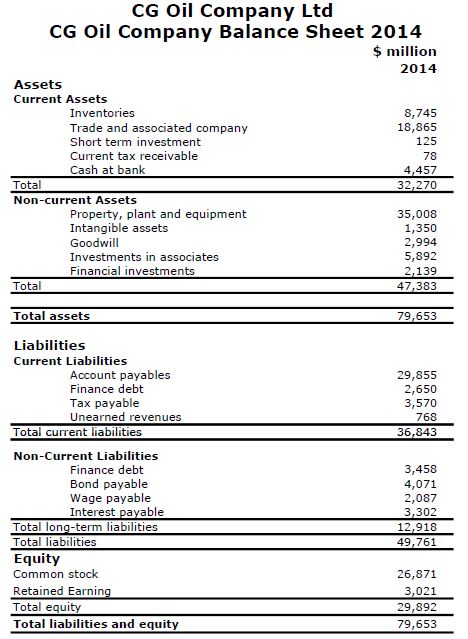

Balance sheet is prepared based on transactions and transactions can take place only between two entities. For this purpose, promoter/s are considered as entity/ies separate from business. Having shown business as a separate entity in the balance sheet, should a promoter choose to retire/withdraw from business, investment made by the promoter becomes a liability for business.

As the prepaid service or product is gradually delivered over time, it is recognized as revenue on theincome statement. Gross sales are used to measure a specific area of revenues, that is goods and services that are sold.

Total revenues are based on actual funds received by the company; they are calculated by adding up the actual money received in cash or equivalents, from all sources. The balance sheet can help you understand the financial condition of a business at a particular time, but not over a cumulative period. The balance sheet is issued at the end of a reporting period and contains both the assets and the liabilities of a business. It is assumed that every business that is established is growth oriented and growth is foeither profit based or on a no profit no loss basis.

You will notice that total revenue is maximized when this company prices its product at $60 and sells 9 units. In order to sell the tenth unit, however, the company would have to lower its price per unit to $50, and it would actually generate $40 less in total revenue. If the business sold its product at $65, it could sell 8 units for a total revenue of $520; this is a higher average price but lower overall total revenue than if it sold 9 units. When a company has net income, there are essentially two things you can do with that profit. This is what corporations do when they pay dividends to stockholders; owners of small businesses take a draw, which means pulling money out of the business for personal use.

How does revenue affect the balance sheet?

In that case, the reinvested amount gets added to owner’s equity (or stockholder’s equity in the case of a corporation) on the balance sheet. The difference between net sales and net income is the difference between the top and bottom lines. Net sales, or net revenue, is the money your company earns from doing business with its customers. Net income is profit – what’s left over after you account for all revenue, expenses, gains, losses, taxes and other obligations. Capital investments generally are made to increase operational capacity, capture a larger share of the market, and generate more revenue.

Since the balance sheet is prepared for the business and not the promoter, capital is shown under liabilities although it is an investment made by the promoter. When people speak of the bottom line in business, they’re talking about net income. Net income is simply profit, and the whole income statement flows toward this number. Unearned revenue is recorded on a company’s balance sheet as a liability. It is treated as a liability because the revenue has still not been earned and represents products or services owed to a customer.

For example, with a shoe retailer, the money it makes from selling shoes before accounting for any expenses is its revenue. If the company also has income from investments or a subsidiary company, that income is not considered revenue; it does not come from the sale of shoes. Additional income streams and various types of expenses are accounted for separately. Capital investment is a sum of money provided to a company to further its business objectives. The term also can refer to a company’s acquisition of long-term assets such as real estate, manufacturing plants, and machinery.

If a company’s payment terms are cash only, then revenue also creates a corresponding amount of cash on the balance sheet. If the payment terms allow credit to customers, then revenue creates a corresponding amount of accounts receivable on the balance sheet. Or, if a sale is being made in exchange for some other asset (which occurs in a barter transaction) then some other asset on the balance sheet might increase.

But the exact timing, and thus the amount of revenue listed on an income statement, depends on a company’s accounting method. If a business uses cash accounting, revenue is recognized when a product or service is paid for, which may be after it is sold. With the accrual method, revenues are recorded when a sale is made, and so are the associated expenses.

Revenue is the total amount of income generated by the sale of goods or services related to the company’s primary operations. Profit, typically called net profitor the bottom line, is the amount of income that remains after accounting for all expenses, debts, additional income streams and operating costs. If a publishing company accepts $1,200 for a one-year subscription, the amount is recorded as an increase in cash and an increase in unearned revenue. Both are balance sheet accounts, so the transaction does not immediately affect the income statement. If it is a monthly publication, as each periodical is delivered, the liability or unearned revenue is reduced by $100 ($1,200 divided by 12 months) while revenue is increased by the same amount.

To acheive these ends, capital needs to be infused into the business by the promoter/s. Irrespective of the number of promoters, the possibility that the business runs in loss or is sold to another company needs to be taken into account when the balance sheet is prepared. This is so because a balance sheet has to account for all events in business.

- But the exact timing, and thus the amount of revenue listed on an income statement, depends on a company’s accounting method.

- If a business uses cash accounting, revenue is recognized when a product or service is paid for, which may be after it is sold.

- With the accrual method, revenues are recorded when a sale is made, and so are the associated expenses.

Gross sales are the total sales that a business receives from the products and services that it sells before deducting customer discounts, returned merchandise and allowances for doubtful accounts. Total revenues are all earnings from regular business transactions including sales, interest or dividends earned from investments in other companies. Gross profit is the direct profit left over after deducting the cost of goods sold, or “cost of sales”, from sales revenue.

What Are Long-Term Investments?

It’s used to calculate the gross profit margin and is the initial profit figure listed on a company’s income statement. All capital, that is the funds put in by the owners of a business or a firm appear on the liability side of a balance sheet. These funds may appear under different account heads such as owners funds, share capital, and retained earnings. An a wider meaning of capital, which is generally used in some phrase like ‘capital employed’ refers to what ever is the value of the assets owned by the including its fixed assets and working capital. This capital employed appears on the assets side of the balance sheet, and its amount is exactly equal to its sources of funds included on the liability side.

Therefore, the balance sheet classification of investment – whether it is long-term or short-term – has a direct impact on the net income that is reported on the income statement. Short-term investments are marked to market, and any declines in value are recognized as a loss.

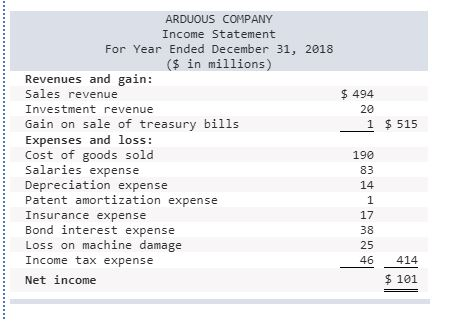

EBIT stands for Earnings Before Interest and Taxes and is one of the last subtotals in the income statement before net income. EBIT is also sometimes referred to as operating income and is called this because it’s found by deducting all operating expenses (production and non-production costs) from sales revenue.

The company may make a capital investment in the form of an equity stake in another company’s complementary operations for the same purposes. This increase in assets also creates an offsetting increase in the stockholders’ equity part of the balance sheet, where retained earnings will increase. Thus, the impact of revenue on the balance sheet is an increase in an asset account and a matching increase in an equity account. Noncurrent assets are a company’s long-term investments, which are not easily converted to cash or are not expected to become cash within a year. However, increases in value are not recognized until the item is sold.

If an increase in price causes an increase in total revenue, then the demand is inelastic. Just like baby formula or milk, the increase in price does not have a large impact on the quantity demanded.

The next transaction is for office furniture that the company bought. The total cost was $5,000, and Computer Solutions paid $1,000 cash and agreed to pay $4,000 to the vendor in two installments. By providing the asset furniture to Computer Solutions without receiving the full amount of cash in return, the vendor in effect furnished funds to the company. Put another way, the vendor has a claim against the assets of $4,000. An outside party (other than an owner) who has a claim against the entity is called a creditor.

Long-Term Investments Explained

U.S. companies typically use accrual-based accounting, in accordance with generally accepted accounting principles (GAAP). The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time. From an accounting standpoint, the company would recognize $50 in revenue on itsincome statementand $50 in accrued revenue as an asset on its balance sheet. When the company collects the $50, the cash account on the income statement increases, the accrued revenue account decreases, and the $50 on the income statement will remain unchanged.

On the contrary, if an increase in price causes a decrease in total revenue, then the demand can be said to be elastic. A business with elastic demand that is selling a name brand soup might be hesitant to raise prices because it knows that increases in price can greatly decrease the quantity demanded.

Accounting for Intercorporate Investments: What You Need to Know

Where do investments go on the balance sheet?

A long-term investment is an account on the asset side of a company’s balance sheet that represents the company’s investments, including stocks, bonds, real estate, and cash. Long-term investments are assets that a company intends to hold for more than a year.

The name of the liabilities arising from a vendor’s claim is accounts payable. If you’re new to business, or just unfamiliar with the accounting aspects of business, terms such as net sales, net revenue, cost of sales and gross margin may be confusing, even intimidating. But getting a grasp on these concepts is the first step toward evaluating your company’s efficiency and profitability. A total revenue test is a way for a company to determine whether demand for its product or good is elastic or inelastic.